The following information is provided by Eagle River Energy Advisors LLC. All inquiries on the following listings should be directed to Eagle River. Hart Energy is not a brokerage firm and does not endorse or facilitate any transactions.

EnCore Permian Holdings LP retained Eagle River Energy Advisors LLC for the sale of nonoperated Permian Basin assets in West Texas through an offering closing Nov. 14.

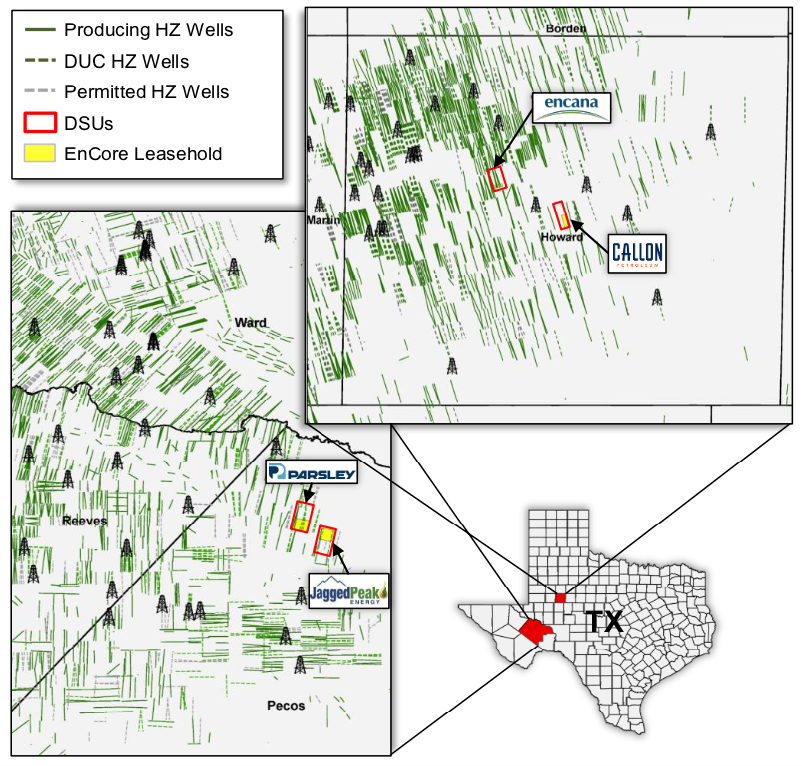

The offer comprises certain nonop working interest assets and associated lands in the Delaware and Midland basins of Howard and Pecos counties, Texas.

Highlights:

- About 238 net acres nonoperated leasehold (100% HBP)

- 7.4% average Working Interest / 0.74 net wells

- Diversified leasehold across 4 DSUs and operators

- Assets operated by publicly traded, Permian Basin focused E&P companies

- Callon Petroleum Co., Encana Corp., Jagged Peak Energy Inc. and Parsley Energy Inc.

- 10 producing horizontal wells in the Wolfcamp 'A' and Lower Spraberry

- All 10 horizontal wells brought online in 2018 - 2019

- Three drilled but uncompleted wells and one active permit to provide line of sight to near-term development

- Recent, modern completions by asset operators demonstrate drilling economics greater than 40% internal rate of return

- Significant remaining drilling inventory in proven reservoirs (Wolfcamp 'A' / Lower Spraberry) across all drill spacing units (DSUs)

- Additional stacked-pay potential across un-tested horizontal targets in each DSU (Bone Spring, Wolfcamp B - D, Upper Spraberry, and others)

Bids are due by 4 p.m. MT Nov. 14. The virtual data room will be available starting Oct. 14. The transaction is expected to have a Nov. 1 effective date.

For information visit eagleriverholdingsllc.com or contact Brian Green, managing director of Eagle River, at BGreen@EagleRiverEA.com or 832-680-0110.

Recommended Reading

Shell, Akselos Enter Enterprise Deal for Structural Performance Management

2024-08-28 - Shell Information Technology International will leverage Akselos’ structural performance management software to monitor the health and lifecycle of Shell’s critical assets in Qatar, Canada, the Gulf of Mexico and elsewhere.

Shell Offshore Takes FID on Waterflood Project in GoM

2024-08-14 - Shell Offshore’s waterflood secondary recovery process involves injecting water into the reservoir formation to extract oil.

Breakthroughs in the Energy Industry’s Contact Sport, Geophysics

2024-09-05 - At the 2024 IMAGE Conference, Shell’s Bill Langin showcased how industry advances in seismic technology has unlocked key areas in the Gulf of Mexico.

E&P Highlights: Aug. 19, 2024

2024-08-19 - Here’s a roundup of the latest E&P headlines including new seismic solutions being deployed and space exploration intersecting with oil and gas.

Chevron Gets Approval for Farm-in Offshore Uruguay

2024-09-26 - Chevron Corp. received approval for farm-in at the AREA OFF-1 block offshore Uruguay and along with partner CEG Uruguay SA eyes the acquisition of 3D seismic over the remainder of 2024.