Vital is on the lookout for more adds—particularly as a surge of basin consolidations announced late last year and through this year is expected to create cast-offs when new owners high-grade their integrated portfolios. (Source: Shutterstock/ Vital Energy)

Permian producer Vital Energy is following its 2023 “small ball” strategy of adding six asset packages totaling $1.6 billion with a “‘Moneyball’” tack this year that bolsters the technology and economics of its upgraded portfolio.

“We did amazing work in 2023 to continue our transformation as a company,” Jason Pigott, president and CEO, said in an earnings call Feb. 22. “We talked a lot last year about this transition to small ball, which was performing a series of smaller transactions that weren't as competitive … and it was wildly successful.”

Already, Vital has added another 185 locations to its portfolio via one pilot hole and revised economics based on lower well costs: $12 million down to $10.5 million.

“We're switching a little bit more to ‘Moneyball,’ which is ‘Let's spend [via] testing new zones and get wells—not for free, but—almost for free,’” Pigott said.

It could still buy

But Vital is on the lookout for more adds—particularly as a surge of basin consolidations announced late last year and through this year is expected to create cast-offs when new owners high-grade their integrated portfolios.

“We will still be active in the market,” Pigott said. “There are deals out there today and there are going to be deals in the future, but I would say the bar has been raised for us.”

New deals would need to meet or surpass the economics and stacked-well potential Vital’s reached in the past year.

“Any deals that we look at will need to be accretive to us, and inventory will need to [improve] the inventory that we've added this year. So I'd say we're still going to look at it,” he said.

Adds could come from Diamondback Energy’s discards post-acquisition of Endeavor Energy, or from Occidental Petroleum, post-acquisition of CrownRock, or other properties “adjacent to us and can make a lot of sense.”

But the hurdle is high, he reiterated. “Vital Energy is a much different company today than we were a year ago.”

For example, it just added 185 locations “at a very low cost just because of our technical work.”

Vital is in a good position to pick up property with less competition, he said. “We’re one of the few SMID-caps remaining out there trying to buy and aggregate these assets. So there's less competition for us in some of these areas.”

Vital doesn’t pay dividends yet like several other Permian operators, noted Gregg Brody, high-yield analyst for Bank of America Securities, on the call.

Bryan Lemmerman, Vital’s CFO, said net debt to EBITDA will need to get below 1.0x, then “we will put something in place that's very well thought out.” He added that “we have a good line of sight of that happening later this year.”

Science-ing

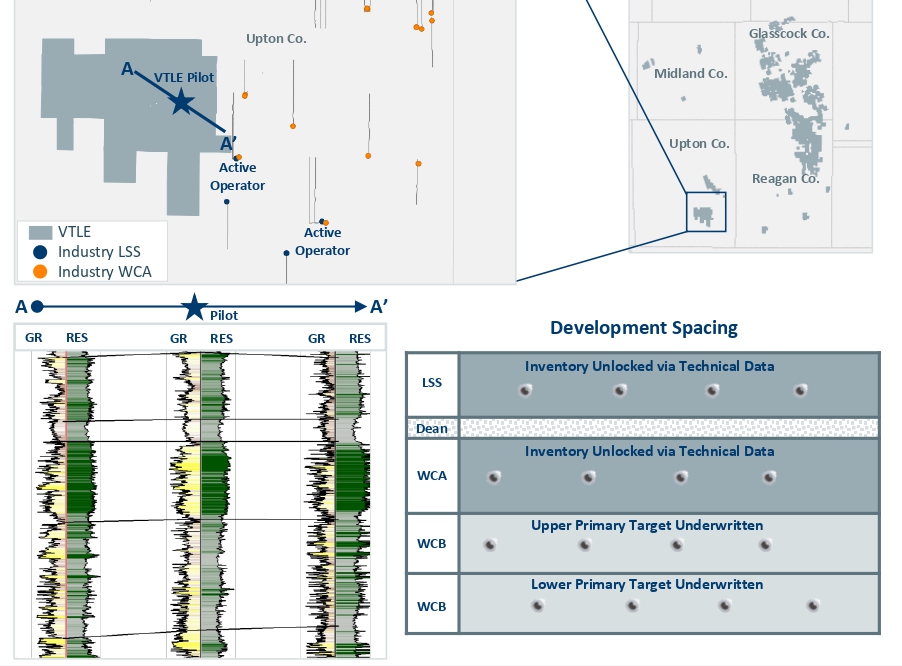

2023 deals came with 88,000 net acres, 465 gross oil-weighted locations and 280 future-well locations. And Vital added another 185 via new geology and geophysics evaluation, improved economics and higher well performance. Vital’s fourth-quarter production was 47% oil, averaging 113,700 boe/d.

In Upton County in the Midland Basin, it underwrote 78 upper and lower Wolfcamp B locations in the acquisition price.

Post-closing, Vital added 65 additional locations that were “unlocked via technical data” in Lower Sprayberry and Wolfcamp A. The adds were supported by a vertical pilot and that the stacked pay across the position has a consistent reservoir quality.

Katie Hill, COO, said the technical evaluation included neighbors’ results.

In the Delaware Basin, Vital underwrote 202 locations and added another 120 from improved economics.

“One is our frac design,” said Kyle Coldiron, vice president of new well delivery. “We put a high-intensity, tight cluster-spacing, high proppant-loading completion design on these wells, and we think that certainly contributes.”

Vital wine-racks wells. Second-gen Permian horizontals during the mid-2010s were “over-drilled or too tightly spaced wells, and you've seen a lot of operators moving to a wider spacing solution,” Coldiron said.

Toward improved economics, for example, Vital is bringing online a two-pad, 20-well package in the Midland’s Glasscock County.

Coldiron said, “One of the great benefits of that was we were basically able to park our Halliburton frac [spread] there and complete 10 of those wells [in one pad] without ever having to move the fleet.”

Delaware pads are smaller with three to five wells each, he added.

Total company leasehold is 256,000 net acres. In the Delaware, its position is in Ward, Reeves and Pecos counties—mostly in Reeves. In the Midland, it’s in Howard, Glasscock, Reagan, Upton and Midland—mostly in the former three.

It plans to have four rigs and 1.7 completion crews at work through 2024.

At year-end 2023, Vital estimated it has 830 locations at less than $55 WTI, more than 10 years of drilling inventory at current activity levels and 275 locations that break even below $50.

Recommended Reading

CEO: Coterra Drops Last Marcellus Rig, May Halt Completions

2024-09-12 - Coterra halted Marcellus Shale drilling activity and may stop completions as Appalachia waits for stronger natural gas prices, CEO Tom Jorden said at an industry conference.

Vitol CEO: US Shale Gas Growing Source of Shipping, Trucking Fuel

2024-09-18 - International commodities trading house Vitol sees growing demand for U.S. shale gas to spur LNG exports to China, India and emerging economies in Asia.

Midcon Momentum: SCOOP/STACK Plays, New Zones Draw Interest

2024-09-03 - The past decade has been difficult for the Midcontinent, where E&Ps went bankrupt and pulled back drilling activity. But bountiful oil, gas and NGL resources remain untapped across the Anadarko, the SCOOP/STACK plays and emerging zones around the region.

Non-op Rising: NOG’s O’Grady, Dirlam See Momentum in Co-purchase M&A

2024-09-05 - Non-operated specialist Northern Oil & Gas is going after larger acquisitions by teaming up with adept operating partners like SM Energy and Vital Energy. It’s helping bridge a capital gap in the upstream sector, say NOG executives Nick O’Grady and Adam Dirlam.

Dallas Fed: Low Natgas Prices Force Permian E&Ps to Curtail Output

2024-09-25 - Falling oil prices, recession fears and the U.S. election cycle are weighing on an increasingly pessimistic energy industry, according to a new survey of oil and gas executives by the Federal Reserve Bank of Dallas.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.