Global supply continues to be a force that support crude prices, as the extended OPEC+ cartel implements production cuts with a high compliance degree, according to Stratas Advisors. (Source: Shutterstock.com)

[Editor’s note: This report is an excerpt from the Stratas Advisors weekly Short-Term Outlook service analysis, which covers a period of eight quarters and provides monthly forecasts for crude oil, natural gas, NGL, refined products, base petrochemicals and biofuels.]

The Energy Information Administration (EIA) reported last week total U.S. refined products consumption at 19.6 million b/d, which has finally reached the levels of the five-year historical range.

If this price level occurs prior to winter’s arrival, it could minimize the impact of a potential upcoming second wave on the oil markets. Before this second wave crude prices could see a last boost that can bring the oil sector one step closer to normalization, and the evidence to support this is being provided by the U.S. consumer.

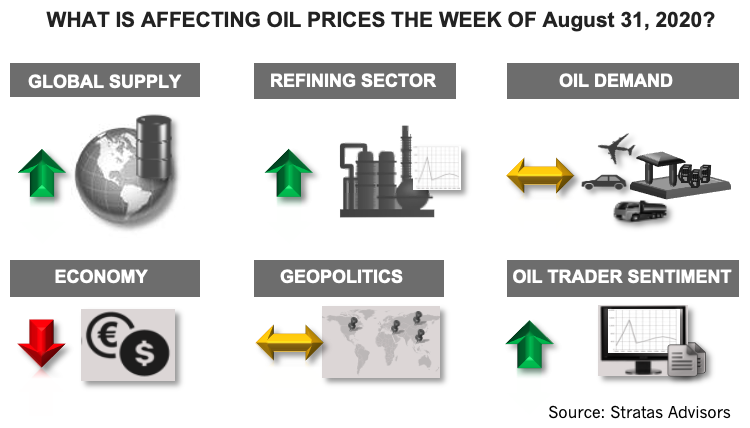

Global Supply—Positive

Global supply continues to be a force that support crude prices, as the extended OPEC+ cartel implements production cuts with a high compliance degree.

U.S. crude inventories continue to decline falling by 4.7 million barrels during the prior week, even with U.S. production increasing by 100,000 bbl/d (but still 1.70 million bbl/d the production level of the previous year).

Consequently, for this week global supply is expected to be a positive variable for oil prices.

Geopolitics – Neutral

The heightened tensions between China-India and the U.S. are signs of the long-term structural change affecting the global economy—and has less of a short-term impact.

For this week, geopolitics is expected to have a neutral impact for oil prices for this week.

Economy—Negative

The status of the global economy has not changed significantly over the last week. The last unemployment claims report in the U.S. included over a million people reaching out for benefits, which is an indication that some sectors have still way to go in order to recover normalcy.

For this week, the global economy is seen as having a negative contribution for oil prices this week.

Oil Demand—Neutral

U.S consumption continues to perform stronger than expected for another month, despite concern of infections in several States. In a similar fashion oil demand is poised to continue recovering in China and several European countries.

We see a neutral contribution of demand to global crude prices, although WTI prices are expected to perform with a more bullish demeanor than Brent prices, on the heels of a more positive US scenario for refined products demand.

Refining sector—Positive

An improving margin environment the refining sector is viewed as a positive for oil prices, as additional purchases from the refining sector can maintain crude nominations on a stable level, thus underpinning prices.

Oil Trader Sentiment—Positive

Trading activity for oil and products markets did not change versus last week, when considering both futures and options, except for an increased participation in the RBOB contract. Open interest of the gasoline contract edged up by 4.4% versus last week, underpinned by stronger than expected U.S. consumption.

About the Author:

Jaime Brito is vice president at Stratas Advisors with over 24 years of experience on refining economics and market strategies for the oil industry. He is responsible for managing the refining and crude-related services, as well as completing consulting.

Recommended Reading

Souki’s Saga: How Tellurian Escaped Ruin with ‘The Pause,’ $1.2B Exit

2024-09-11 - President Biden’s LNG pause in January suddenly made Tellurian Inc.’s LNG export permit more valuable. The company’s July sale marked the end of an eight-year saga—particularly the last 16 months, starting with when its co-founder lost his stock, ranch and yacht in a foreclosure.

Cibolo Energy Closes Fund Aimed at Upstream, Midstream Growth

2024-09-10 - Cibolo Energy Management LLC closed its second fund, Cibolo Energy Partners II LP, meant to boost middle market upstream and midstream companies’ growth with development capital.

NextDecade Appoints Former Exxon Mobil Executive Tarik Skeik as COO

2024-07-25 - Tarik Skeik will take up NextDecade's COO reins roughly two months after the company disclosed it had doubts about remaining a “going concern.”

Petrobras’ 2Q Production Rises 2.4% YOY to 2.7 MMboe/d

2024-07-31 - Brazil’s state-owned Petrobras reported average production of 2.7 MMboe/d in second-quarter 2024 as offshore production continues to ramps up.

Pemex Hits Debt Target, Struggles to Reverse Production Declines

2024-07-26 - Pemex achieved its long-term debt target, which aimed to gets its financial obligations below the $100 billion, while struggling to halt production declines.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.