The following information is provided by Energy Advisors Group Inc. (EAG), formerly PLS Divestment Services. All inquiries on the following listings should be directed to EAG. Hart Energy is not a brokerage firm and does not endorse or facilitate any transactions.

Merced Capital retained Energy Advisors Group Inc. (EAG) to market nonoperated working interest in the Haynesville play at North Louisiana operated by Comstock Resources Inc. with about $1 million per month of net cash flow in first-half 2019.

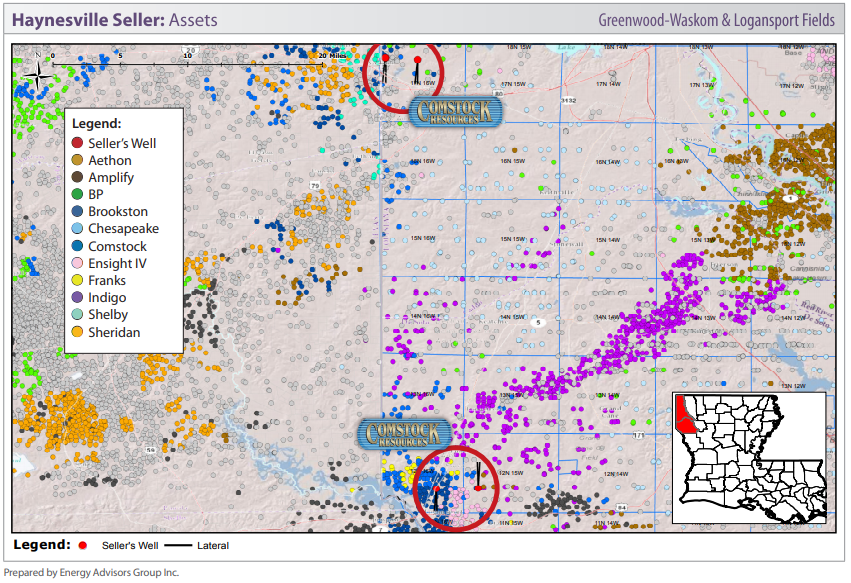

The sale package consists of eight producing wells, Comstock Gen 2 completion design (24.8 Bcf EUR for 10,000 ft L Type Well), located in Caddo and De Soto parishes, La., in the Greenwood-Waskom and Logansport fields. Current gross production totals about 66.6 million cubic feet per day (MMcf/d) from four leases. The eight wells have cum'd over 40.4 billion cubic feet (Bcf) since April 2018, first well reported production.

The wells are Gen II wells—3,800 lbs/ft of proppant, and five stages per 750 ft—with lateral lengths approaching 10,000 ft. Comstock’s investor presentations state that their 10,000 ft lateral wells have estimated ultimate recoveries (EURs) of 24.8 Bcf. The B-factor assigned to this type curve is 0.99.

Well performance to date indicates the wells are on track to make at least 2.2 Bcf/1,000 ft, which is higher than the Ryder Scott reserves. Upside exists for the Brown 7-18 HZ 2 and the Florsheim 9-16 1 in that 2.2 Bcf/1,000 ft is achieved with B-factors of 0.73 and 0.61, respectively, considerably less than the Comstock 0.99 B-factor. Additionally, the Florsheim 9-16 2ALT well is overproducing the type curve.

This sale package allows a buyer to receive strong cash flow from successful Haynesville wells under a well-known public operator. A third-party reserve report was prepared by Ryder Scott. As of August, proved developed producing (PDP) net reserves are 13.2 Bcf with a PV-10 value of about $20.3 million. The package includes 3.2%-42.2% working interests and 2.5%-33.8% net revenue interests before payout with current net production of about 14.3 MMcf/d. Some of the wells have reversionary interests after payout.

Highlights

- Eight Prolific Gas Wells. About 10,000 Ft Laterals

- Caddo and De Soto Parishes, La.

- Greenwood-Waskom and Longansport Fields

- Operated by Comstock

- 3.2%-42.2% Nonop Working Interest and 2.5%-33.8% Net Revenue Interest

- Gross Production: 66.633 MMcf/d

- Net Production: 14.268 MMcf/d

- First-Half 2019 Net Cash Flow: about $1,030,080 per month

- PDP PV-10 Value: $20,280,490

- Net Reserves: 13.2 Bcf

Bids are currently being accepted for this package. Click here to view the online data room or visit energyadvisors.com/deals to view our other 30-plus assignments. For more information on the conventional, South Louisiana operated sale package, contact Eric Thompson, A&D director with EAG, at ethompson@energyadvisors.com or 713-600-0136.

Recommended Reading

SLB Launches New GenAI Platform Lumi

2024-09-17 - Lumi’s machine learning capabilities will be used to enhance SLB’s Delfi digital platform offering for better automation and operational efficiencies.

PakEnergy Plows Ahead with New SCADA Solution

2024-09-17 - After acquiring Plow Technologies, home of the OnPing SCADA platform, PakEnergy looks to enhance its remote monitoring solutions.

ChampionX Releases New Plunger Lift Well Solution

2024-09-13 - The SMARTEN Unify control system is the first plunger lift controller in ChampionX’s SMARTEN portfolio.

HNR Increases Permian Efficiencies with Automation Rollout

2024-09-13 - Upon completion of a pilot test of the new application, the technology will be rolled out to the rest of HNR Acquisition Corp.’s field operators.

Chevron Launches New Hydraulic Fluid for Marine, Construction Use

2024-09-10 - Chevron said its Clarity Bio EliteSyn AW hydraulic fluid meets or exceeds the biodegradation, toxicity and bioaccumulation limits set by government regulations.