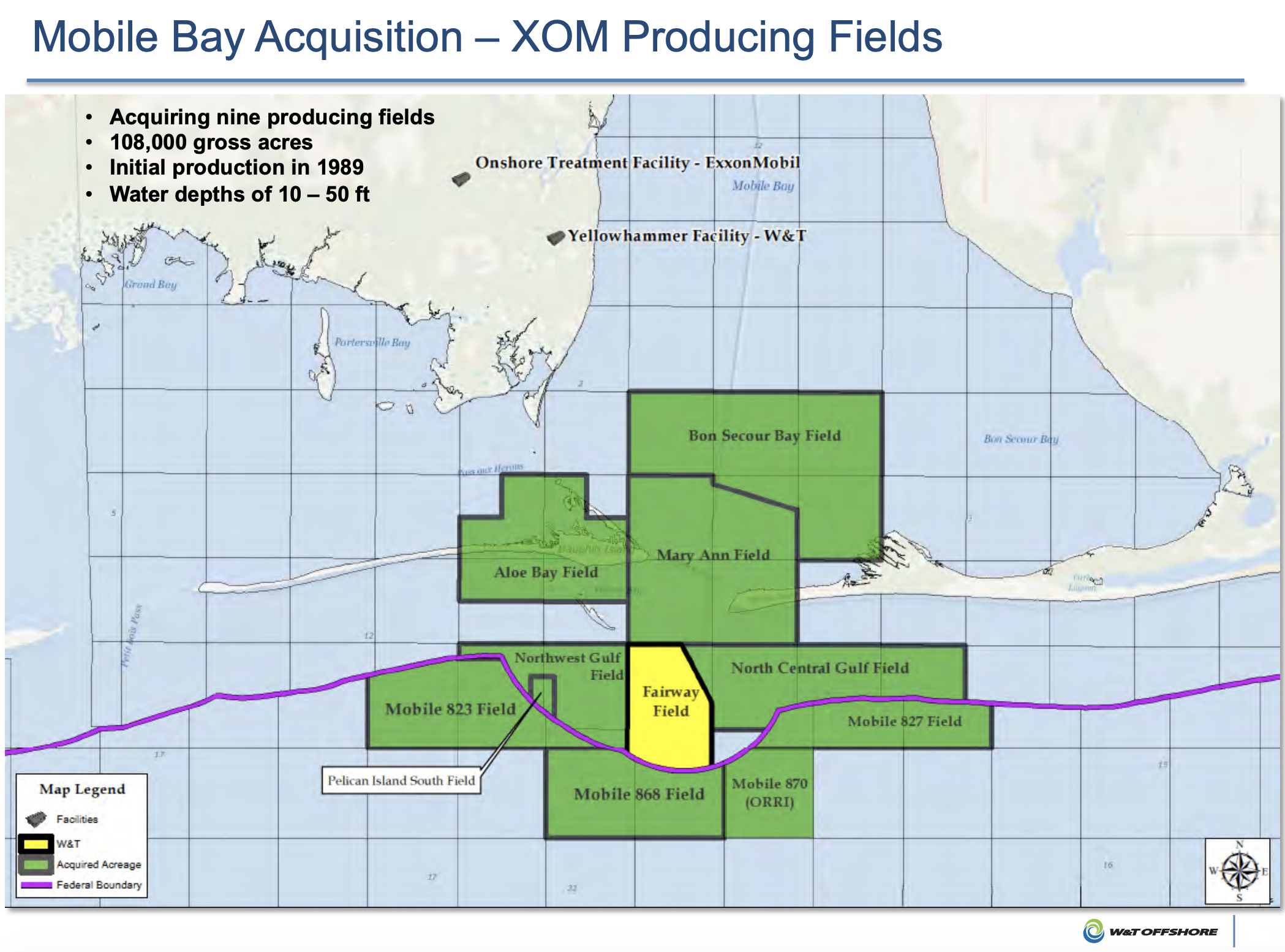

The acquisition consists of working interests in nine shallow-water producing fields and related operatorship in the Mobile Bay area offshore Alabama. (Source: Exxon Mobil Corp.)

[Editor's note: This story was updated at 9:40 a.m. CDT June 28.]

W&T Offshore Inc. is expanding its footprint in the U.S. Gulf of Mexico (GoM) with an agreement on June 27 for a $200 million acquisition from Exxon Mobil Corp.

The Houston-based independent entered a purchase and sale agreement with Exxon Mobil to acquire producing properties offshore Alabama. The assets, located in the Mobile Bay area, produced roughly 19,800 net barrels of oil equivalent per day (25% liquids) in first-quarter 2019.

W&T Offshore said the purchase will make it the largest operator in the Mobile Bay area within the eastern GoM. The acquisition, expected to close in August, consists of working interests in nine shallow-water producing fields and related operatorship plus an onshore treating facility.

Analysts with Capital One Securities Inc. estimate the price tag for the Exxon Mobil acquisition equates to roughly 18% of W&T Offshore’s enterprise value.

Overall, Capital One saw the deal as a slight positive for W&T Offshore as the transaction is set to increase cash flows with minimal expected capital spend on “an acquisition that is mostly centered on gas assets,” the firm’s analysts wrote in a research note on June 28.

Further, the analysts said the added incremental volumes from the transaction represent about 50% of W&T Offshore’s total production and 19% of the company’s EBITDA.

In a statement, W&T Offshore Chairman and CEO Tracy W. Krohn said: “We are pleased with this purchase of producing properties which meets all the criteria we have outlined in the past as necessary to drive increased shareholder value from acquisitions.”

Krohn noted that the Exxon Mobil properties are adjacent to W&T Offshore’s current GoM operations providing the company with “the opportunity to recognize increased scale, rationalize operations and capture cost efficiencies to further grow cash flow.”

“We believe this acquisition, with its long-life reserves, production and infrastructure, complements our ongoing strategy to recognize value for our shareholders through drill bit success, effective risk and cost management, and joint venture partnership,” he added.

The transaction has an effective date of Jan. 1. W&T plans to fund the acquisition using available cash on hand and its revolving credit facility.

Emily Patsy can be reached at epatsy@hartenergy.com.

Recommended Reading

E&P Highlights: Aug. 12, 2024

2024-08-12 - Here’s a roundup of the latest E&P headlines, with a major project starting production in the Gulf of Mexico and the latest BLM proposal for oil and gas leases in North Dakota.

E&P Highlights: Sept. 16, 2024

2024-09-16 - Here’s a roundup of the latest E&P headlines, with an update on Hurricane Francine and a major contract between Saipem and QatarEnergy.

E&P Highlights: July 1, 2024

2024-07-01 - Here’s a roundup of the latest E&P headlines, including the Israeli government approving increased gas export at the Leviathan Field and Equinor winning a FEED contract for the all-electric Fram Sør Field.

E&P Highlights: July 29, 2024

2024-07-29 - Here’s a roundup of the latest E&P headlines including Energean taking FID on the Katlan development project and SLB developing an AI-based platform with Aker BP.

E&P Highlights: Sept. 9, 2024

2024-09-09 - Here’s a roundup of the latest E&P headlines, with Talos Energy announcing a new discovery and Trillion Energy achieving gas production from a revitalized field.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.