The following information is provided by TenOaks Energy Advisors LLC. All inquiries on the following listings should be directed to TenOaks. Hart Energy is not a brokerage firm and does not endorse or facilitate any transactions.

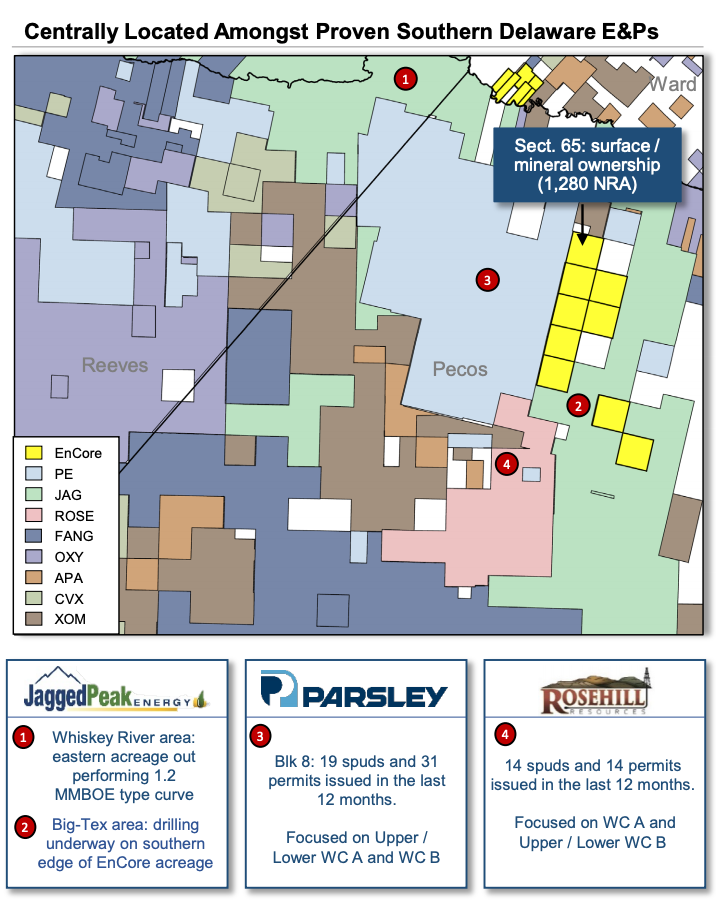

EnCore Permian Holdings LP retained TenOaks Energy Advisors for the sale of its operated Southern Delaware Basin position in Texas within Northwest Pecos and Southern Ward counties.

Highlights:

- Drill-Ready Position with Majority Operational Control

- About 4,000 net acres (90% Northwest Pecos | 10% Ward)

- About 92% Working Interest / 69% Net Revenue Interest (75% Net Revenue Interest/Working Interest)

- No near-term leasehold expirations

- Majority of the leasehold accommodates 2-mile laterals

- Position includes some surface and mineral ownership (1,280 Net Royalty Acres)

- More than 190 quantified horizontal drilling locations with single-well Internal Rate of Returns exceeding 100%

- Ongoing delineation in the immediate area by proven, public E&Ps including Jagged Peak Energy Inc., Parsley Energy Inc., Rosehill Resources Inc. and Diamondback Energy Inc.

- Package includes a 12.5% nonoperated Working Interest in an actively developed unit in Jagged Peak’s Big Tex area

(Source: TenOaks Energy Advisors)

Bids are due by noon CST on June 13. For information visit tenoaksenergyadvisors.com or contact Trey Bonvino, TenOaks associate, at 214-420-2331 or Trey.Bonvino@tenoaksadvisors.com.

Recommended Reading

E&P Highlights: Sep. 2, 2024

2024-09-03 - Here's a roundup of the latest E&P headlines, with Valeura increasing production at their Nong Yao C development and Oceaneering securing several contracts in the U.K. North Sea.

Breakthroughs in the Energy Industry’s Contact Sport, Geophysics

2024-09-05 - At the 2024 IMAGE Conference, Shell’s Bill Langin showcased how industry advances in seismic technology has unlocked key areas in the Gulf of Mexico.

E&P Highlights: Sept. 16, 2024

2024-09-16 - Here’s a roundup of the latest E&P headlines, with an update on Hurricane Francine and a major contract between Saipem and QatarEnergy.

Seadrill to Adopt Oil States’ Offshore MPD Technology

2024-09-17 - As part of their collaboration, Seadrill will be adopting Oil States International’s managed pressure drilling integrated riser joints in its offshore drilling operations.

TGS Grants Early Access to CCS Data Along Texas, Louisiana Gulf

2024-07-15 - TGS’ carbon storage dataset covers the available Texas General Land Office lease blocks and is scheduled for release in early August.