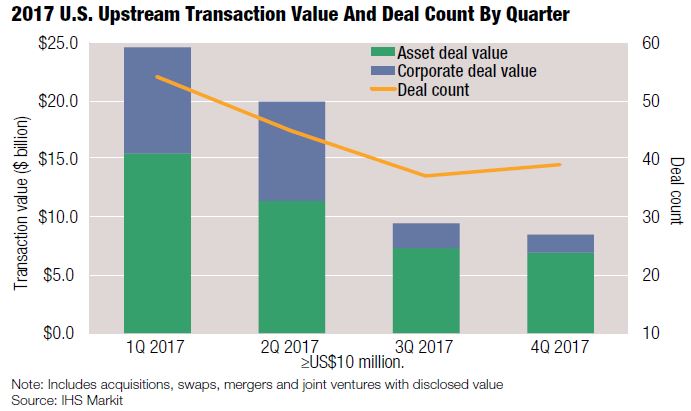

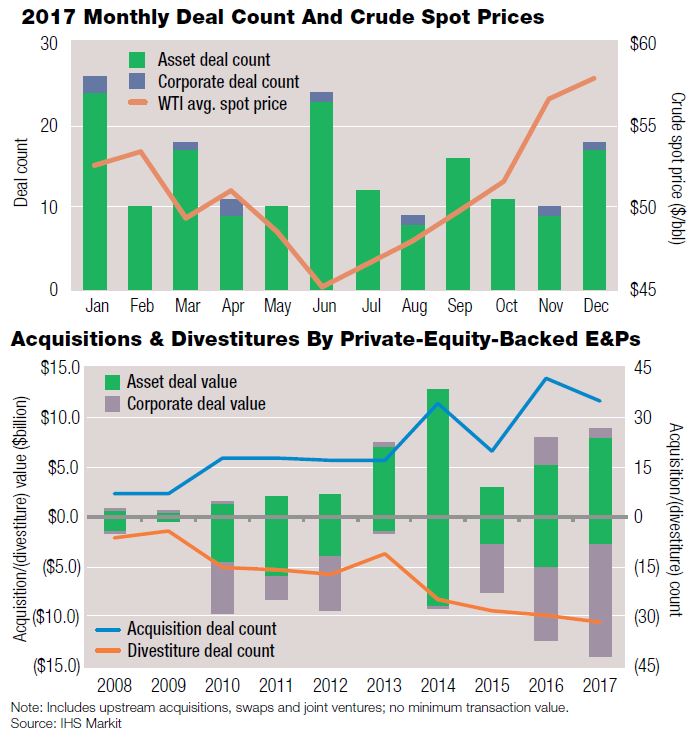

The U.S. upstream M&A market was a tale of two halves in 2017. Deal-making in the first half got off to a strong start, particularly in the first quarter, as oil prices remained firm in the $50- to $55-per-barrel (bbl) range. The first half accounted for more than 70% of total transaction value for the year, including more than 80% of corporate deal value. Buyers and sellers had more difficulty reaching consensus in the second half, however, amid significant oil-price volatility that featured a drop in spot West Texas Intermediate to $45/bbl and a sharp ascent to $65 to close out the year.

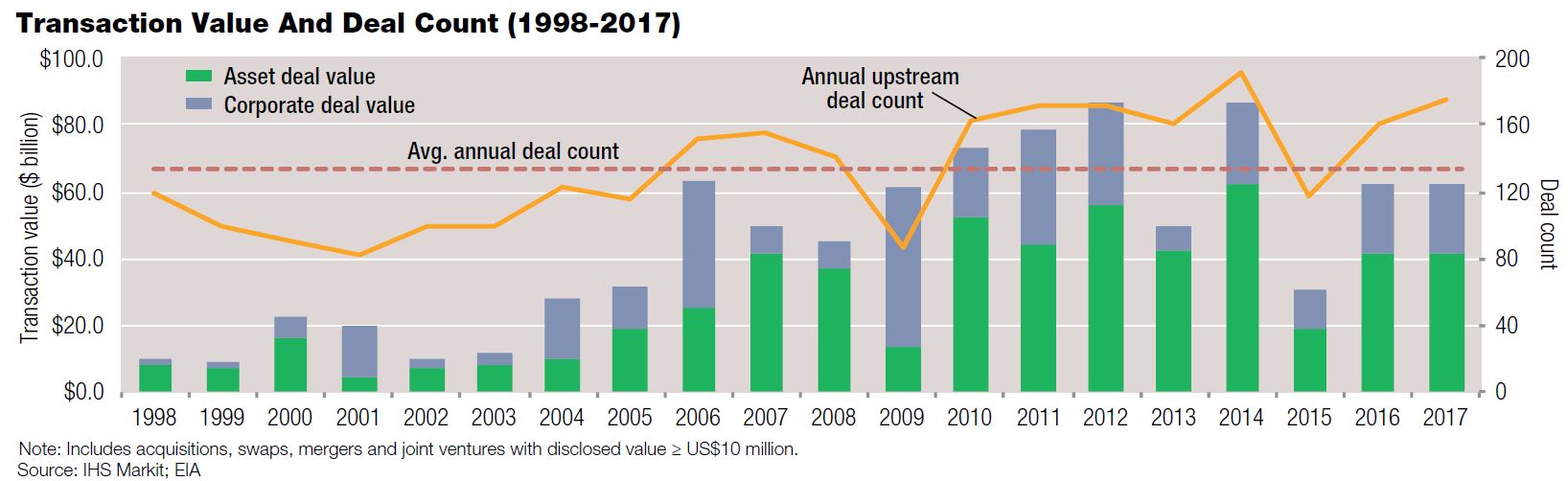

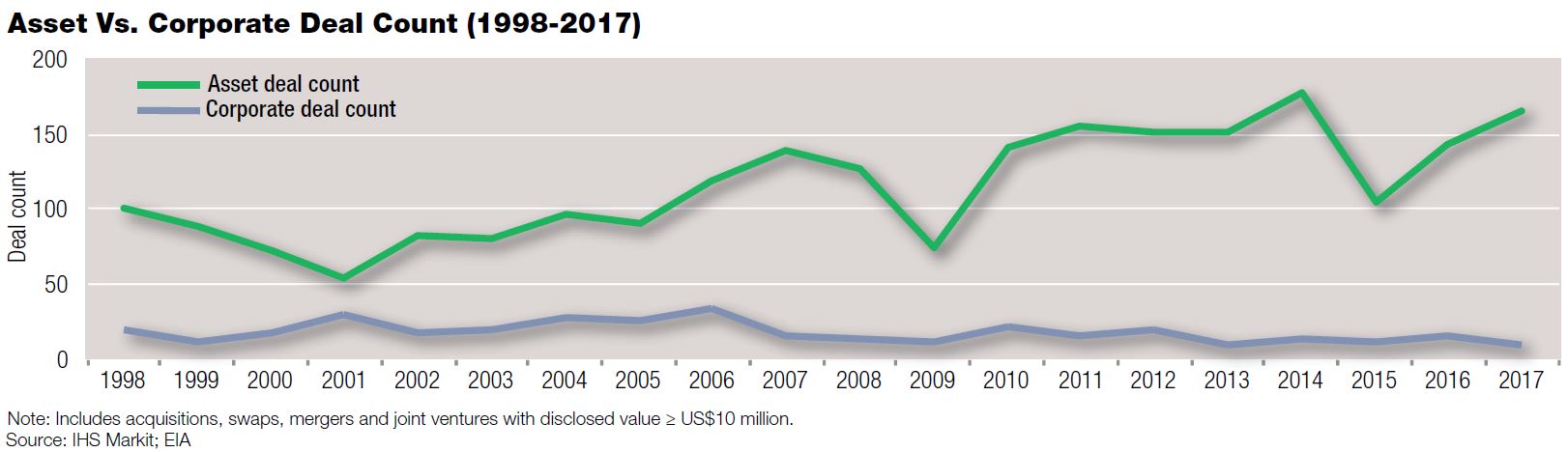

For the full year, deal count rose for the second consecutive year to well above the longer-term average but below the recent 20-year high that was set in 2014. Transaction value remained steady at $62.5 billion, following a strong rebound in 2016. Corporate deal count fell by nearly half to a 20-year low. There were no corporate transactions or takeovers of more than $10 billion for the fifth consecutive year.

Despite the decrease in corporate deal count, corporate transactions still accounted about a third of total U.S. upstream deal value for the second consecutive year and remained above the recent lows of 2013 and 2015. Asset deal count rose 13% to more than 160—the highest level since 2014.

After a busy 2016, privately held E&Ps were even more active in 2017. They led the way as both buyers and sellers, announcing nearly 100 acquisitions and divestitures totaling more than $40 billion in gross proceeds. Private-equity and financial sponsors slowed their direct acquisitions of upstream assets in 2017, but continued to funnel capital into existing and newly formed E&Ps at a record pace, making 50 investments totaling $9.6 billion in disclosed value during the year.

Small publicly traded E&Ps had a resurgence as buyers following a multiyear dip in activity, announcing nearly 50 acquisitions totaling $8.3 billion. The global integrateds were noticeably quiet in terms of deal count, announcing just one acquisition and one divestiture, although ExxonMobil Corp.’s $5.6-billion Permian purchase in 2017 was its largest acquisition since the $40-billion takeover of XTO Energy Inc. that was closed in 2010.

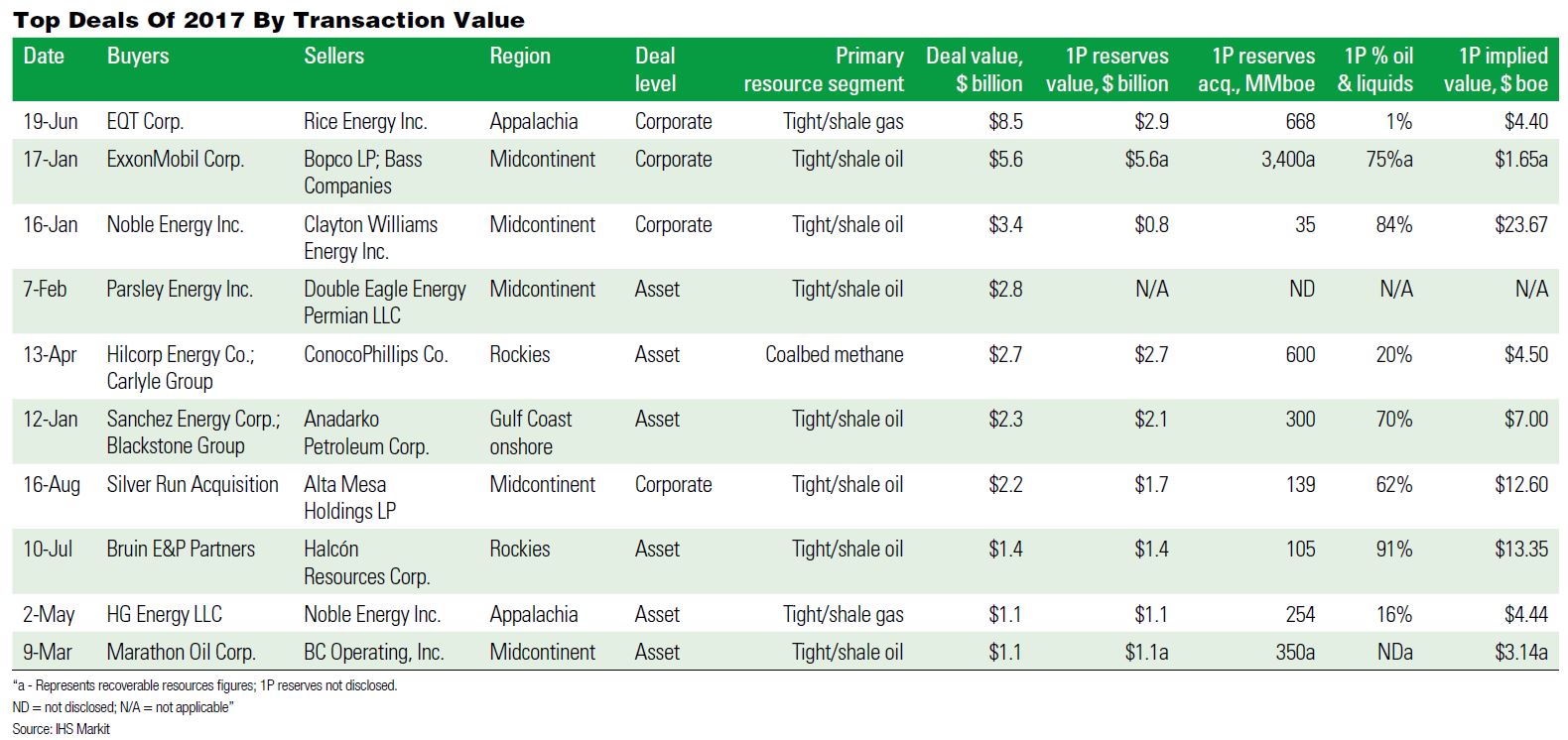

Unconventional resource transactions made up the entirety of the top 10 deals, with the majority focused on oil assets. Together, the 10 largest U.S. upstream deals of 2017 by transaction value totaled $31 billion, a 30% increase from the prior year, and accounted for nearly half of total upstream deal value.

Despite a dearth of corporate transactions, these accounted for four of the top 10 largest U.S. upstream deals, including these top three: EQT Corp.’s $8.5-billion takeover of Appalachia-focused Rice Energy Inc., ExxonMobil’s $5.6-billion acquisition of privately held Delaware Basin companies owned by the Bass family and Noble Energy Inc.’s $3.4-billion takeover of Permian Basin-focused Clayton Williams Energy Inc.

Silver Run Acquisition Corp. II’s $2.2-billion takeover of Oklahoma Stack producer Alta Mesa Holdings LP was the other U.S. corporate transaction to crack the top 10. ConocoPhillips Co.’s $2.7-billion sale of its San Juan Basin coalbed-methane (CBM) assets to an affiliate of Hilcorp Energy Co. and The Carlyle Group was the only deal in the top 10 not focused on tight/shale resources.

The Permian Basin was the target of four of the 10 largest deals, followed by the Marcellus Shale (two of 10), then the San Juan Basin, Eagle Ford, Stack play and the Bakken (one of 10). Parsley Energy’s $2.8-billion acquisition of Double Eagle Energy Permian LLC’s Midland Basin assets was the largest U.S. asset acquisition of 2017 and the only acreage-focused transaction in the top 10.

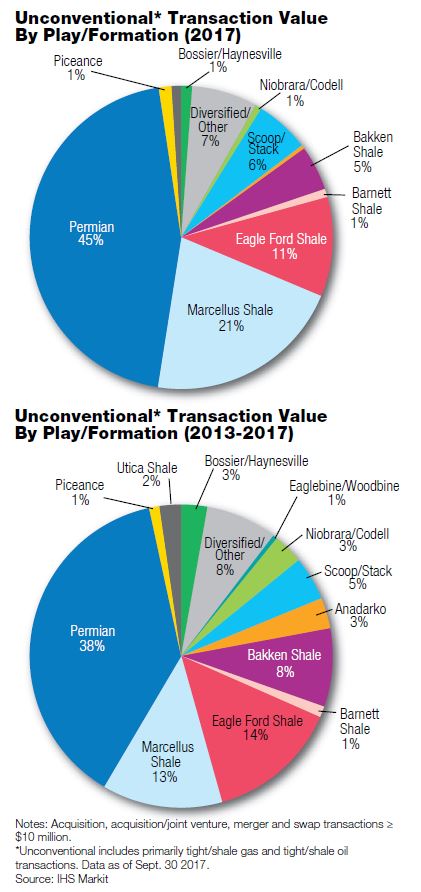

M&A spending on unconventional resources reached nearly $60 billion in 2017, the highest level in three years. Unconventionals represented more than 90% of total upstream transaction value, the largest share on record. The Permian Basin was once again the focal point for unconventional spending, accounting for 44% of total U.S. upstream unconventional spending in 2017, slightly above the 2013 to 2018 five-year total.

However, the Permian’s dominance in U.S. tight/shale deal-making began to wane by year-end, with its count and transaction value falling sequentially each quarter during the year. It went from accounting for nearly three-quarters of total upstream deal value and half of total upstream count in the first quarter to less than 20% on each measure during the fourth quarter.

For the entire year, the Permian accounted for 40% of upstream deal value after accounting for 42% in 2016, representing the first year-over-year decline in its share of deal value since 2011. Other plays accounting for a significant portion of unconventional deal value included the Marcellus (21%), Eagle Ford (11%), Oklahoma’s Scoop/Stack plays (6%) and the Bakken (5%).

Nearly 85% of 2017 total transaction value focused on tight/shale oil and gas resources, an increase of about 10% from the prior year. Tight/shale oil deals accounted for 58%, an 8% increase, and tight/shale gas accounted for 26%, a 2% increase.

Nearly every other resource type saw a decrease in transaction value from 2016 to 2017. Onshore conventional deal value experienced the largest decline, falling from 12% of total deal value in 2016 to 4% in 2017. Coalbed methane was the only other resource type to see an increase in transaction value from 2016 to 2017, from less than 1% to 5%, due almost entirely to ConocoPhillips’s sale of its San Juan Basin CBM assets.

The Midcontinent region accounted for nearly half of transaction value for the second consecutive year. The Appalachian and Rockies regions’ share more than doubled to 19% and 17%, respectively. Privately held Bruin E&P Partners acquired Halcón Resources Corp.’s Williston Basin assets for $1.4 billion and was the first $1-billion-plus Bakken deal since 2014.

The Gulf Coast onshore region had the largest decline in market share, from 17% to 12%. The four largest Gulf Coast transactions all targeted assets in the Eagle Ford. Only one of them exceeded $1 billion: Sanchez Energy Corp. and Blackstone Group’s $2.3-billion acquisition of Anadarko Petroleum Corp.’s liquids-weighted producing assets in the western Eagle Ford.

M&A activity in the Gulf of Mexico and on the West Coast accounted for less than 5% of U.S. deal value combined. Only one significant Gulf of Mexico reserve transaction was announced: privately held Talos Energy LLC’s $945-million takeover of Stone Energy Corp. The West Coast count remained minimal, limited to less than $500 million and among regionally focused producers. There were few U.S. deals that featured regionally diversified operations in 2017, after these typically larger corporate transactions accounted for 13% of value the prior year.

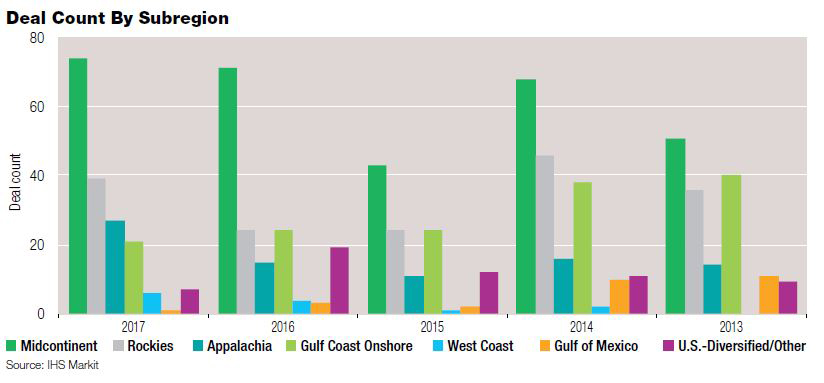

Activity once again centered on the Midcontinent region, where the count nearly doubled that of the next most active region. However, the total count in the region was flat from the prior year. It increased modestly in the Rockies, Appalachia and on the West Coast, while the Gulf Coast onshore, Gulf of Mexico and diversified regions each saw a slight decrease in count from 2016.

Of the 3.3 billion barrels of oil equivalent (Bboe) of disclosed proved reserves transacted in the U.S. during 2017, nearly 75% (2.4 Bboe) were in either the Rockies or Appalachia. More than half that amount was tied to two gas-weighted deals: EQT’s acquisition of Rice Energy and ConocoPhillips’ San Juan CBM sale to Hilcorp. Although the Midcontinent accounted for nearly half of upstream transaction value, the region accounted for just 12% of transacted 1P reserves during 2017, as a significant number of transactions in the Permian involved undeveloped properties or assets without associated proved reserves. This followed a year during which 43% of transacted 1P reserves were in the Midcontinent.

The oil and liquids weighting of transacted 1P reserves remained relatively flat, at 35%, with the two largest U.S. deals in terms of disclosed proved reserves being heavily gas-weighted: EQT-Rice and Hilcorp-ConocoPhillips. The liquids weighting of 1P reserves, when excluding corporate transactions, was slightly higher at 39%; it was unchanged from 2016 and in line with the 2008 to 2017 10-year weighted average.

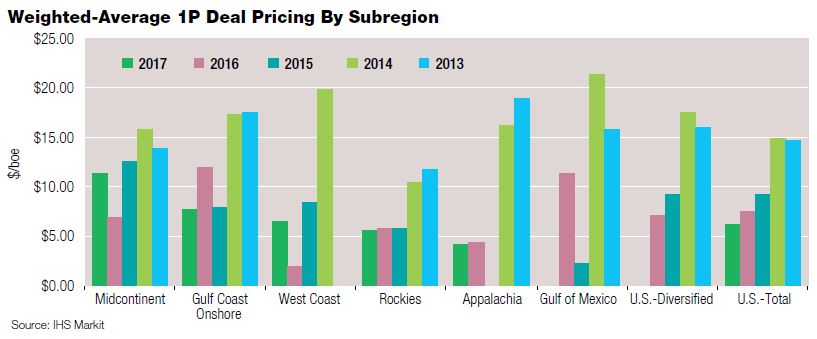

U.S. 1P asset deal pricing declined for the third consecutive year, hitting a new 10-year low for both liquids- and gas-weighted transactions. The decline was less pronounced when excluding deals of more than $1 billion. Pricing for 1P reserves, in both asset and corporate transactions, was significantly higher in the Midcontinent at $11.32/boe, followed by the Gulf Coast onshore and West Coast regions at about $7 to $8. Pricing for 1P reserves in the Rockies and Appalachia held steady from the prior year at around $5/boe.

Recommended Reading

DNO ‘Hot Streak’ Continues with North Sea Discovery

2025-03-26 - DNO ASA has made 10 discoveries since 2021 in the Troll-Gjøa exploration and development area.

E&P Highlights: March 24, 2025

2025-03-24 - Here’s a roundup of the latest E&P headlines, from an oil find in western Hungary to new gas exploration licenses offshore Israel.

CNOOC Makes Oil, Gas Discovery in Beibu Gulf Basin

2025-03-06 - CNOOC Ltd. said test results showed the well produces 13.2 MMcf/d and 800 bbl/d.

E&P Highlights: Feb. 24, 2025

2025-02-24 - Here’s a roundup of the latest E&P headlines, from a sale of assets in the Gulf of Mexico to new production in the Bohai Sea.

Black Gold, LGX Find Multiple Pay Zones in Western Indiana

2025-04-04 - Black Gold Exploration Corp. and LGX Energy Corp. are working to start production at the Fritz 2-30 oil and gas well in Indiana within 60 days.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.