Hydrogen players are expecting a surge in activity in the U.S. given how federal incentives improve economics. (Source: Siemens Energy)

Incentives in the Inflation Reduction Act (IRA) and other legislation have positioned the U.S. to become a potential leader in the global hydrogen economy; however, the industry has challenges to overcome.

A big one, according to Rich Voorberg, president of North America for Siemens Energy, is infrastructure.

“I think we can get an awful lot of things done, but we’ve got to have everything done,” Voorberg told Hart Energy.

“Infrastructure is going to be the biggest issue that we’ve got in front of us.”

As the U.S. works to progress its hydrogen strategy, companies are stepping up hydrogen investments or making plans to do so backed by incentives despite the risks. This comes as the U.S. aims to grow production to 10 million metric tonnes (MMmt) of clean hydrogen annually by 2030, 20 MMmt by 2040 and 50 MMmt annually by 2050.

If successful, clean hydrogen could lower U.S. emissions by about 10% by 2050, according to the Department of Energy’s Clean Hydrogen Strategy and Roadmap.

“We went from being behind in the U.S. to being a leader now when it comes to hydrogen. I think we’ll see some very substantial projects coming out in the very near future.”—Rich Voorberg, Siemens Energy North America

A 10-year production tax credit with a maximum value of $3/kg for hydrogen produced with nearly no emissions is motivating many.

“The U.S. went from being a minor back door player to being front and center,” Voorberg told media ahead of Siemens Energy Talks in October.

He noted customers’ inquiries about more electrolyzers for projects and how quickly they could get them. “We see a lot of movement now when it comes to hydrogen,” he said.

Seeing opportunities

Today, hydrogen is mostly used for oil refining and in the production of chemicals, ammonia, methanol and steel.

Siemens, which provides PEM water electrolyzers for large-scale green hydrogen production among other technologies, sees hydrogen initially taking off in the mobility sector as it is used to fuel trucks, buses and trains.

Companies are already making low-emission fuel a priority.

Amazon, for example, is using green hydrogen to power forklifts and heavy-duty trucks as it strives for net-zero carbon by 2040. This comes as other companies like DHL test long-haul hydrogen trucks.

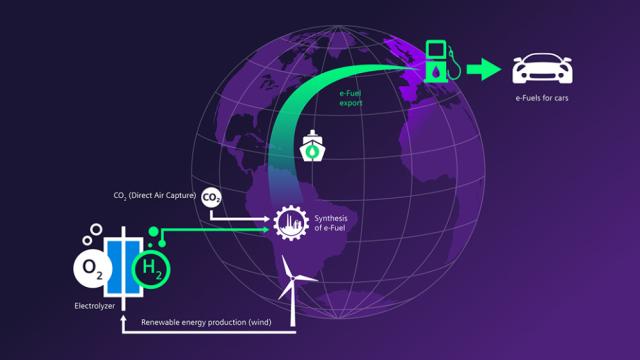

Siemens and HIF Global are leading a pilot project in Chile—called Haru Oni—to generate climate-neutral fuel, using low-cost wind energy in the Magallanes region. Other partners include Porsche, Enel, Exxon Mobil, Gasco and ENAP. The facility combines green hydrogen with CO2 to get methanol, which is then converted to produce the fuel.

HIF Global has also partnered with Topsoe to develop in an eFuels facility in Matagorda County, Texas.

Siemens also sees potential for more fertilizer production and converting hydrogen into ammonia for exports.

“When it comes to power generation, we see that as a 2035 play, maybe even a little bit later,” Voorberg added. It will take time to build out infrastructure, for the price of hydrogen to fall and to improve project economics.

Making economics work

The $3/kg incentive gets the industry to a point where hydrogen makes sense, he said, adding projects need to be economically sound.

“If we’re doing things just because they’re really cool or they’re really exciting, you’re going to get something that disrupts it and it’s going to fade away,” Voorberg said. “So, we’ve got to make sure there’s economics behind each of these [projects].

Scale could help.

At 18 MW each, PEM electrolyzers made by Siemens are among the largest in the world. Multiples of these on site adds scale, ultimately driving down price, according to Voorberg.

Incentives are “kickstarting our industry. We went from being behind in the U.S. to being a leader now when it comes to hydrogen. I think we’ll see some very substantial projects coming out in the very near future.”

However, Voorberg cautioned government officials not to “get us addicted to incentives,” saying that is not how the economy needs to run. The industry needs to be weaned off incentives at the right time, he said, not knowing when.

Addressing challenges

Hydrogen players are expecting a surge in activity given how federal incentives improve economics.

Are they ready?

“There’s a lot of motivation to go do the right thing,” Voorberg said, adding preparation is still not there yet.

Having the right infrastructure is chief among his concerns.

“We’re going to create potentially a lot of hydrogen in this country,” he continued, “and we’ve got to get it from point A to point B where it’s going to be needed. … If you’re out in West Texas and you want to take wind turbine electricity, create hydrogen and get it to say Corpus Christi, there’s no pipeline that gets it there. So, it’s that infrastructure.”

Voorberg, like others in the sector, also sees challenges on the permitting side, including for high-voltage, direct current (HVDC) electric power lines and hydrogen pipelines.

“The process is still very cumbersome,” he said, using Texas as an example. “Once you start going across state lines, it just gets even worse. To me, our biggest risk is that infrastructure side.”

However, legislative efforts are underway to improve the process and ensure “everybody’s working together to make sure that infrastructure really works,” he added.

Permitting woes have delayed some projects for years.

If the problem isn’t solved, lots of renewable energy will be generated for power but it won’t be able to get where it’s needed, Voorberg said, adding grids also need to be updated to better handle the on-and-off nature of renewables.

Technology already exists, he said, plugging Siemens’ synchronous condensers.

“We know how to get there,” he said. “We just need the economics [to work], and we need the permitting of it to make it happen.”

Recommended Reading

E&P Highlights: Aug. 19, 2024

2024-08-19 - Here’s a roundup of the latest E&P headlines including new seismic solutions being deployed and space exploration intersecting with oil and gas.

Shell Offshore Takes FID on Waterflood Project in GoM

2024-08-14 - Shell Offshore’s waterflood secondary recovery process involves injecting water into the reservoir formation to extract oil.

Breakthroughs in the Energy Industry’s Contact Sport, Geophysics

2024-09-05 - At the 2024 IMAGE Conference, Shell’s Bill Langin showcased how industry advances in seismic technology has unlocked key areas in the Gulf of Mexico.

E&P Highlights: July 22, 2024

2024-07-22 - Here's a roundup of the latest E&P headlines, with LLOG acquiring 41 blocks in the Gulf of Mexico and Saipem securing $500 million in contracts from Saudi Aramco.

E&P Highlights: Sept. 9, 2024

2024-09-09 - Here’s a roundup of the latest E&P headlines, with Talos Energy announcing a new discovery and Trillion Energy achieving gas production from a revitalized field.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.