(Source: Shutterstock.com)

For the second consecutive month, private equity firm Tailwater Capital LLC announced an agreement to purchase midstream assets, roughly a year after raising a $1.1 billion fund as the industry slid into a downturn.

Dallas-based Tailwater signed a definitive agreement on Feb. 17 to acquire NorTex Midstream Partners LLC, an independent natural gas and transportation company based in Houston. Tailwater said the deal, which follows its acquisition of Tall Oak Midstream II and III last month, represents a bet on the continued reliance of natural gas for power generation even as renewable power sources gain ground.

Tailwater did not disclose the financial terms for the NorTex and Tall Oak acquisitions.

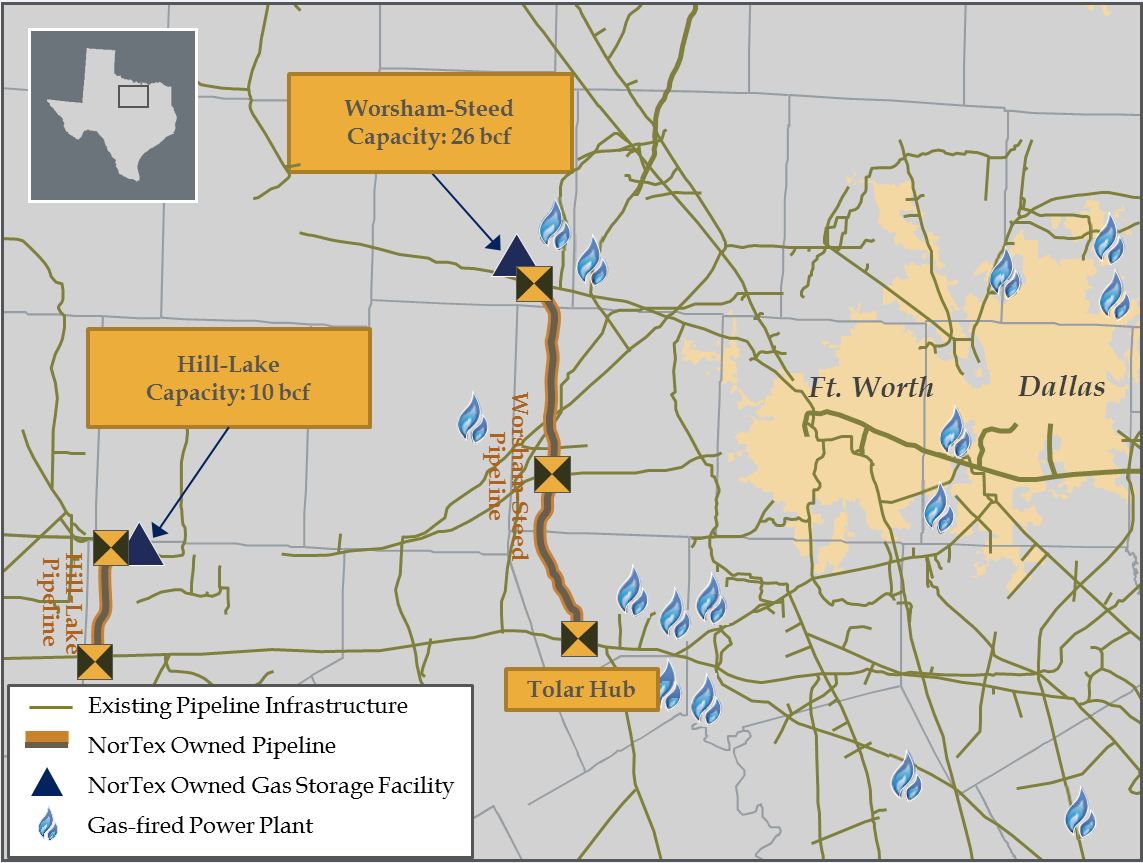

NorTex interconnects with several major pipeline systems serving the North Texas energy markets with gas supplies sourced from the Permian Basin, the Barnett Shale and Oklahoma’s SCOOP/STACK plays in Oklahoma.

A Castleton Commodities International LLC company founded in 2007, NorTex operates the largest portfolio of non-utility gas storage facilities in North Texas. The NorTex asset base includes 36 Bcf of depleted reservoir working gas capacity, 83 miles of natural gas transportation pipelines and operators the Tolar Hub—the largest natural gas hub in North Texas. The company’s storage facilities have served the Dallas-Fort Worth market for nearly 60 years.

Following the close of the transaction, which is subject to regulatory and closing conditions, NorTex will remain headquartered in Houston. Its three field operation sites will continue to be led by the current management team, including CEO John Holcomb, CFO Reed Hatch and COO Kurt Haaland.

Tailwater said it was positioning itself alongside a high-growth population center that will need increased amounts of natural gas to sustain reliable power. The firm said that as more intermittent, renewable power sources are added to the electrical grid, “thermal generation will be critical to deliver power at a moment’s notice.”

"As demand for high-deliverability natural gas storage continues to grow in the North Texas region, we are thrilled to partner with such a sophisticated team of infrastructure experts and operators in Tailwater, who intimately understand our business and the natural gas needs in North Texas,” Holcomb, NorTex’s CEO, said in a news release.

Edward Herring, co-founder and managing partner of Tailwater Capital, said that as demand “accelerates and renewables continue to play a growing role in the evolution of the North Texas power grid, intermittency will continue to present an ongoing challenge.”

“We are excited to work with John [Holcomb] and the management team to step up and play a key role in the energy transition process through NorTex's unrivaled storage capabilities,” Herring continued, “and we look forward to working together to strategically grow the business and position it for continued and sustainable success.”

Kirkland & Ellis served as legal counsel to Tailwater Capital in connection with the transaction. Jefferies LLC acted as exclusive financial adviser representing NorTex and NorTex’s parent company, CCI. Eversheds Sutherland served as legal counsel to NorTex and CCI in connection with the transaction.

Recommended Reading

Devon, BPX to End Legacy Eagle Ford JV After 15 Years

2025-02-18 - The move to dissolve the Devon-BPX joint venture ends a 15-year drilling partnership originally structured by Petrohawk and GeoSouthern, early trailblazers in the Eagle Ford Shale.

E&Ps Pivot from the Pricey Permian

2025-02-01 - SM Energy, Ovintiv and Devon Energy were rumored to be hunting for Permian M&A—but they ultimately inked deals in cheaper basins. Experts say it’s a trend to watch as producers shrug off high Permian prices for runway in the Williston, Eagle Ford, the Uinta and the Montney.

Ring May Drill—or Sell—Barnett, Devonian Assets in Eastern Permian

2025-03-07 - Ring Energy could look to drill—or sell—Barnett and Devonian horizontal locations on the eastern side of the Permian’s Central Basin Platform. Major E&Ps are testing and tinkering on Barnett well designs nearby.

Hibernia IV Joins Dawson Dean Wildcatting Alongside EOG, SM, Birch

2025-01-30 - Hibernia IV is among a handful of wildcatters—including EOG Resources, SM Energy and Birch Resources—exploring the Dean sandstone near the Dawson-Martin county line, state records show.

On The Market This Week (Jan. 6, 2025)

2025-01-10 - Here is a roundup of listings marketed by select E&Ps during the week of Jan. 6.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.