The risk of COVID-19 cases extends past India since there are numerous countries in Asia and other regions that have been slow in ramping up their vaccination programs, according to Stratas Advisors. (Source: Shutterstock.com)

[Editor’s note: This report is an excerpt from the Stratas Advisors weekly Short-Term Outlook service analysis, which covers a period of eight quarters and provides monthly forecasts for crude oil, natural gas, NGL, refined products, base petrochemicals and biofuels.]

The price of Brent crude oil ended the week at $66.11 after closing the previous week at $66.77, while the price of WTI ended the week at $62.14 after closing the previous week at $63.13.

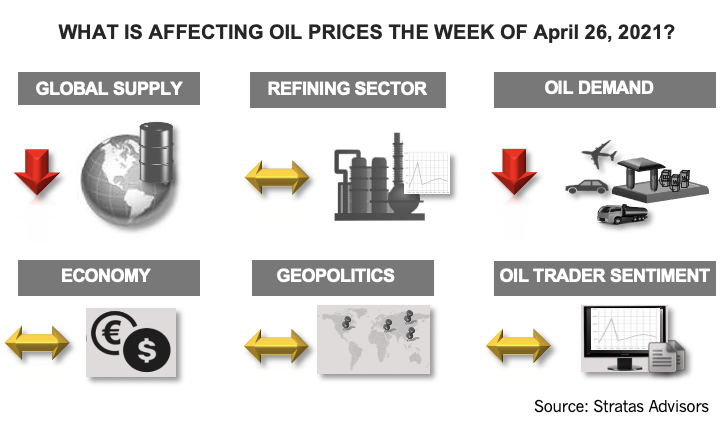

Last week, we pointed out that the fundamentals pertaining to the oil market are strengthening and looked supportive of oil prices during the second quarter. The demand outlook has continued to improve with the impact of COVID-19 being mitigated by behavior, vaccines and time. Furthermore, it appears that the recovery of the global economy is well on the way with the expectation that oil demand will outpace global supply during second-quarter 2021. We also discussed the range of geopolitical issues that could impact the oil markets (among others—Russia and the potential to disrupt the OPEC+ framework, China and its expanding linkages with Iran, and the increasing tensions between China and U.S. and the allies of the U.S. in Asia, as well as in Europe). However, while these geopolitical issues represent noteworthy risks, potential implications do not seem to be on the immediate horizon.

The one risk we highlighted that could have a more immediate impact—and the risk we have been highlighting since November—is the potential for another round of surges in COVID-19 cases that would have a global impact. This risk has been reinforced by the situation in India. Currently, in India the official number of COVID-19 cases per day is exceeding 300,000 and is expected to continue increasing up toward 500,000 cases per day. The situation is stunning because in early February, the cases were at record lows. With the surges in COVID-19 cases comes the potential impact on demand. While India only represents about 5% of total oil demand, during the previous peak of COVID-19 in 2Q20, India’s demand fell by 1.15 million bbl/d in comparison to the same period in 2019. As such, the demand decrease associated with India could have a significant impact on overall demand growth if India continues to struggle with COVID-19 and needs to implement severe lockdown measures. Furthermore, the risk of COVID-19 cases extends past India, since there are numerous countries in Asia and other regions that have been slow in ramping up their vaccination programs.

With additional crude supply coming to the market, the oil market will have heightened concerns about the robustness of demand and forecasted demand growth, and therefore, will react negatively to any signs that indicate weakening demand growth.

We will continue to monitor and assess the situation in India, as well as across the globe to determine if and when we might need to reduce our demand outlook for 2021, which entails a demand growth forecast of 6.34 million bbl/d in 2021 (in comparison with 2020).

About the Author:

John E. Paise, president of Stratas Advisors, is responsible for managing the research and consulting business worldwide. Prior to joining Stratas Advisors, Paisie was a partner with PFC Energy, a strategic consultancy based in Washington, D.C., where he led a global practice focused on helping clients (including IOCs, NOC, independent oil companies and governments) to understand the future market environment and competitive landscape, set an appropriate strategic direction and implement strategic initiatives. He worked more than eight years with IBM Consulting (formerly PriceWaterhouseCoopers, PwC Consulting) as an associate partner in the strategic change practice focused on the energy sector while residing in Houston, Singapore, Beijing and London.

Recommended Reading

WhiteWater-Led NatGas Pipeline Traverse Reaches FID

2025-04-04 - The Traverse natural gas pipeline JV project will give owners optionality along the Gulf Coast.

Kinder Morgan to Build $1.7B Texas Pipeline to Serve LNG Sector

2025-01-22 - Kinder Morgan said the 216-mile project will originate in Katy, Texas, and move gas volumes to the Gulf Coast’s LNG and industrial corridor beginning in 2027.

East Daley: Midstream Investors Drawn to Southeast as Demand Heats Up

2025-03-25 - Competition for gas supply will heat up as demand from data centers and new LNG projects jockey for a spot on takeaway lines.

Ironwood Launches Third Eagle Ford Midstream Co. After January Sale

2025-03-25 - Ironwood Midstream has launched its third iteration after having sold assets to Plains All American in January.

Williams’ CEO: Pipeline Permitting Costs Twice as Much as Steel

2025-03-12 - Williams Cos. CEO Alan Armstrong said U.S. states with friendlier permitting polices, including Texas, Louisiana and Wyoming, have a major advantage as AI infrastructure develops.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.