The number of oil and gas rigs operating in the U.S. was 251 last week, compared with about 800 in January. (Source: Hart Energy)

U.S. oil companies have increased production by 1.2 million bbl/d over the past six weeks, as they restore wells shut earlier this year and start producing from others they left unfinished as prices sank.

Output bottomed out at 9.7 million bbl/d in the second week of June but has since risen to 10.9 million bbl/d as activity starts to pick up in the big shale fields of Texas, according to Genscape, a division of consultancy Wood Mackenzie that monitors energy flows. That figure is more than the U.K.’s entire crude production of 1.1 million bbl/d.

U.S. production should now stabilise at about 11m b/d through to the end of 2020, analysts said. That is well below the 13 million bbl/d in March before the Saudi-Russian price war and coronavirus pandemic devastated U.S. oil prices.

“It’s a slow, slow recovery, but it’s happening,” said Alexandre Ramos-Peon, a senior analyst at Rystad Energy, a consultancy.

Despite the restarting of wells shut around the time the U.S. oil price plunged below zero in April, drilling activity remains weak. The number of operating rigs was just 251 last week, compared with about 800 in January.

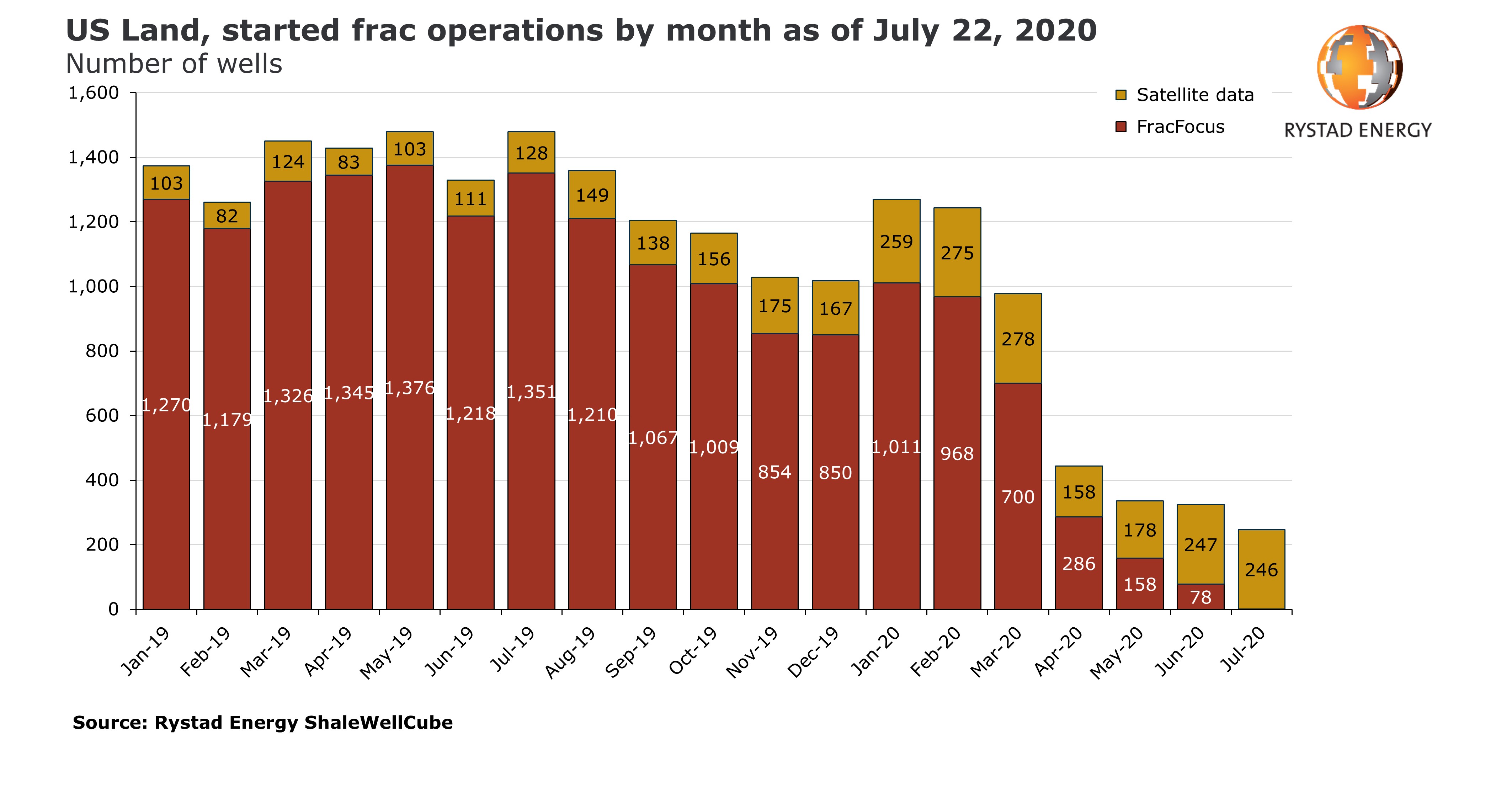

But oilfield services companies say activity is beginning to pick up as operators redeploy crews to bring DUCs into production. Hydraulic fracturing, or fracking, uses water, sand and chemicals pumped into a well to open small cracks that will release the oil or gas.

The rise in fracking will ease fears that production could slip into an even more severe downward spiral.

Shale is unusual in the oil business because a typical well produces prolifically for a year before output drops steeply and then settles into a modest and diminishing flow rate thereafter. That means thousands of wells must be drilled each year just to hold overall output steady.

The number of so-called frac crews carrying out well-completion work crashed to a low of 45 in May, just 10% of the levels a year earlier, according to Primary Vision, an oilfield data provider.

But the research firm said 62 frac crews were now operating across the country. Rystad estimated more than 400 wells would be fracked this month, up from a low of 325 in June.

U.S. shale basins hold more than 7,000 wells that have been drilled but await completion, according to the federal Energy Information Administration (EIA).

That leaves a large inventory of wells for operators to bring into production. Even so, a sustained recovery in output would need more drilling, say analysts.

“The stock of uncompleted wells is like a savings account for the industry,” said Ian Nieboer, a managing director at RS Energy Group, a consultancy. “It buys time—but even treading water to keep production flat will become difficult if drilling activity doesn’t increase.”

Last year more than 14,000 wells were drilled in the U.S., but fewer than half that number would be drilled in 2020, Nieboer said.

Rystad predicts U.S. production will grow by about 500,000 bbl/d in 2021, after hovering around 11 million bbl/d for the remainder of this year. That is well below the growth rates of recent years.

“We would need to see fracking activity return to the thousands [of wells] in order to see such a production growth,” Ramos-Peon said.

“Right now, it’s like a reset to the industry,” he said. “Lots of bankruptcies, lots of disenchantment, less capex. But it’s still profitable to continue growing at these prices.”

Recommended Reading

What's Affecting Oil Prices This Week? (March 10, 2025)

2025-03-10 - Prices were weighed down by concerns about economic growth, in part, because of more tariffs being imposed by the Trump administration, and OPEC+ reiterating that its production cuts would start unwinding in April.

What's Affecting Oil Prices This Week? (Jan. 27, 2025)

2025-01-27 - For the upcoming week, Stratas Advisors predict that the price of Brent crude will threaten $75.

What's Affecting Oil Prices This Week? (Feb. 24, 2025)

2025-02-24 - Net long positions of WTI have decreased by 59% since Jan. 21 and are 61% below the level seen on July 16, 2024, when the price of WTI was $80.76.

What's Affecting Oil Prices This Week? (April 7, 2025)

2025-04-07 - From an upside perspective – a favorable resolution of the tariffs will push the price of Brent crude to $75 and the price of WTI to $70.

What's Affecting Oil Prices This Week? (Jan. 13, 2025)

2025-01-13 - Stratas Advisors expect that there is some room for oil prices to move higher this week, but the price of Brent crude oil will struggle to breakthrough $82.50.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.