Key Points

Dry gas production declined by 0.19 billion cubic feet per day (Bcf/d) to average at 93.49 for the report week. Cooler temperatures in most parts of the country saw demand from the power generation sector drop by nearly 15% and average around 29.82 Bcf/d. Dry gas exports to Mexico increased by 0.20 Bcf/d or 1.4 billion cubic feet (Bcf) to average 5.76 Bcf/d, while dry gas imports from Canada saw a reduction of 0.43 Bcf/d or nearly 9% to average 4.44 Bcf/d for the report week.

Given the low demand, our analysis leads us to expect a massive 116 Bcf storage build would be reported by the U.S. Energy Information Administration (EIA) for the report week. This would be higher than the current 108 Bcf consensus whisper expectation and more than 43% above the five-year average storage build of 81 Bcf.

Our overall view for the week is to see a negative movement in Henry Hub prices due to the huge injection forecast. We anticipate Henry Hub prices to trade within +/- 5 cents of the Oct. 14 $2.23 per million British thermal unit (MMBtu) closing price this week.

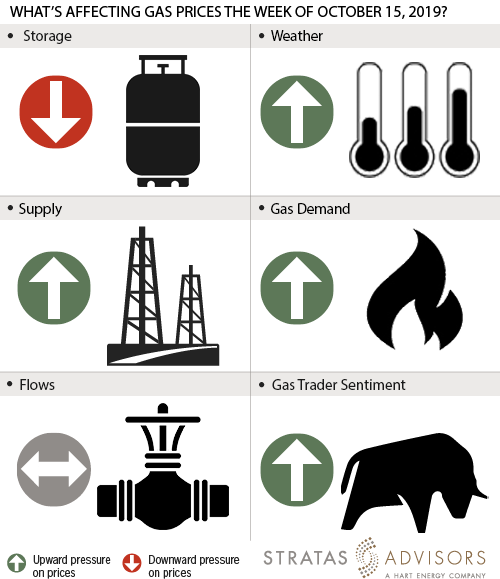

Storage – Negative

We estimate a storage injection of 116 Bcf will be reported this week for the week ended Oct 11. If our forecast holds, our 116 Bcf expectation will be 35 Bcf higher than the five-year average value of 81 Bcf. Last week we had predicted a storage build of 97 Bcf. This was 1 Bcf lower than the actual reported value of 98 Bcf. The inventory levels are at 3,415 Bcf, 472 Bcf higher than year ago levels and 9 Bcf lower than five-year average values. All in, we see storage changes as a negative driver for this week’s natural gas market.

Weather – Positive

The latest National Oceanic and Atmospheric Administration (NOAA) weather forecasts are predicting below normal temperatures across the Rocky Mountains to western areas of the Great Plains with lows in the 20s to 30s. Above normal temperatures with highs in the 80s are likely to the west, including California and parts of western Oregon, Nevada and Arizona. East of the Mississippi Valley and along the Gulf Coast of Texas will also experience above normal temperatures with highs in the 90s. Overall, we expect stronger demand this week compared to the previous. We expect weather to have a positive effect on gas prices this week.

Supply – Positive

Average field supply decreased marginally by 0.19 Bcf/d or 1.33 Bcf and averaged at 93.49 Bcf/d for the report week. Accordingly, supply should likely exert a mild positive pressure to this week’s price activity.

Demand – Positive

Residential and commercial sector demand moved up by 1.65 Bcf/d or nearly 16% to average at 12.11 Bcf/d for the report week. Industrial demand also moved up and showed week-on-week gains of 0.27 Bcf/d for a weekly average value of 21.54 Bcf/d. We expect structural demand-side drivers for the report week to have a positive effect on prices.

Flows – Neutral

Flows to LNG terminals remained at 6.15 Bcf/d for a consecutive week. The no change in flows can be considered as neutral this week.

Trader Sentiment – Positive

The U.S. Commodity Futures Trading Commission's (CFTC) Oct. 11 commitment of traders report for Nymex natural gas futures and options showed that reportable financial positions (managed money and other) on 10/8/2019 were 162,903 net short while reportable commercial operator positions came in with a 130,334 net long position. Total open interest was reported for this week at 1,257,682 and was up 58,769 lots from last week's reported 1,198,913 level. Sequentially, commercial operators this reporting week were adding to longs by 12,244 while cutting shorts by 29,897. Financial speculators added shorts and cut longs for the week (39,125 vs. -2,475, respectively). Overall, we see trader sentiment will likely be positive this week.

Recommended Reading

E&P Highlights: Sep. 2, 2024

2024-09-03 - Here's a roundup of the latest E&P headlines, with Valeura increasing production at their Nong Yao C development and Oceaneering securing several contracts in the U.K. North Sea.

Breakthroughs in the Energy Industry’s Contact Sport, Geophysics

2024-09-05 - At the 2024 IMAGE Conference, Shell’s Bill Langin showcased how industry advances in seismic technology has unlocked key areas in the Gulf of Mexico.

Interoil to Boost Production in Ecopetrol Fields

2024-09-03 - Interoil will reopen shut-in wells at three onshore fields, which are under contract by Ecopetrol.

Chevron Boosts Oil, NatGas Recovery in Gulf of Mexico

2024-09-03 - Chevron’s Jack/St. Malo and Tahiti facilities have produced 400 MMboe and 500 MMboe, respectively.

CNOOC Makes Ultra-deepwater Discovery in the Pearl River Mouth Basin

2024-09-11 - CNOOC drilled a natural gas well in the ultra-deepwater area of the Liwan 4-1 structure in the Pearl River Mouth Basin. The well marks the first major breakthrough in China’s ultra-deepwater carbonate exploration.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.