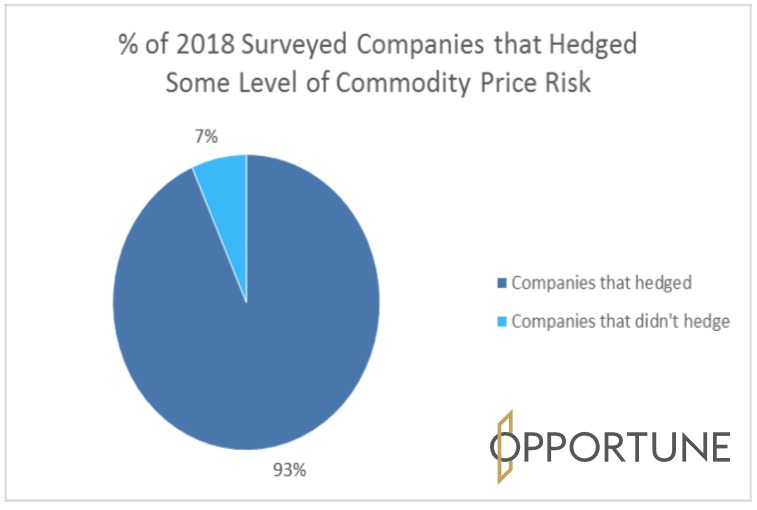

Overall, 93% of the companies Opportune surveyed hedged some level of commodity price risk, with swaps, collar and three-way options the most popular instruments. (Source: Hart Energy)

Hedging has long been a way for U.S. oil and gas producers to protect against the volatility of commodity prices.

A recent survey from Opportune LLP notes that while natural gas prices were relatively flat in 2018, crude prices rose from $60 per barrel (/bbl) to nearly $75/bbl during the first three quarters. Then, in the fourth quarter, natural gas spiked briefly while crude fell to $45 from $75.

The fourth-quarter drop was the most severe decline in crude prices since 2014, according to Opportune’s derivative valuation and commodity risk management advisory group.

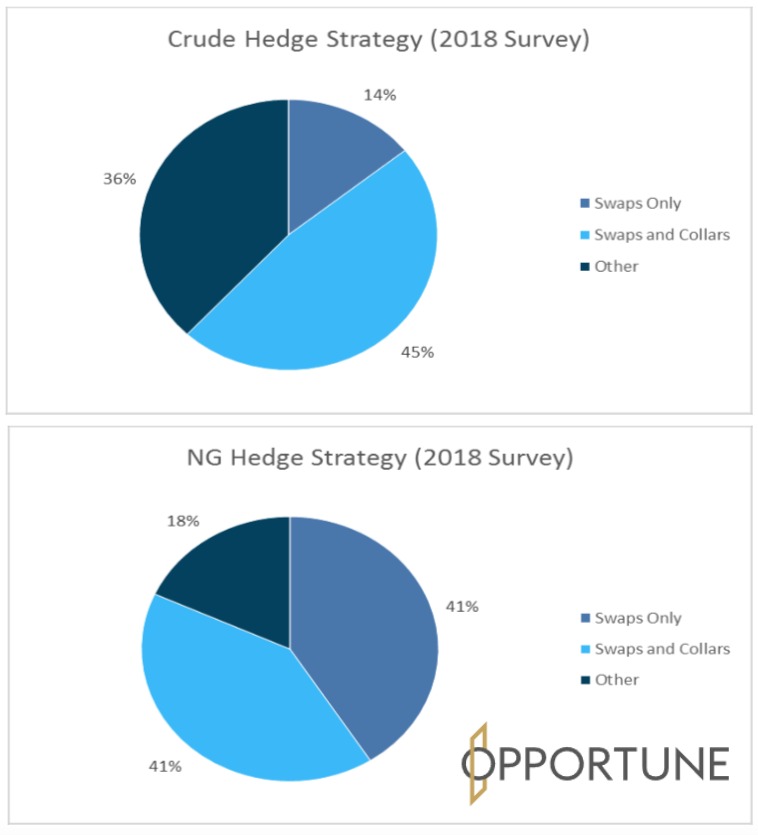

The Houston-based firm surveyed the hedging positions of 30 of the largest public oil and gas producers as disclosed in their Dec. 31, 2018, 10-K filings. The results show that swaps continue to be the preferred instrument for both natural gas and crude oil; however, the use of swaps decreased from the prior year while purchased puts were on the rise for public companies.

“For a producer, swaps provide the highest amount of downside protection,” noted the survey’s authors Shane Randolph, managing director, and Josh Schulte, manager.

The authors noted that swaps, however, limit upside price protection.

“This leads producers to utilize purchased puts, which can be costly, or costless collars, which allow the producer to participate within a range of price movements,” they said.

A challenge for producers is how far out to hedge production because if prices increase, they may be giving up upside.

“Based on the survey results, it is common for companies to hedge some level of the prompt 12-month period representing 2019,” the authors said. “A higher percentage of companies hedged crude than natural gas in 2020. However, it is interesting to note that more companies have hedged natural gas in 2021 to 2023 than crude.”

The authors believe this may reflect a more conservative view of natural gas price potential.

The Opportune managers also noted that “as a hedging program is intended to increase cash flow predictability, the price level at which companies execute hedges is often heavily influenced by operating budgets and debt compliance.”

So, what price levels did companies hedge at as reported in their 10-Ks?

So, what price levels did companies hedge at as reported in their 10-Ks?

For the 27 companies that disclosed hedged price levels, the average swap price for crude was $57.85/bbl for 2019 and $61.30/bbl for 2020, according to the survey results. Natural gas averaged $3.05 per million British thermal unit (/MMBtu) for 2019 and $2.82/MMBtu for 2020.

Meanwhile, the average put price—non-three-way—for crude was $57.96/bbl for 2019 and $58.21/bbl for 2020. Natural gas was $2.93/MMBtu for 2019 and $2.74/MMBtu for 2020.

Opportune noted that few companies disclosed the amount of their forecasted production that was hedged as of year-end 2018. Only seven companies made this disclosure. For those producers, the average hedge level for crude was 47% of forecasted 2019 production and 62% of forecasted natural gas production. (These hedge levels include coverage provided by three-way options.)

Overall, 93% of the companies surveyed hedged some level of commodity price risk, with swaps, collar and three-way options the most popular instruments. For 2018, 45% of companies surveyed use swaps and collars, 30% used other, and 14% used swaps only for crude. For natural gas, 41% used swaps and collars, 41% used swaps only, and 18% used other.

As for hedge length, 79% of companies were 12 months out on crude, 57% were 24 months out and 4%were 36 months out. For gas, 79% were 12 months out, 39% were 24 months out, 14% were 36 months out and 11% were 48 months and 60 months out, for each period.

Recommended Reading

US Drillers Cut Oil, Gas Rigs for Fifth Week in Six, Baker Hughes Says

2024-09-20 - U.S. energy firms this week resumed cutting the number of oil and natural gas rigs after adding rigs last week.

Western Haynesville Wildcats’ Output Up as Comstock Loosens Chokes

2024-09-19 - Comstock Resources reported this summer that it is gaining a better understanding of the formations’ pressure regime and how best to produce its “Waynesville” wells.

August Well Permits Rebound in August, led by the Permian Basin

2024-09-18 - Analysis by Evercore ISI shows approved well permits in the Permian Basin, Marcellus and Eagle Ford shales and the Bakken were up month-over-month and compared to 2023.

Kolibri Global Drills First Three SCOOP Wells in Tishomingo Field

2024-09-18 - Kolibri Global Energy reported drilling the three wells in an average 14 days, beating its estimated 20-day drilling schedule.

Permian Resources Closes $820MM Bolt-on of Oxy’s Delaware Assets

2024-09-17 - The Permian Resources acquisition includes about 29,500 net acres, 9,900 net royalty acres and average production of 15,000 boe/d from Occidental Petroleum’s assets in Reeves County, Texas.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.