This story will appear in the upcoming Hydraulic Fracturing special report presented by:

The shale industry has evolved considerably since its early days, and this evolution continues as producers keep pursuing technological advances and efficiency gains. While significant advances involving hydraulic fracturing and downhole completions technologies were previously made during commodity price downturns, the current high price environment does not appear to have stopped the pursuit of new gains.

Cost efficiency remains a priority, but there are also other drivers of technological advances that have emerged, including decarbonization. The industry is also taking a more sophisticated approach to gathering downhole data and responding to it more quickly.

There is room for improvement, however, and as the industry seeks ways to improve it can also be expected to increasingly embrace automation and digitalization. Another factor to consider is that shale basins are maturing, and producers are increasingly moving out from their core areas into more challenging acreage. Against this backdrop, improving the efficiency of completions and boosting well productivity becomes even more important.

Fracking trends

There are several areas in which fracking and completions technology has advanced during recent years as producers have sought to maximize production. According to Dan Hill, regents professor and noble chair at Texas A&M University’s Harold Vance Department of Petroleum Engineering, major trends in fracking technology over recent years include the increased use of proppant and fracture fluid, with 2,000 lb/ft of proppant now the average. Laterals have also become longer, with 10,000-ft wells now common, Hill told Hart Energy. Tighter spacing between perforation clusters and fewer perforations per cluster is another recent trend.

“This is aimed at creating denser networks of fractures and to facilitate limited entry effects to fracture more clusters in each stage,” Hill said.

Liberty Oilfield Services’ vice president of engineering, Leen Weijers, also highlighted this trend as being among one of the most significant.

“On the downhole side, there are continuous efforts to create larger, denser fracture networks that act as the plumbing system to get oil and gas back to the well and to properly scale that frac system for the given well spacing,” Weijers said. “Also, this has to be done at an economic optimum—finding a way to further reduce the cost to bring a barrel of oil to the surface. This (dollars per barrel of oil) reduction is currently addressed with more aggressive limited entry perforating, with associated efficiencies enabling us to treat a longer piece of the lateral at the same time.”

There are several ways in which costs of bringing a barrel of oil to the surface can be reduced. Among them is the use of locally sourced sand for proppant, as well as smaller-sized proppant, such as 100 mesh.

“This is primarily to reduce transportation costs, a major cost of hydraulic fracturing operations,” Hill said. He noted that this is one of the areas where cost-cutting is tied to decarbonization.

Emission and cost cuts

“Emission reductions for fracturing operations are tied directly to costs, so there is significant incentive to reduce both,” Hill said. “A huge source of emissions for fracturing is truck traffic. For example, a typical South Texas frac job requires about 900 truck trips just to transport the proppant to the well site. If water also has to be trucked, that is hundreds more 18-wheeler round trips, so companies are building pipeline systems to transport the frac water to their well sites and using locally sourced sand as proppant to reduce the miles of truck transport required.”

Another significant trend that ties together cost-cutting and decarbonization efforts is the ongoing shift from diesel to electric and natural gas-fueled frac fleets.

“Lower emissions are certainly a driver. Our customers and even some of our vendors are keen on understanding how our equipment will help them meet their emission commitments,” Weijers said. “Reduction in fuel cost goes hand in hand with this goal.”

Liberty is tapping into this trend with its digiFrac offering, whose rollout will be driven by customers that want to achieve fuel savings by switching from diesel to natural gas, Weijers said.

“We are putting significant effort into our digiFrac system, which will run on 100% natural gas, and, depending on the source of the natural gas burned in modern frac engines, the price can be 20% to 40% of the cost of diesel,” Weijers said. “This is a significant source of savings on dual-fuel and gas reciprocating engines, and these savings alone can go a long way to justifying the upgrade to the next generation of equipment.”

The company is now testing a new offering, digiFrac Prime, which is aimed at providing even further fuel savings by “mostly skipping a few steps in the power transfer.”

Other oilfield service providers are also embracing the shift away from diesel in fracking operations.

“As today’s fracture operations become more complex, the industry is realizing the benefits of an electric powertrain,” Halliburton’s vice president of production enhancement, Shawn Stasiuk, said. “Electric fracturing is another important advancement. In addition to lowering emissions and fuel costs, the performance of these electric systems supersedes conventional engines. These machines deliver higher and more consistent horsepower, they are more reliable, and simpler to maintain and operate. Today’s electric fracturing technology delivers on reduced emissions and fuel cost savings, without having to sacrifice on the performance required to deliver today’s high-intensity fracture operations.”

Stasiuk sought to emphasize the importance of cost when it comes to electric fracking.

“ESG is a key driver in every conversation, but so is cost, both for us and our customers,” he said. “The commercial construct of an electric offering needs to make sense first, and then we can leverage the lower emission benefit. We adopted an electric hybrid model that allows flexibility and customization, so more operators can begin to adopt this technology at a pace that works for them.”

Future of fracking

Halliburton Co. views low-emission fleets as one of the major drivers of fracking technology and looking ahead into the future. It considers intelligent fracturing, entailing automation and the use of real-time data, to be another major driver.

“For intelligent fracturing, the evolution of adoption accelerates as we integrate digital and automation into a solution that an operator can scale,” Stasiuk said. “We provide solutions that deliver the digitization and automation of surface operations combined with the optimization of subsurface outcomes.”

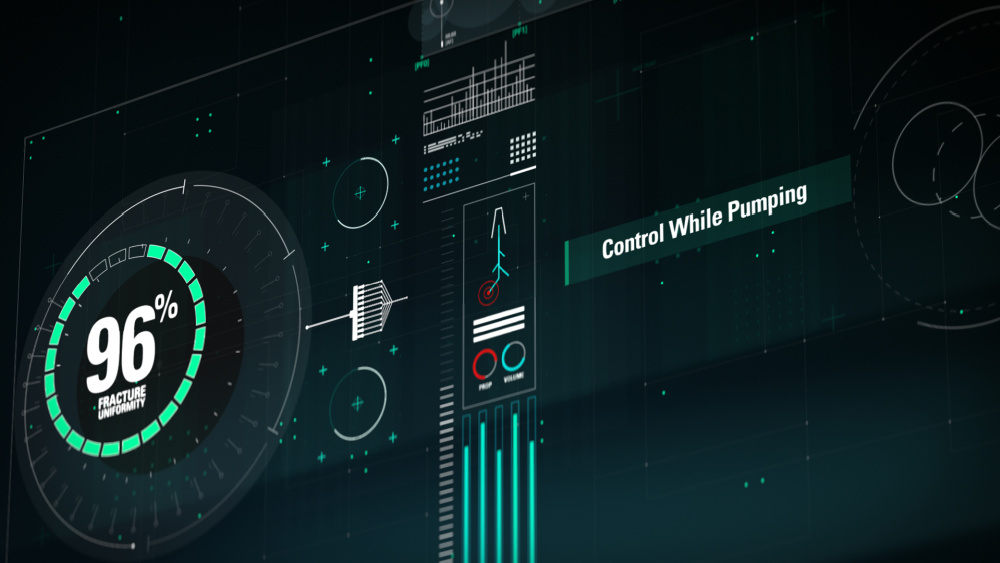

Halliburton has developed its SmartFleet intelligent fracturing system and believes that as the industry increasingly embraces data and automation, this type of real-time system represents the future of fracking.

“SmartFleet is the culmination of many years of listening to the toughest challenges our customers face in hydraulic fracturing,” Stasiuk said. “In particular, they pump millions of dollars of sand and fluid downhole and don’t fully understand the effectiveness of that investment. First, we want to understand what's going on downhole, then we need a solution to act on real-time data to create more effective, consistent fracs. Just like the onset of MWD [measurement-while-drilling] in drilling created the need for rotary steerable, the use of fiber-optics for frac operations created a need for a tool to control the outcome of what we see downhole. SmartFleet is that tool.”

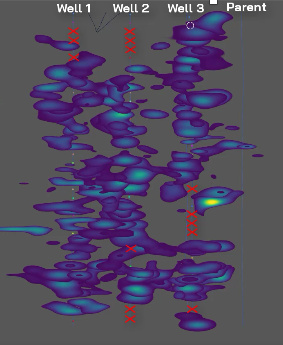

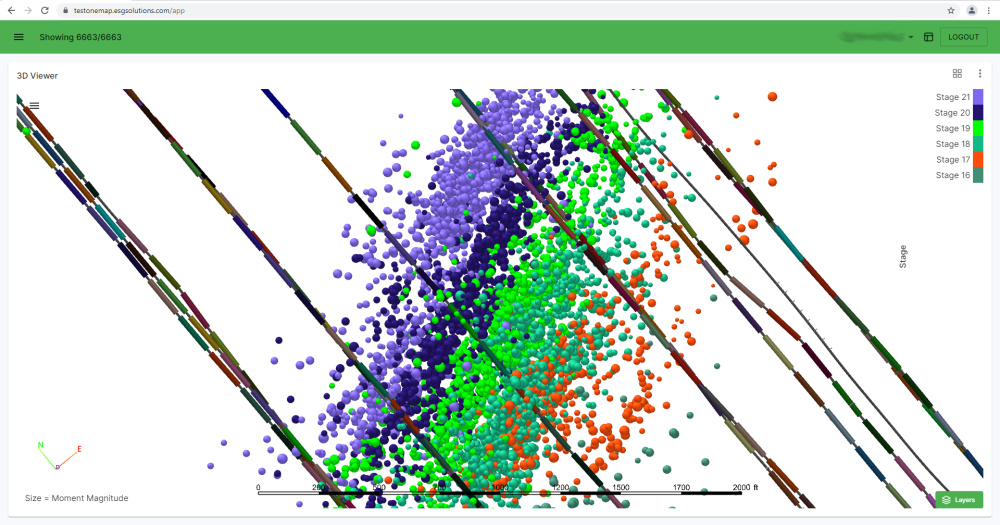

The importance of using real-time data was also highlighted by ESG Solutions, which was acquired by subsurface imaging and frac diagnostics company Deep Imaging last year. The transaction gave the companies an expanded suite of real-time analytical tools, according to ESG’s CEO David Moore.

“We’ve got a breadth of technologies that we can combine together to provide real-time data so that they can make better completions decisions, and those completions decisions should drive value in production,” Moore said. “I think historically, if we look at any of the technologies, whether it’s downhole, borehole microseismic, our electromagnetic [EM] technology, or if they're using something like tracers—any of the technologies—they have to understand the efficacy of their completions are always still a look back, or a lot of them are. They’re starting to use pump data to make on-the-fly decisions stage by stage. We’re providing stage-by-stage, real-time borehole microseismic so that they understand what the fracture networks are doing on a stage-by-stage basis.”

Room for improvement

The use of real-time data could be better still, however, and Moore sees room for improvement in this area.

“The thing that I still struggle with is that because of investment dollars, a lot of the production data isn’t shared right away,” he said. “And it’s hard for the customer to correlate the production they’re getting from a completion that happened a year ago when they’re already on to the next formula, the next model. We as an industry need to probably adopt things a little bit faster, so that we can pull it all together and make the right changes.”

Conversations are increasingly happening about operators moving away from following fixed models and completions recipes, Moore noted. And this will become even more important as they move away from what he describes as A acreage to B acreage.

“A lot of our customers entering B acreage really need to understand what’s going on and find the most effective plan, in real time, so that they can produce at the levels that they’re promising their investors,” he said.

More advanced diagnostics could also be helpful in other areas where there is room for improvement, according to Texas A&M’s Hill.

“There is still a lot of uncertainty about the distribution of proppant in the created fracture systems, so more and more advanced diagnostic methods that can locate proppant far from wells would be of great benefit,” he said.

Beyond this, operators and service providers alike can be expected to continue their pursuit of efficiency gains and of doing more with less. This trend may have been accelerated by the oil price downturns of the past decade, but it has not gone away in the era of higher oil prices, as producers remain under pressure to prioritize shareholders and as rising costs squeeze margins for operators and service providers alike. Liberty’s goals serve as an illustration of this pursuit of continuous improvement.

“We are constantly striving for further efficiency gains and to safely pump a larger portion of each day,” said Liberty’s Weijers. “Proof of that is the constant increase in sand throughput as measured per Liberty employee. Over the last decade this metric has gone from about 800,000 pounds per employee per year to 8,000,000 pounds per employee per year. This is the result of numerous small improvements in technology and efficiency. We do not see a break in the trend of this key metric.”

Within that, there are several ways in which the company is pursuing additional efficiency gains.

“Two of the many initiatives we are working on focus on running pumps within a more restricted domain of interlocks, helping in a reduction of downtime and repair and maintenance cost; testing ‘hot swaps’, where we can pull out and depressurize a horsepower unit while pumping the main job with remaining pumps, thus enabling our crew to conduct maintenance on this pump outside the red zone,” Weijers said.

Market challenges

The industry is now having to contend with new challenges in the form of rising costs and supply chain constraints. Thus far, higher oil prices have helped operators to ramp up drilling and completion activity—albeit cautiously—but they run the risk of being constrained by supply chain issues.

“Drilling and completion activity always follows oil and gas price trends, and that is happening again,” said Texas A&M’s Hill. “I expect drilling and fracturing activity will continue to increase until limited by the availability of drilling rigs or frac fleets.”

Constraints are starting to materialise in several areas, as evidenced by oilfield service providers’ recent experience.

“The market remains tight for hydraulic fracturing, and we remain sold out through the second half of the year,” said Halliburton’s Stasiuk. “Lead times on parts, pumps and people are constraining the number of spreads we can add to meet this demand, and we expect next year to remain extremely tight for fracturing services. However, through our experienced people and an expanded supply chain, we are prepared for the increased activity and will continue to execute at the level the industry expects.”

Liberty has also run into some constraints.

“There have certainly been challenges in keeping up with rapid changes in prices for commodities such as sand and diesel, and associated with sourcing basic parts, such as air filters,” Weijers said. “The supply chain constraints of 2022 have also caused our digiFrac rollout, particularly the power component, to be rolled out somewhat later that we had initially intended.”

ESG’s Moore said his company has had to focus on becoming more efficient.

“We’ve had to figure out how to get the same fidelity in our technology, whether it’s our EM, our borehole microseismic, our fiber,” he said. “How do we get more efficient in deploying? Can we get the same fidelity with a smaller array?”

And while this has been challenging, the company has succeeded in making these efficiency gains, he added.

“Market challenges a lot of times equal innovation,” Moore said. “And we’ve done a lot of that through this, we’re not the only ones. And our customers have as well. They’re trying to figure out better ways to use the data. I think a lot of what the price is and the cost and everything going on in the world—not just in our industry—has really started to drive innovation internally for us as well for our customers.”

This goes against the belief that most innovation happens during oil price downturns for the industry. Regardless of crude price levels—currently above $100/bbl—the pressure to innovate and pursue efficiencies does not look likely to ease anytime soon. Operators and service providers will likely keep experimenting with various technologies and methods, but momentum is picking up for some, such as the use of real-time data,more than others. This can be expected to drive the emergence of more dynamic completions models, and, with the industry increasingly having to target more challenging acreage, this is timely.

Recommended Reading

US Drillers Cut Oil, Gas Rigs for Fifth Week in Six, Baker Hughes Says

2024-09-20 - U.S. energy firms this week resumed cutting the number of oil and natural gas rigs after adding rigs last week.

Western Haynesville Wildcats’ Output Up as Comstock Loosens Chokes

2024-09-19 - Comstock Resources reported this summer that it is gaining a better understanding of the formations’ pressure regime and how best to produce its “Waynesville” wells.

August Well Permits Rebound in August, led by the Permian Basin

2024-09-18 - Analysis by Evercore ISI shows approved well permits in the Permian Basin, Marcellus and Eagle Ford shales and the Bakken were up month-over-month and compared to 2023.

Kolibri Global Drills First Three SCOOP Wells in Tishomingo Field

2024-09-18 - Kolibri Global Energy reported drilling the three wells in an average 14 days, beating its estimated 20-day drilling schedule.

Permian Resources Closes $820MM Bolt-on of Oxy’s Delaware Assets

2024-09-17 - The Permian Resources acquisition includes about 29,500 net acres, 9,900 net royalty acres and average production of 15,000 boe/d from Occidental Petroleum’s assets in Reeves County, Texas.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.