The price of Brent crude ended the week at $92.16 after closing the previous week at $90.89. (Source: Shutterstock)

The price of Brent crude ended the week at $92.16 after closing the previous week at $90.89. The price of WTI ended the week at $88.08 after closing the previous week at $87.69. The price of DME Oman ended the week at $92.33 after closing the previous week at $91.47.

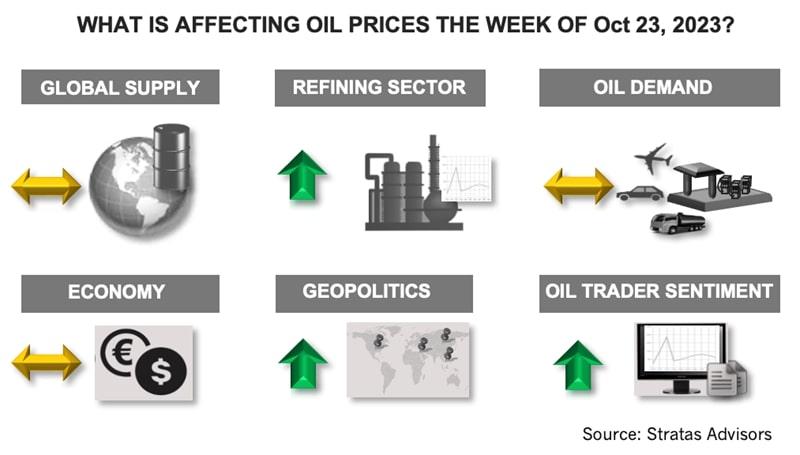

As with last week, the conflict between Israel and Hamas will continue to be the most important factor affecting the oil markets. The global geopolitical situation is becoming more tenuous with the Israeli - Hamas conflict threatening to expand beyond Gaza – even before the initiation of the ground attack on Gaza. The conflict has already reached Lebanon with fighting between Hezbollah and Israel. The U.S. continues to move more military assets to the region, including a second aircraft carrier to the region and a Marine rapid response force. Additionally, the U.S. has moved B1 bombers to the U.K., which locates the bombers in range of the Middle East. It also appears that Israel is ramping up its bombing campaign on Gaza, which is likely an indicator that Israel is getting closer to moving military forces into Gaza. Hezbollah has stated that it will take further attacks on Israel if Israel invades Gaza. It is also being reported that Israel has bombed Syrian airports – Damascus and Aleppo.

As we highlighted last week, the conflict has the potential to spin out of control and involve many other countries. Iran supports Hamas, as well as Hezbollah. Both Russia and China have been increasing their ties with Iran during the last few years. China is a major buyer of Iran’s energy exports and Russia has been acquiring weapons from Iran. Additionally, China and Russia have both expressed support for the Palestinians and both have been critical of Israel – as well as the U.S. Turkey is another country that could be pulled into the situation because of its support for Palestine. Egypt could also become involved, if for no other reason than having a border with Gaza. Qatar has connections with Hamas and has been involved in the negotiations for prisoner exchanges between Hamas and Israel. Saudi Arabia, Kuwait and the UAE could also be drawn into the conflict, including the request to ramp up oil production to offset any potential loss of supply stemming from the conflict – such as the U.S. placing greater restrictions on Iranian oil exports.

Besides the Israeli-Hamas conflict – there are already heightened tensions between the U.S. and Russia because of the conflict in Ukraine – where the U.S. has increased its involvement by providing longer-range missiles (with cluster munitions) to Ukraine, which are then used to attack Russian positions. The tensions between China and the U.S. are also elevated because of increased trade sanctions, more aggressive rhetoric about Taiwan – along with disputes pertaining to the South China Sea that involves allies of the U.S.

As with last week, we are expecting there will be upward pressure on oil prices and the price of Brent crude could test $95.00, unless there are tangible signs that the Israeli-Hamas situation is deescalating – which at this time does not seem likely.

If the conflict is contained and the threat to the flow of oil is mitigated, the risk premium will start eroding and the previous price dynamics will govern price movements. The very real possibility remains, however, that the situation will spin out of control and that the conflict will expand, involving other countries. With this scenario, the price of Brent crude will test $115 – and even go higher if there is a disruption to oil supply – either because of physical interference or because of an embargo imposed by oil producers in opposition to supporters of Israel.

For a complete forecast of refined products and prices, please refer to our Short-term Outlook.

About the Author: John E. Paise, president of Stratas Advisors, is responsible for managing the research and consulting business worldwide. Prior to joining Stratas Advisors, Paisie was a partner with PFC Energy, a strategic consultancy based in Washington, D.C., where he led a global practice focused on helping clients (including IOCs, NOC, independent oil companies and governments) to understand the future market environment and competitive landscape, set an appropriate strategic direction and implement strategic initiatives. He worked more than eight years with IBM Consulting (formerly PriceWaterhouseCoopers, PwC Consulting) as an associate partner in the strategic change practice focused on the energy sector while residing in Houston, Singapore, Beijing and London.

Recommended Reading

Analyst: Is Jerry Jones Making a Run to Take Comstock Private?

2024-09-20 - After buying more than 13.4 million Comstock shares in August, analysts wonder if Dallas Cowboys owner Jerry Jones might split the tackles and run downhill toward a go-private buyout of the Haynesville Shale gas producer.

Quantum’s VanLoh: New ‘Wave’ of Private Equity Investment Unlikely

2024-10-10 - Private equity titan Wil VanLoh, founder of Quantum Capital Group, shares his perspective on the dearth of oil and gas exploration, family office and private equity funding limitations and where M&A is headed next.

Cibolo Energy Closes Fund Aimed at Upstream, Midstream Growth

2024-09-10 - Cibolo Energy Management LLC closed its second fund, Cibolo Energy Partners II LP, meant to boost middle market upstream and midstream companies’ growth with development capital.

Companies Take Advantage of ABSs to Finance Acquisitions

2024-10-17 - Some companies have taken advantage of asset-backed securitizations to monetize some of their cash flows and better position themselves for a sale.

No Rush: Post-M&A Frenzy, Divestiture Market to Pick Up by 2025

2024-10-07 - Lenders with a variety of capital structures are poised to fund the upcoming portfolio rationalization in the post-consolidation era, bankers and deal advisers said at Hart Energy’s Energy Capital Conference.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.