Analysts with Tudor, Pickering, Holt & Co. said the transaction implies a total valuation for the Targa Badlands asset in the Bakken of roughly $3.6 billion. (Source: Hart Energy/Shutterstock.com)

Targa Resources Corp. (NYSE: TRGP) revealed a Bakken asset sale on Feb. 19 set to bring in $1.6 billion in cash earmarked to reduce the Houston-based company’s debt and fund capital needs in the North Dakota shale play.

The sale is comprised of a 45% stake in Targa Badlands LLC, which operates oil and gas gathering and processing assets located in the Bakken and Three Forks shale plays within the Williston Basin of North Dakota.

Funds managed by Blackstone Group LP (NYSE: BX) and its credit investment arm GSO Capital Partners agreed to jointly acquire the Targa Badlands stake. Meanwhile, Targa will maintain operatorship and governance rights in Badlands.

Analysts with Tudor, Pickering, Holt & Co. (TPH) said the transaction implies a total valuation for Targa Badlands of roughly $3.6 billion. Further, the price tag “easily clears” the Street over-under of between $2.6 billion and $3 billion in total value, the TPH analysts wrote in a Feb. 19 research note.

TPH estimates the sale will reduce Targa’s debt by about $500 million with the balance of the sale proceeds satisfying the majority of the company’s 2019 equity funding needs for its roughly $2 billion to $2.1 billion capital program.

“We expect outperformance today as transaction alleviates financing overhang and refocuses market on asset quality and cash flow ramp,” the TPH analysts said.

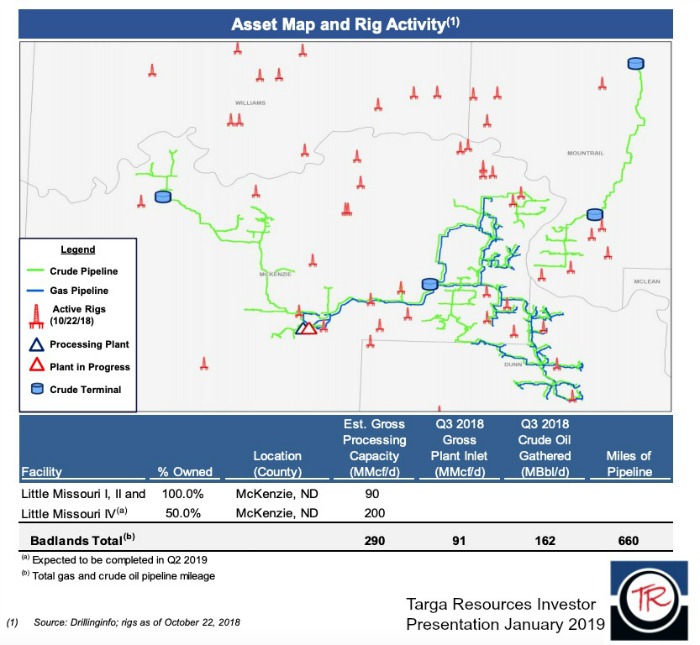

The Badlands assets include about 480 miles of crude oil gathering pipelines, 125,000 barrels of operational crude oil storage, roughly 260 miles of natural gas gathering pipelines and the Little Missouri natural gas processing plant with a current gross processing capacity of about 90 million cubic feet per day (MMcf/d). Additionally, Badlands owns a 50% interest in the 200 MMcf/d Little Missouri 4 Plant that is anticipated to be completed in second-quarter 2019.

Targa CEO Joe Bob Perkins said he expects the company’s partnership with Blackstone, as a result of the sale, will support continued growth in the Bakken.

“Selling a minority interest in the Badlands at an attractive valuation allows us to satisfy a substantial portion of our estimated 2019 equity funding needs and provides us with significant flexibility looking forward,” Perkins added in a Feb. 19 statement.

Targa expects to close the transaction in second-quarter 2019, subject to customary regulatory approvals and closing conditions, according to the company press release.

Evercore is Targa’s exclusive financial adviser and Vinson and Elkins LLP is acting as its legal counsel on the transaction. Citi is serving as Blackstone’s exclusive financial adviser and Akin Gump Strauss Hauer & Feld LLP is the investment firm’s legal counsel.

Emily Patsy can be reached at epatsy@hartenergy.com.

Recommended Reading

Aethon to Offer $1B in Private Sale of Senior Notes

2024-09-19 - Aethon United, managed by Aethon Energy Management, said proceeds would go toward buying notes due in 2026

Dividends Declared in the Week of Sept. 9

2024-09-13 - Here is a compilation of dividends declared by select upstream and service and supply companies for third-quarter 2024.

Viper Energy Offers 10MM Shares to Help Pay for Permian Basin Acquisition

2024-09-12 - Viper Energy Inc., a Diamondback Energy subsidiary, will use anticipated proceeds of up to $476 million to help fund a $1.1 billion Midland Basin deal.

Kosmos to Repay Debt with $500MM Senior Notes Offer

2024-09-11 - Kosmos Energy’s offering will be used to fund a portion of its 7.125% senior notes due 2026, 7.750% senior notes due 2027 and 7.500% senior notes due 2028.

ONEOK Offers $7B in Notes to Fund EnLink, Medallion Midstream Deals

2024-09-11 - ONEOK intends to use the proceeds to fund its previously announced acquisition of Global Infrastructure Partners’ interest in midstream companies EnLink and Medallion.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.