Key Points: Dry gas production was flat overall with a modest gain of 0.3 Bcf/d seen week-on-week for the report week ending May 3. An overall increase in demand of approximately 5 Bcf/d, mostly from residential and commercial, representing an increase of 10% w-o-w was also observed. Our analysis leads us to expect 87 Bcf storage build would be reported by EIA for the report week, in comparison to the current 85 Bcf consensus whisper expectation and almost 30% higher than the five- year average storage build of 68 Bcf.

Natural gas prices stayed in the $2.61/MMBtu range throughout the report week. Based on bearish injections and mild weather outlook, we do not anticipate much movement from the current levels. LNG flows are at its highest at 5.26 Bcf/d and with the imminent start of LNG trains at Elba Island and Cameron, it is expected to grow larger only.

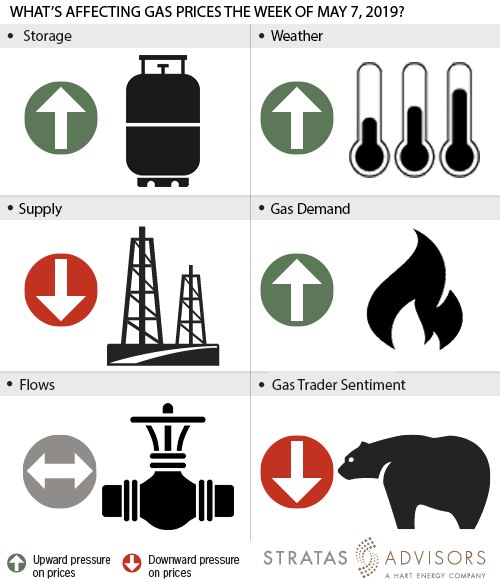

Storage: Positive

Last week, the EIA reported a higher than expected storage build of 123 Bcf that took working gas levels to 1,462 Bcf, which is 128 Bcf above year ago levels but 316 Bcf below the 5-year normal. We expect to see an 87 Bcf storage build for the current week. Higher demand driven by cool weather should result in a drop in gas into storage. Accordingly, we see storage as a positive driver for this week’s gas prices.

Weather: Positive

The latest NOAA 8-14 day weather forecast shows unseasonably cold temperatures prevailing over the next couple of weeks with only Pacific Northwest seeing warmer than normal temperatures. Lower temperatures could lead to higher demand thereby reducing overall supply. All in, we see weather as a positive driver for this week’s price activity.

Supply: Negative

Field supply increased marginally through the week to account for an average of 85.43 Bcf/d, an increase of 2 Bcf from the prior week. Dry gas production has consistently stayed above 85 Bcf/d for the past several weeks and this trend is looking to continue into the summer as well. Accordingly, supply will be a negative driver for gas prices this week.

Demand: Positive

Demand has increased by 10% w-o-w or by 40 Bcf during the report week. NRG Energy Inc is planning to return its inactive Gregory natural gas plant in Corpus Christi Texas into service. The plant has a capacity of 385 MW with an expected natural gas consumption of 70 MMcf/d. Therefore, we anticipate an uptick in demand in the coming weeks. For this week, demand will offer positive pressure on gas prices.

Flows: Neutral

We see no new material upset conditions to report on so we see flows as a neutral driver for gas prices this week.

Trader Sentiment: Negative

With exceptionally high storage build from last week, traders decreased the June natural gas futures by 6 cents. The CFTC's 5/3/2019 commitment of traders report for NYMEX natural gas futures and options showed that reportable financial positions (Managed Money and Other) on 5/30/2019 were 71,116 net short while reportable commercial operator positions came in with a 42,722 net long position. Total open interest was reported for this week at 1,257,077 and was down 20,333 lots from last week's reported 1,277,410 level. We see trader sentiment as being negative.

Recommended Reading

OPEC Gets Updated Plans From Iraq, Kazakhstan on Overproduction Compensation

2024-08-22 - OPEC and other producers including Russia, known as OPEC+, have implemented a series of output cuts since late 2022 to support the market.

E&P Highlights: Aug. 26, 2024

2024-08-26 - Here’s a roundup of the latest E&P headlines, with Ovintiv considering selling its Uinta assets and drilling operations beginning at the Anchois project offshore Morocco.

OMV Makes Gas Discovery in Norwegian Sea

2024-08-26 - OMV and partners Vår Energi and INPEX Idemitsu discovered gas located around 65 km southwest of the Aasta Hansteen field and 310 km off the Norwegian coast.

E&P Highlights: Sep. 2, 2024

2024-09-03 - Here's a roundup of the latest E&P headlines, with Valeura increasing production at their Nong Yao C development and Oceaneering securing several contracts in the U.K. North Sea.

Breakthroughs in the Energy Industry’s Contact Sport, Geophysics

2024-09-05 - At the 2024 IMAGE Conference, Shell’s Bill Langin showcased how industry advances in seismic technology has unlocked key areas in the Gulf of Mexico.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.