Key Points: Due to the limited and fleeting effects of Barry, which was downgraded from Hurricane 1 to Tropical Storm as it came ashore July 13, we think the markets will tend to price natural gas lower through the week until the storage report comes out. Offshore producers announced on July 15 the resumption of restarts toward normal offshore operation, and onshore refiners announced plans to resume refining operations onshore. LNG loadings appear likely to ramp back to normal this week. Power outages appear relatively manageable and thankfully occurring amid cooler cloudy weather that will make the outage more bearable for affected customers. The wet weather this week is likely to dampen regional power demand, but that should not deal a huge blow to the overall market. A few days of lower Gulf Coast gas production is likely to show up this week.

Last week’s data shows marginal week-over-week decreases in average dry gas production by 1 billion cubic feet per day (Bcf/d) or 7 Bcf. Gas demand for power generation set another year-to date high of 43.56 Bcf/d one day during the report week while demand in other sectors remained in line with the prior week. Exports to Canada and Mexico rose by 0.05 Bcf/d or 0.34 Bcf and 0.12 Bcf/d or 0.86 Bcf, respectively. Our analysis leads us to expect a 68 Bcf injection level for the report week. Our expectation is 5 Bcf less than the current consensus of 73 Bcf and 3 Bcf more than the 65 Bcf five year average storage build.

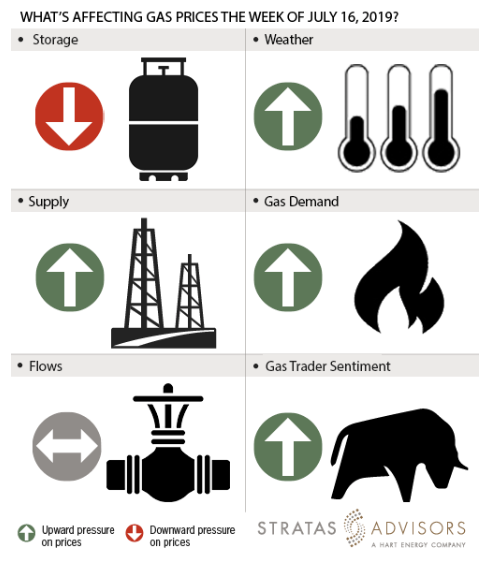

Storage: Negative

The U.S. Energy Information Administration (EIA) reported a storage build of 81 Bcf for the prior week ending July 5. Inventory levels are comfortably above year ago levels and are only 5.4% below five-year average levels. We expect a storage build of 68 Bcf would be announced by the EIA for the report week. According to our forecasts, we expect end-of-summer storage levels to reach 3.0 to 3.3 Tcf depending on capacity of LNG exports and industrial demand capacity coming online. We continue to monitor inventory and will update the numbers when there are any changes. All in, we see storage changes as a negative driver for this week.

Weather: Positive

Tropical storm Barry bought significant rain and ambient cooling to the Gulf Coast. The Southwest and regions on either side of the Mississippi River Valley are going to remain very hot with temperatures in the 100s to 110s. Accordingly, we see strong natural gas demand this week through the Lower 48. We were surprised to see Henry Hub prices trade in the first hour of July 15 at $2.53/MMBtu as this was the first time prices rose above $2.50 mark in more than four weeks. Prices on July 16 are in the $2.30/MMBtu range that is consistent with pre-Barry prices. So from here, with weather heating up, we see weather as a positive driver for gas price activity.

Supply: Positive

Dry gas production dropped by 1 Bcf/d, however stayed above 85 Bcf/d. The Interior Department's Bureau of Safety and Environmental Enforcement disclosed that the industry is shutting in 1.237 Bcf/d of offshore natural gas production or 1% of U.S. total natural gas production because of tropical storm Barry. We believe supply will exert a positive pressure on prices.

Demand: Positive

Demand from power generation has risen by 2.1 Bcf/d or 14.67 Bcf over the report week and also set the daily 2019 record burn. Power generation average for the report week was 40.32 Bcf/d, and we don’t expect the numbers to increase much beyond this high weekly level. Demand for power generation appears to have peaked early this year in July, a month earlier than our prior forecast. Demand from industrial sector has stayed at approximately 20 Bcf/d. All in, we see a positive effect from demand side drivers which we think are not fully priced in to gas prices this week yet.

Flows: Neutral

There appears to be no significant lasting damage from the landfall of Barry. The platforms in the offshore Gulf of Mexico are still evaluating startup plans. Until we see actual news of any long-term disruption, we see no new upset conditions or pipeline disruptions. We see flows as being neutral this week.

Trader Sentiment: Positive

We see trader sentiment as being positive driver for gas price activity this week. The CFTC’s July 12 commitment of traders report for NYMEX natural gas futures and options showed that reportable financial positions (managed money and other) on July 9 were 158,878 net short while reportable commercial operator positions came in with a 130,012 net long position. Total open interest was reported for this week at 1,314,135 and was down 9,301 lots from last week’s reported 1,323,436 level.

Recommended Reading

Vistra Buys Remaining Stake in Subsidiary Vistra Vision for $3.2B

2024-09-19 - Vistra Corp. will become the sole owner of its subsidiary Vistra Vision LLC, which owns various nuclear generation facilities, renewables and an energy storage business.

Kimmeridge Signs Natgas, LNG Agreement with Glencore

2024-09-19 - Under the terms of the agreement, set to be finalized later this year, Glencore will purchase 2 mtpa of LNG from Commonwealth LNG and source natural gas from Kimmeridge Texas Gas.

Matador Closes $1.8B Ameredev Deal, Updates Asset Development Plans

2024-09-19 - Matador Resources’ $1.83 billion bolt-on acquisition of the Delaware Basin’s Ameredev II adds 33,500 acres and brings the company’s inventory to approximately 2,000 net locations.

TotalEnergies Signs LNG Agreements in China, Turkey

2024-09-19 - TotalEnergies announced two separate long-term LNG sales in China and a non-binding agreement with Turkey’s BOTAŞ in an effort to grow its long-term LNG sales.

WhiteHawk Energy Adds Marcellus Shale Mineral, Royalty Assets

2024-09-18 - WhiteHawk Energy LLC said it acquired Marcellus Shale natural gas mineral and royalty interests covering 435,000 gross unit acres operated by Antero Resources, EQT, Range Resources and CNX Resources.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.