Stock market concept with oil rig in the gulf and oil refinery industry. (Source: Shutterstock.com)

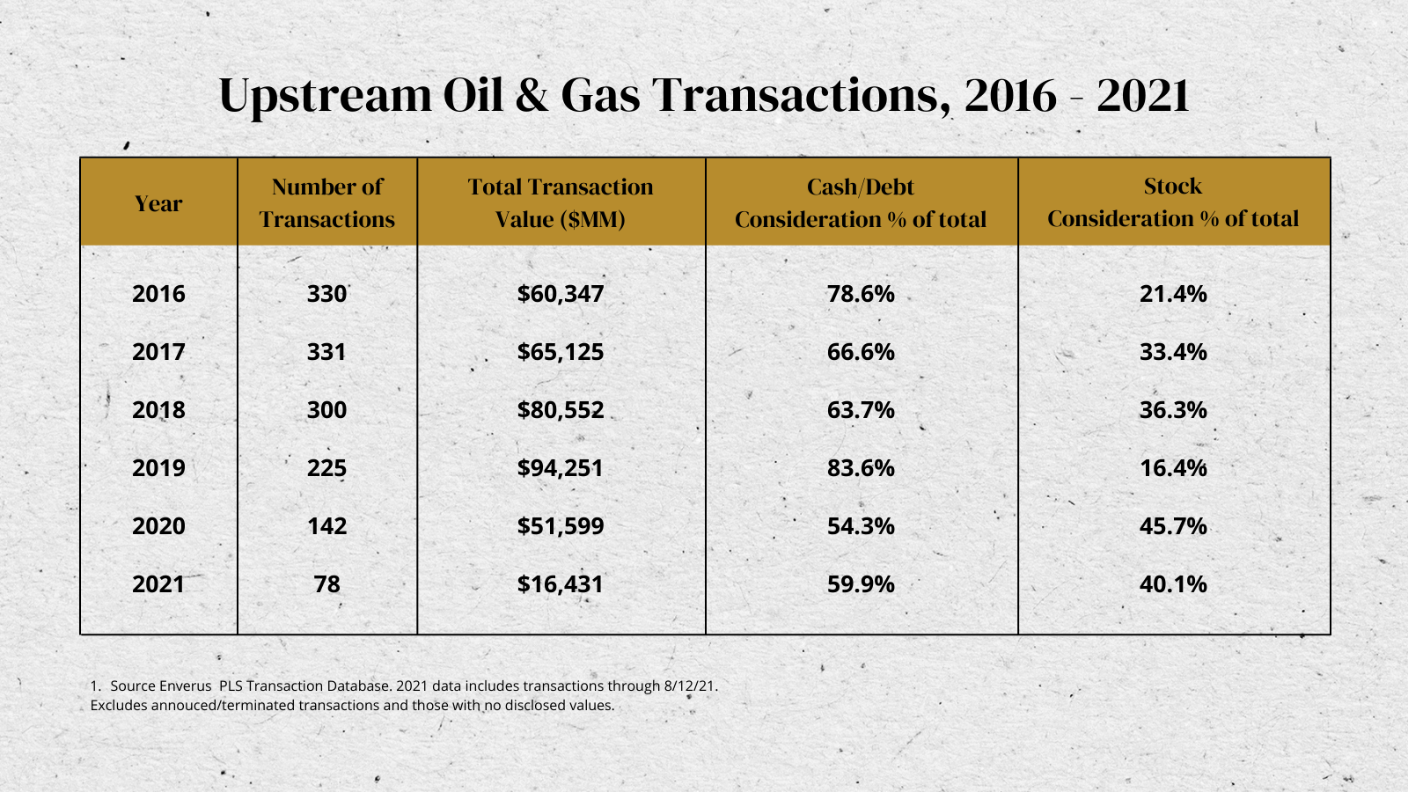

Over the last several years, an acquiring company’s stock has become a more commonly used currency in upstream oil and gas merger and acquisition transactions. As shown in the table below, since 2016, stock as a percentage of the total consideration in upstream oil and gas transactions have increased substantially:

Companies that are considering utilizing their stock as a form of consideration in a transaction should keep the following five concepts in mind:

- Establishment Of Purchase Price — When the acquirer is a publicly traded company, establishing the purchase price amount is relatively straightforward. However, if the acquirer is a privately held entity, the establishment of the purchase consideration to be allocated can be more difficult to accomplish. In this instance, the shares of the acquirer that are being used for consideration will need to be valued to establish the consideration amount. This would include the estimation of the company’s business enterprise value (i.e., total asset value), utilizing one or more of the three generally accepted valuation approaches (income, cost, and/or market approach). If the acquirer has a complex capital structure, with various classes of equity that have different rights and preferences, this will also include the valuation of the applicable classes of equity.

- Purchase Price Allocation Requirements — In a transaction in which stock is used as consideration, like with all acquisitions, ASC 805, Business Combinations, requires the allocation of the purchase consideration to be identified as tangible and intangible assets for financial reporting purposes.

- Changes In Market Conditions Before Closing — The value of shares to be issued as consideration might not always align exactly with the value of the acquired assets. Market conditions and other forces may bring about changes in values in both the equity being used as consideration and the assets being acquired, between the time that the transaction is announced and the time that it closes. Valuation analysts should keep in close communication with the management of the acquirer, and the respective auditor, to ensure that there are no surprises when the transaction closes and the final purchase price allocation is performed.

- Consistency In Valuation Assumptions — In instances where the shares of the acquirer are being valued to establish the consideration amount, care should be taken to ensure that key valuation assumptions are consistent between the valuation of the equity of the acquirer and the assets of the acquiree. These assumptions should also be consistent with prior fair value analyses. Examples of such valuation assumptions in the upstream oil and gas industry would include commodity pricing, volumetric risking, and discount rates. If there are substantial differences between the respective analyses, there should be supportable reasons why such differences exist.

- Use Of A Control Premium — In some instances where equity is being used as consideration, a question may arise as to whether a control premium should be applied to the consideration being paid. This will require the valuator to understand the terms of the purchase agreement and to understand whether a control element has already been priced into the transaction. For example, in the acquisition of a limited partnership, a general partner may have also been acquired in the transaction. Often, the amount paid for this general partnership interest may represent the “control” factor (i.e., the ability to affect change in the projected cash flows, above and beyond the acquisition of the limited partnership).

Summary

The use of stock as part of consideration has become much more common in today’s oil and gas acquisition market. In instances where a company’s stock is used as consideration for a merger or acquisition, the factors noted above make it more critical than ever to have a strong, defensible valuation supporting the value of the consideration paid, as well as the purchase price allocation.

About the Experts

Kevin Cannon is a Director in Opportune’s Valuation practice based in Houston. He has 17 years of experience performing business and asset valuations and providing corporate finance consulting.

His specific experience includes valuations of businesses and intangible assets for purchase price allocations, impairment, tax planning, management planning and portfolio valuation purposes for companies in a variety of industries, including oil and gas, oilfield services, and industrial manufacturing.

Alan Huynh is a Manager in Opportune’s Valuation practice based in Houston. He has held financial analysis roles in the energy industry and has experience in the areas of valuations of businesses and intangible assets throughout the energy value chain.

Recommended Reading

US Drillers Cut Oil, Gas Rigs for Fifth Week in Six, Baker Hughes Says

2024-09-20 - U.S. energy firms this week resumed cutting the number of oil and natural gas rigs after adding rigs last week.

Western Haynesville Wildcats’ Output Up as Comstock Loosens Chokes

2024-09-19 - Comstock Resources reported this summer that it is gaining a better understanding of the formations’ pressure regime and how best to produce its “Waynesville” wells.

August Well Permits Rebound in August, led by the Permian Basin

2024-09-18 - Analysis by Evercore ISI shows approved well permits in the Permian Basin, Marcellus and Eagle Ford shales and the Bakken were up month-over-month and compared to 2023.

Kolibri Global Drills First Three SCOOP Wells in Tishomingo Field

2024-09-18 - Kolibri Global Energy reported drilling the three wells in an average 14 days, beating its estimated 20-day drilling schedule.

Permian Resources Closes $820MM Bolt-on of Oxy’s Delaware Assets

2024-09-17 - The Permian Resources acquisition includes about 29,500 net acres, 9,900 net royalty acres and average production of 15,000 boe/d from Occidental Petroleum’s assets in Reeves County, Texas.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.