Developers must change their business approach to attract necessary capital for stalled LNG projects before huge opportunities are lost. (Source: Hart Energy; Rextag map; TravelerFL/Shutterstock.com)

There are over 25 stalled, independent North American LNG export ventures. Many have been stalled for over eight years. Despite spending hundreds of millions of dollars on engineering and government approval processes, these projects remain stuck year after year. So, what’s the problem, why can’t these projects move forward?

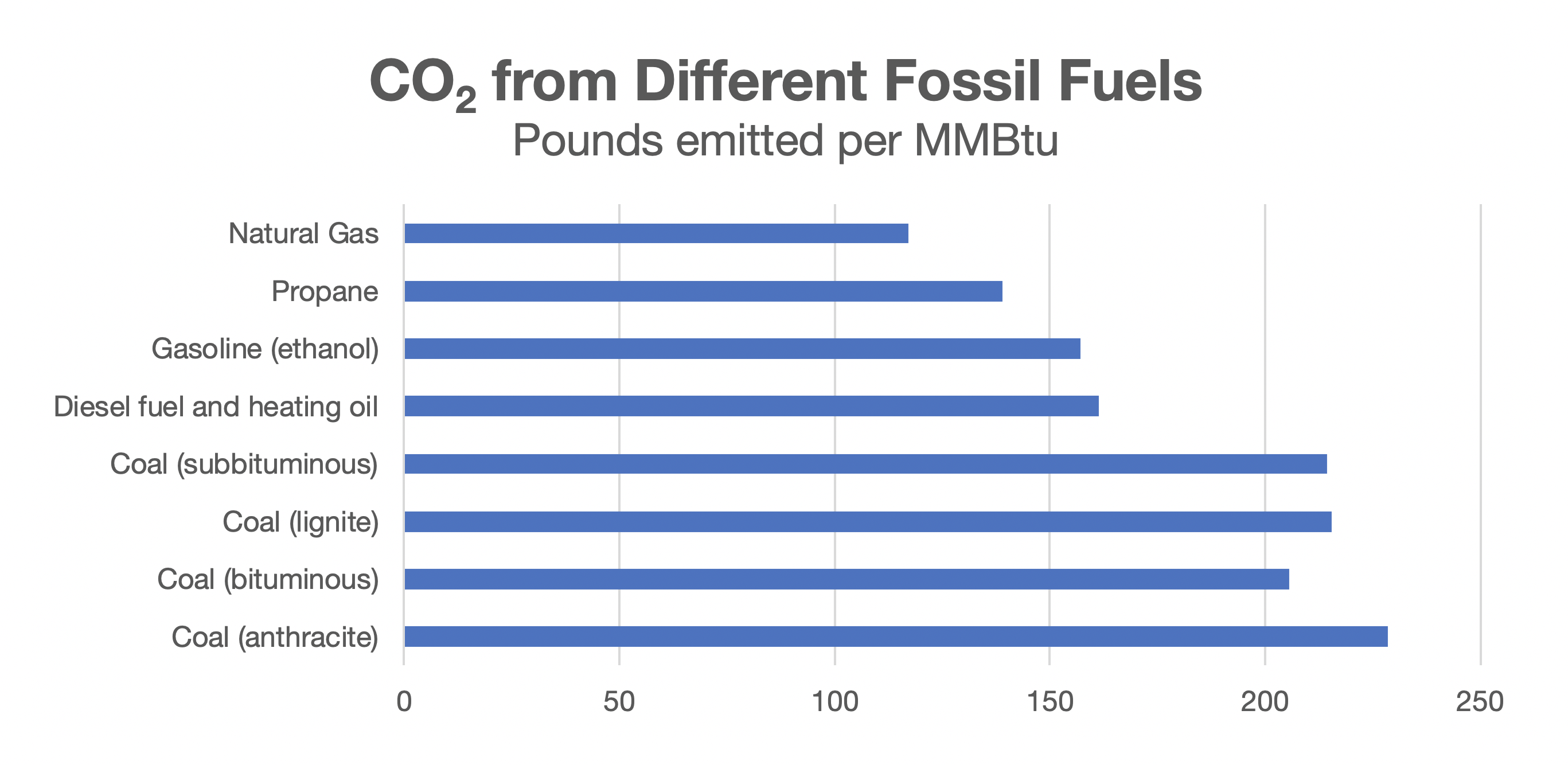

The simple answer is this: Stalled projects are unable to raise the significant amount of capital needed to build liquefaction and export faculties. But it doesn’t have to be this way. As a cleaner energy resource, North American natural gas is abundant, relatively cheap and should play a very much larger role globally in energy transitions away from dirtier coal than what’s happening today. There are major international energy transition opportunities that will disappear unless positive change occurs soon for stalled projects. To reverse ongoing capital raise failures, project developers must break away from the conventional North American gas industry mindset.

North American natural gas industry narratives

Where export markets are concerned, the North American natural gas industry promotes several key narratives. Industry narratives are relevant to stalled LNG projects because they influence developers’ business models. Unfortunately, with so many stalled projects, the impact of the influence speaks for itself.

First narrative: North American natural gas enjoys price and other advantages vs. competing international suppliers

According to the U.S. International Trade Association, U.S. LNG has three unique strengths. U.S. suppliers can offer business terms that other countries are not currently offering; the pricing mechanism for U.S. LNG is flexible and “not linked with the crude oil price” and U.S. LNG is free from destination clause, which means some international buyers can resell U.S. LNG to other buyers.

Recent energy policy shifts by Japan (and Korea) to reduce LNG-fired power by 50% by the end of the decade may negate any perceived strengths of North American LNG suppliers. Japanese utilities that have sizable ownership stakes in LNG export facilities (including some in the US) will most probably need to find ways to create demand outside of Japan for their excess LNG fuel coming from prior long term buy commitments. As its domestic consumption shrinks, Japan will in effect become an LNG trader / broker and likely compete directly with North American LNG exporters offering similar terms.

The shift to more green energy sources and away from LNG by traditional top LNG buyers like Japan is causing considerable industry upheaval. In the coming few years, these policy changes are likely to create tougher, global LNG competition potentially removing any North American supplier pricing or flexible business term advantages, particularly where stalled, independent LNG projects are concerned.

Utilities, LNG traders and bankers are keenly aware of global energy transition goals, financial market trends and associated risks. Debt finance for major long term, infrastructure projects involving complex LNG supply chains may be particularly challenging for lenders under today’s market circumstances. Approaches by some North American LNG project developers offering shorter term offtakes at higher prices or hybrid pricing structures (linked to crude oil pricing) to trading groups are not likely to result in bankable contracts. In coming years, LNG buyers will have even more LNG supply options than today.

Second narrative: Many new independent North American LNG export projects will be financed and online in time to fill production capacity gaps and supply future global demand.

For several years, independent North American LNG project developers have promoted the idea that a global LNG production capacity shortfall will occur around the year 2025. Given that LNG export projects take several years to complete, the concept was to fund and commence new project construction well in advance of 2025 to take advantage of short supply and growing LNG demand.

North American developers’ messaging and industry graphics have suggested that LNG production (natural gas liquefaction) over-capacity of the 2020 time period will last only a few years and that beyond the year 2025 will have a void of projects to meet demand. Developers have suggested that world markets will find the benefits of dealing with North American LNG suppliers too compelling to ignore.

Contrary to developers’ messaging, data show there are several viable, fully funded new or expanding LNG export projects currently under construction outside North America including projects in Australia, Papua New Guinea, Mozambique, West Africa, Egypt, Russia and elsewhere.

The Shell LNG Outlook 2021 report shows that Qatar’s new $29 billion, 32 mtpa expansion project, among others, is scheduled to be online by 2024. Within the last six months, it appears the beginning of the LNG production capacity shortfall has moved forward five years to 2030. Perhaps in a few more years, the projected LNG production capacity shortfall gap will shift forward once again and well beyond 2030, filled in by several of the international projects now under construction.

Third narrative: Environmental awareness trends favor North American gas producers who responsibly source gas (RSG). Higher standards of methane emissions control advantageously differentiate North American natural gas internationally, driving increased demand.

Like what European and U.S manufacturers attempted in the late ’80s and early ’90s with the use of ISO 9000 certifications to differentiate their operations and associated product quality from Asian competitors, the North American gas industry’s attempts to differentiate its gas from international competitors will likely be short-lived and unsuccessful. Methane monitoring certification is becoming increasingly common among North American gas producers as more and more buyers demand it. Others internationally are likely to adopt similar, competing certifications. Over the longer term, for pricing and contract awarding purposes, any differentiation will be difficult to verify and sustain.

Conclusions

While North American natural gas has much to offer global energy transition efforts, time is short for its stalled, independent LNG export projects to turn their fortunes around. Competing international projects, alternative energies and new technologies are formidable headwinds.

Legacy industry narratives are not helpful. Entrenched industry business model thinking by stalled project developers is demonstrably not working. The conventional industry mindset is seemingly rendering independent North American LNG project developers incapable of meaningful business model change to the point of successfully raising project finance. Industry narratives are not compelling enough, whether on their own or in combination, to lenders where significant size project loans are concerned.

The energy world is changing. North American shale gas producers are facing lower demand at home. The Biden Administration is planning to transition to a carbon-free power grid by 2035. Lower cost renewable electricity is already starting to reduce natural gas’s share of the U.S. power mix. According to the EIA, natural gas will account for 34% of U.S. electricity generation in 2022, down from 39% two years ago. At the same time, renewables will increase their share from 12% to 16%. And both these trends are expected to continue. Regardless of U.S. manufacturing sector lobbying efforts to slow LNG exports, if North American gas producers cannot sell their surplus gas domestically, they must seek out new overseas markets with the help of unstuck LNG export ventures.

For North American LNG is to fulfill its tremendous potential and play a necessary, more aggressive ESG role in the inevitable global energy transitions, independent stalled LNG projects must get unstuck and built. Independent North American LNG export project developers are best suited to creatively address challenging domestic and international energy transitions.

To be successful, capital must be raised for many of the 25 stalled projects. Independent developers must first change their mindset and then radically change their approach to the business. Hopefully positive change will occur in the near-term future.

David Scull is the CEO of BlueHawk Energy Inc.

Recommended Reading

ONEOK Offers $7B in Notes to Fund EnLink, Medallion Midstream Deals

2024-09-11 - ONEOK intends to use the proceeds to fund its previously announced acquisition of Global Infrastructure Partners’ interest in midstream companies EnLink and Medallion.

Talos Ups Buybacks, Pays Down Debt Post $1.29B QuarterNorth Deal

2024-07-22 - Talos Energy said it repaid $325 million in debt since closing its $1.29 billion cash-and-stock acquisition of E&P QuarterNorth in March.

Archrock Offers Common Stock to Help Pay for TOPS Transaction

2024-07-23 - Archrock, which agreed to buy Total Operations and Production Services (TOPS) in a cash-and-stock transaction, said it will offer 11 million shares of its common stock at $21 per share.

ISS, Glass Lewis Push Crescent, SilverBow Shareholders to Vote for Merger

2024-07-19 - Proxy Advisory firms Institutional Shareholder Services and Glass Lewis also recommend that Crescent Energy shareholders vote for the approval of the issuance of shares on Crescent Class A common stock.

Norwegian Energy Data Companies PGS, TGS Complete Merger

2024-07-02 - Norwegian companies PGS and TGS have completed their merger to create a full-service energy data company.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.