As the U.S. rig count has plummeted, Exxon Mobil and XTO have continued to ramp up their drilling program in the Permian to 55 rigs with at least another 20 rigs in other basins. (Source: Exxon Mobil Corp.)

[Editor's note: A version of this story appears in the January 2020 edition of Oil and Gas Investor. Subscribe to the magazine here.]

The desert city of Midland, Texas, is generally a poor barometer by which to measure booms, busts or even the passing of seasons. Year-round, the landscape alternates between the rugged chaparral brush and the 11 evergreen golf courses catering to the city. But something has caught in the air in Midland, like ragweed or discontent.

Grumbles from Uber drivers notwithstanding, it’s difficult to divine any outward sign of either good or bad times in the oil business. As it has for decades, the West Texas metropolis of 140,000 souls faithfully orbits the industry, the source of its life, regardless.

“There’s a slowdown going on in the Permian,” Pioneer Natural Resources Co. CEO Scott Sheffield told Oil and Gas Investor, “while oil majors are increasing production.”

In early November, CNN Business heralded Midland’s mystique as “America’s ultimate boomtown” and featured an interview with Sheffield, speaking in the distinct Midlandese accent that President George W. Bush is known for.

As CNN’s story was playing on cable TV on Nov. 7, the Federal Reserve Bank of Dallas reported unemployment rates in Midland and Odessa (though still lowest in the state) had ticked up with activity in the energy sector declining, particularly among service companies, as oil prices fell in the third quarter.

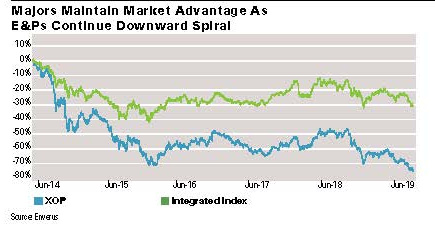

From March to October, E&Ps’ compounded annualized loss rate hit 33%, according to the Federal Reserve Bank of Dallas. Those figures exclude integrated companies. Indeed, Exxon Mobil Corp. has been hyperactive. In 2019, the company built a contrarian rig program in the Permian Basin.

In the late afternoon on Nov. 4, XTO Energy Inc. president Staale Gjervik arrived by passenger car at the DoubleTree by Hilton hotel in downtown Midland. Cinematic presidents of giant conglomerates are often depicted arriving under whirling helicopter blades atop skyscrapers, but the tallest building in Midland is a 24-story bank. Besides, to anyone who recognizes Gjervik, a rooftop landing isn’t necessary to convey the power and influence that XTO and its owner, Exxon Mobil, now wield in the Permian.

In the hotel lobby, flanked by two Exxon Mobil public relations employees, Gjervik, who is from Norway, said XTO is like other oil and gas companies—it’s still learning.

“The unconventional industry is perhaps 10 or 15 years old depending on how you look at it. So, we have a lot to learn particularly in the subsurface, as we look at our capability, whether it’s people or modeling capacity or fundamental research, it’s pretty unique,” Gjervik said. “Being able to apply that to the unconventional like we’ve done on other basins and resource types around the world is going to yield a lot of benefits.”

XTO sees the ability to build scale as one of its primary advantages. The company has committed to running 55 rigs in the Permian by the end of 2019 and, as of November, had 75 rigs deployed throughout the U.S.

Click here for Staale Gjervik’s full presentation

at Hart Energy’s Executive Oil Conference.

Gjervik said there are clear benefits to growing larger in unconventional plays, though it’s not yet clear what the optimal size is or what a full-fledged manufacturing mode would look like.

“Is it yea big, or is it yea big,” Gjervik said, widening the space between his hands to emphasize the point. “That’s kind of a bit of a debate out there these days.”

For major oil corporations, the critical factor is making the transition from learning mode to manufacturing.

The size and scope of XTO’s operations already requires it to consider not just capital efficiency but also the changing geology in an unconventional play. Having enough running room—again, not yet quantifiable—in an area frees a company from being “constantly in learning mode,” he said.

“I think it is critical from a cost-efficiency— but also from a resource extraction—point of view to understand the rocks and then be able to maximize the recovery. I think if your patch of land is too small, it’s hard to do that,” he said.

As XTO has been upping its Permian rig count, generally, since November 2018, the trend has been for companies to lay down rigs. Meanwhile, production continues to climb, reaching 4.47 million barrels per day in September 2019, according to the Dallas Fed.

In an interview with Investor, Pioneer’s Sheffield dismissed any concerns over oil majors ramping up production in a time of chronic oversupply, especially as independents begin to cut back on capex.

“The majors are running more rigs, so they’re eventually going to slow down themselves, because they’re exhausting their inventory,” he said.

Public independents and the private-equity independents are slowing down and some operators are drilling Tier 2 locations.

“We’re all developing a free-cash-flow model, giving back money to the investors in dividends and [stock] buybacks,” he said. “People don’t want to jeopardize their balance sheet.”

Through Nov. 21, spending guidance for nearly two dozen E&Ps was down 13% compared to 2019, according to Cowen Equity Research. However, the Dallas Fed reported that third-quarter 2019 energy sector returns “eroded sharply” even with improvements in cash flow. From March to October, E&Ps’ compounded annualized loss rate was 33%, excluding integrated companies such as Exxon Mobil.

“All that contributes to less production coming out of the Permian,” Sheffield said. “So, I’m not worried about a lot of extra production coming out of the Permian, long term, even from the majors.”

Nevertheless, the future appears to be in the hands of large, integrated companies, particularly as the majors become active in the Permian.

“I think it’s the majors’ game to play now,” said Regina Mayor, global and U.S. sector leader for energy and natural resources at KPMG. “And the speculative money goes elsewhere, like Scoop/Stack and Powder River.”

Resources

Co. CEO Scott

Sheffield said

he welcomes

the majors,

their money and

research to the

Permian Basin but

adds, “I know for

a fact that they

are not making

better wells than

Pioneer, whether

it’s Exxon,

Chevron, Shell

or BP.“

While the heyday of shale prospects may be over, “that doesn’t mean it goes away,” she added.

“It just means you have to be incredibly good at what you do, and you have to be more able to pull it off on your own vs. trying to tap into liquid markets,” she said. “And I hate that I’m so pessimistic. But I have to be a realist. I can’t be a Pollyanna anymore.”

The tide has shifted toward the massive pull of major integrated companies. On Nov. 26, Simmons Energy, a division of Piper Jaffray, initiated coverage of several majors, including BP Plc, Total SA and Royal Dutch Shell Plc, citing the companies as “both relatively advantaged within energy and likely the primary destination for capital if/when it returns.”

Industry analysts acknowledge that the supermajors have siphoned off investors from other oil and gas concerns, though the extent of that shift isn’t clear. The majors bring a mix of intense competitiveness to shale plays, as well as a surprisingly amount of hope for independents eager to see what their money and research can bring to the industry.

Perhaps one of the biggest questions now is the majors’ approach as they peg the Permian and other Lower 48 plays as key production growth engines. In theory, shale offers more easily replaceable reserves for majors. The degree to which they pursue M&A could affect deal flow dramatically. They have access to capital that their independent E&P peers lack. Among some supermajors, their ability to innovate, research and develop is comparable to Amazon and Google.

“Very few companies are able to have the internal knowhow, and I should say capacity and capability to take on true research and move things forward,” Gjervik said.

Few experts or industry observers think the giants will make any sudden moves. Mayor said shale plays’ short cycles allow majors to adjust production depending on prices and how their longer-cycle plays pan out for them.

smaller E&Ps is

that they will be

“either gobbled up

or ... consolidate

with larger caps,”

said Ian Nieboer,

managing director

at RS Energy

Group.

“You still have your long-term investors that love these companies for the stability and the dividend, and they’re not going to change their overall operating philosophy just because they’re in the Permian,” she said. “I don’t think they’re all just going to jump in, and it’s going to be ‘Katy, bar the door.’”

Mutually assured consolidation

Nearly three years have passed since Exxon Mobil’s most recent, large-scale acquisition: the purchase of the Bass family’s BOPCO LP, which largely consisted of assets in the Permian.

“That doesn’t mean we stopped looking,” Gjervik said. “There’s a lot of movement in the market and maybe more so now than it’s been historically.”

At some point, expectations are that the majors will play a significant role in shale M&A.

Andrew McConn, principal analyst, operator intelligence, at Enverus, pointed out in October that the majors need shale, too.

“The game forever has been constantly trying to replace reserves,” McConn said during a Hart Energy event in Dallas. “Even though sentiment has soured so much, I think there’s still a consensus that shale does represent not only the largest, but the most attractive resource theme for the future of oil and gas resource supply.

“From their perspective, it’s kind of a mutual need,” he said.

As majors begin to roam stacked shale plays, mid- and small-cap companies will likely have the most difficult time competing, or getting attention, until they consolidate, said Ian Nieboer, managing director at RS Energy Group.

Those companies will be “either gobbled up or probably have to consolidate amongst peers to get to a scale that makes some sense for the majors [to acquire] or to compete with the larger caps,” he said.

For now, the majors likely have little incentive to look for more assets until they begin to feel insecure about inventory, said Dane Gregoris, senior vice president at RS Energy Group.

Exxon Mobil’s deals in the Permian show the company’s been acquisitive. But Gregoris suspects it will stand pat for a while.

“I think right now they’re probably pretty secure, because ... they’re not buying anywhere else, and [inventory] is probably good for a couple years,” he said.

Gjervik said XTO is continuing to pursue M&A, though the company wants acreage that is the “right fit,” meaning it competes for capital within the company’s portfolio.

“We’re always looking for good deals in the market: What to buy and what to sell is part of our ongoing optimization of our portfolio, and it’s a focus for Exxon Mobil and a focus for our shale business too.”

Sheffield’s been on the record saying that consolidation won’t happen until the majors’ inventory is more depleted.

“Then they may get aggressive,” he said. “So, the question [for] the Permian Basin is, if they end up buying everybody up over time, is that a positive or a negative? But that hasn’t happened, so it’s sort of hard to speculate about that.”

What did catch Sheffield’s attention was Shell’s interest in acquiring Endeavor Energy Resources LP for a reported $8 billion.

“That sales process has been called off,” he said. “It’s mostly in Midland County, and all the majors went through the data room from what I understand. It tells me that the majors aren’t willing to pay a very high price for acreage at this point in time.”

senior vice

president at RS

Energy Group,

said interest

in diversified

asset types had

led to investors

“flocking” to

companies such as

Hess Corp.

As far as the possibility of Pioneer being purchased, Sheffield said, “I’m the first one to say if we ever get an offer from a major, the board will do the right thing for its shareholders.”

Until then, the most active part of the A&D market for majors and large companies may be trades. Recent deals, such as an all-stock deal by Parsley Energy Inc. to purchase Jagged Peak Energy Inc. and a merger between Carrizo Oil & Gas Inc. and Callon Petroleum Co., have been torched in the market.

As deal activity began slowing last year, majors such as Chevron Corp. aimed to build a contiguous Permian position through trades of 150,000 to 200,000 acres, Goldman Sachs analysts said in June 2018.

Sheffield said trades with majors and other companies are practically a daily occurrence.

“We have a lot of 5,000-foot locations. We’re talking to Exxon about trading a bunch of their 5,000-foot [laterals]. Everybody wants to drill a 10,000-foot lateral because that’s the most economic location,” he said. “So, we’re making trades with the majors all the time, day in, day out. And it’s not just us, it’s all independents.”

Gjervik said trades are important for the company materially as “we optimize the acreage we have.”

“Historically, the Lower 48 has in many areas been fairly fragmented as far as the ownership,” he said. “It’s kind of bringing it back together to what may have made sense years and decades ago when we did vertical developments. As we now look at it, drilling long horizontals, you need different size patches than you did in the past.”

The company is assembling acreage in order to drill horizontal wells ranging from 5,000 to 10,000 feet.

“A very important part of what we do, and our M&A group does, is to create those trades. It’s to drive toward those same kinds of contiguous acreage [positions] to get that benefit.”

Those efforts aren’t limited to the Permian. XTO trades within basins and even between basins. “Sometimes it can be easier to find a win-win commercial solution vs. buying and selling,” he said. “There were a lot of deals to be made where you can find a win-win.”

In shale plays, the company looks at a full spectrum of bolt-on and corporate deals, though what constitutes a bolt-on acquisition is in the eye of the beholder. In 2007, prior to its acquisition by Exxon Mobil, XTO announced it would purchase Dominion Resources for about $2.5 billion. At the time, XTO co-founder Bob R. Simpson described the deal as a “supersized bolt-on.”

“There’s nothing unique about how we view [bolt-ons] vs. others,” Gjervik said.

The principle, he said, is the same: Adding acreage where a company already has operations can be more efficient and cost-effective than setting up in a brand-new area.

“That’s kind of what we think about bolt-ons. What more synergies and benefits can you get?”

Fleeting secrets

The interplay between supermajors and independent U.S. shale companies is a matter of curiosity in and outside of the U.S. On recent trips in India and particularly the Middle East, Mayor said, she was frequently asked about her views on how supermajors and independents would operate alongside one another.

“The folks that are close to OPEC are really curious about shale and what’s going to happen now that the integrateds have stronger footprints there,” she said.

Mayor’s view has been consistent. As she told Investor in October 2018, “Once the IOCs are in the basin it’s pretty well-played.”

“I do think the integrated companies [as a group] are advantaged in onshore U.S. and in particular in shale in the coming period as we move from maybe more of the wildcatter types of prospects and the freer access to capital and financing that some of the smaller players had.”

The drying up of capital for small companies is difficult to overcome. “I see it having a material impact on many of the smaller players,” she said, adding that activity will also continue to fall among smaller companies.

Gjervik’s own take on independents—as rivals, competitors or partners—is that “it’s all of the above.”

“Clearly, we are competitors. We are also partners. We have nonoperated positions like everybody else and joint ventures,” he said. “And then you also have certain aspects of the industry that have to be worked [on] in a partnership, whether that’s safety, whether that’s some of the sustainability aspects.”

Gjervik noted that many of the employees work in the same communities and with the same stakeholders. But it’s a relationship admittedly in flux.

“You’ve got to be able to play across that,” he said.

The majors didn’t arrive in the dead of night to set up operations in the Permian, Bakken, Eagle Ford or other shale plays. But more recent aggressiveness in staking out shale—and the Permian in particular—has followed steady increases in production.

game to play

now”, said Regina

Mayor, global and

U.S. sector leader

for energy and

natural resources

at KPMG.

Speculative

money will likely

go to the Scoop-

Stack or Powder

River Basin.

In Texas, for instance, XTO has been the largest natural gas producer since 2015, according to Texas Railroad Commission reports. But XTO didn’t consistently crack the Top 10 in oil production until 2016. In each successive year, the company has crept up the list, sitting at fifth in 2018.

Sheffield, whose Pioneer Natural Resources has consistently been a top oil producer, said he’s “all for” Exxon Mobil and other majors operating in the Permian.

Sheffield’s case for the majors is that they bring more money and therefore more variation to the shale world.

“It’s been a plus for the Permian Basin because they take a different approach,” Sheffield said. “They do tend to spend more capital. They’ll experiment more, and we’ll learn from them—because it’s hard to keep a secret out there.”

Sheffield said Pioneer has a good exchange of information with the majors—and he’s clearly been watching them.

“I knew that Chevron already had a great base there from previous acquisitions, primarily Texaco, so Chevron didn’t have to go out and buy somebody,” he said. “And Exxon, obviously, made a couple of acquisitions.”

Exxon Mobil also telegraphed the company’s moves into the Permian, Sheffield said, noting that its 2018 and 2019 investor days focused entirely on the Permian.

At first, Sheffield was watchful of whether Exxon Mobil’s increased activity might cause service costs to rise, but that hasn’t happened. The rig count has fallen by about 88 in the past 12 months, which Sheffield attributes to a decrease in public independent operators as well as private-equity-backed firms.

“Having a $300 billion company and a $250 billion company coming to the Permian Basin is a plus,” Sheffield said. “And then the other two majors, Shell and BP, are starting to expand.”

Sheffield noted BP’s October 2018 purchase of BHP’s Lower 48 assets for $10.5 billion. Shell likewise “bumped up their assets” in 2012 in a purchase of Permian leasehold from Chesapeake Energy Corp. for $1.9 billion.

“So they’re ramping up activity,” he said, adding that large companies such as Pioneer will share in their findings whether the majors “ramp up or not.”

“Everybody’s wells are being monitored, their lateral lengths are being reported, the amount of frack flow and the type of frack fluid they’re using—everybody’s got to report their frack jobs to FracFocus, so all the data becomes public anyway,” he said.

Exxon Mobil’s ability to innovate gives it clear advantages over its peers, although Gjervik agreed that “Scott is probably right” that the broader industry will eventually benefit from the company’s discoveries. The company would, naturally, like to keep “a lot of that benefit to ourselves,” he said.

However, Exxon Mobil’s colossal resources make it one of the few companies with the “internal know-how and, I should say, capacity and capability, to take on research and move things forward.”

On Nov. 22, the Drucker Institute at Claremont Graduate University ranked Exxon Mobil among the five most innovative companies in a list headed by Amazon.com, Microsoft Corp., Apple Inc. and IMB Corp., The Wall Street Journal reported.

“You look back in history of oil and gas and today we take something like 3-D seismic as a given—surely that was there from day one,” Gjervik said.

Today, the oil industry uses 3-D and 4-D seismic that Exxon Mobil helped develop, he said. “That’s how technology development goes but staying ahead of the curve for us to reap benefit from that as a company” continues to distinguish the company from the field.

Where Sheffield doesn’t cede any ground is in Pioneer’s dominance over well productivity or cost.

“Their production curve is public information. So we know everybody’s type curve and production curve,” he said. “And so I know for a fact that they are not making better wells than Pioneer, whether it’s Exxon, Chevron, Shell or BP. We still have the best type curve in the Permian Basin. The only thing we don’t know ... is their well cost.”

However, Sheffield said that, historically, the majors haven’t been able to drill as inexpensively as the independents.

“Even though they don’t publish their AFEs or well costs, I know for a fact there is no way that their well costs are going to be cheaper than an independent’s,” he said.

Where Sheffield and Gjervik agree is that the presence of the majors is good for the unconventional space. And with their arrival, Gjervik, the majors want to know, “How do we accelerate that to keep it competitive?”

Exxon Mobil, of course, already believes it has part of the answer.

Manufacturer’s guarantee

Gjervik turns the question over in his mind. How far along is Exxon Mobil in developing a manufacturing mode in its shale plays? Is it in place? In progress? Does it exist at all?

He settles on the most appealing question, which is the one he posits himself: What does manufacturing really mean?

In some ways, the answer is the make or break for Exxon Mobil’s and XTO’s plans for the Permian.

In one sense, Gjervik says, Exxon Mobil is industrializing the unconventional. And like any manufacturing process, it must be broken down into its components for assembly.

“There is a manufacturing aspect from a resource development planning and kind of what’s being done literally in the office where you take seismic, you take well data, you apply modeling, you apply science to it to then let that inform how and what you want to develop,” he said.

The scale of production demands efficiency. With, for instance, 10,000 well potential targets, finding a cost-effective way to choose targets is vital. The industry has largely tackled that, though it still “has a ways to go,” he said.

And then there’s execution—drilling, completing and bringing a well on efficiently.

“Unless you have running room and you’ve got a certain level of scale, I don’t think you can do manufacturing to set up a manufacturing plant,” he said. “Just think about it. You’ve got to have more than two widgets to produce, right? You’d like to have to do 10,000 every day for 365 days a year.”

At that level, scale is everything, Gjervik said—and XTO’s edge. XTO holds more than 1.6 million acres in the Permian and plans to grow its total daily production there to 1 million barrels of oil equivalent by 2024 or 2025. Overall, the company holds huge swaths of acreage in the Appalachian and Williston basins and multiple U.S. states.

Part of XTO’s plan centers on a 75-rig drilling fleet that as of late November dwarfs the total rig counts in the Eagle Ford, Williston, Haynesville or Marcellus and, separately, 11 U.S. states.

The rigs aren’t searing through cash haphazardly, but as part of projects as intricate as the company’s nearly 6-mile discovery wells offshore Guyana.

“Historically, there aren’t that many companies that have been running even 10, 15, 20 rigs in one area,” Gjervik said. “So I think we’ve gotten into it, a few other players are ... starting to see the benefit of that.”

Exxon Mobil is already implementing realtime data gathering for its rigs in the U.S.

“Data is gathered centrally, and there are people who determine the insights every day and then apply that straight back either on the same well or the next well that is starting up two days later,” he said. Historically that has been done manually.

“If you have a lot of rigs, that takes a lot of people, it takes a lot of time. How do you create a digital process around that where this can almost be a closed loop,” he said.

Results from operations can be used to finetune well construction and feed into the company’s permitting process based on information from “the well that you drilled last night, not the one you drilled six months ago,” Gjervik said.

As XTO moves into large-scale production, the company is working to “fully stitch it together” and create a process that’s not unlike the manufacture of cars on a conveyor belt.

“We aren’t fully there yet ... overall, I see that as a good thing as we have more running room. I haven’t read a book yet on manufacturing for the unconventional, but we’re definitely trying to write that internally.”

Despite the majors’ position of strength in capital, technology and procurement, one wild card remains in the shale plays, Mayor said: the affect big data will have on improving shale exploration, extraction and production.

“The majors all have significant efforts with big data in shale. And a couple of them are having decent success,” she said. “So, it’s being able to find and extract the hydrocarbons cheaper and more precisely and quicker, which is also part of the cheaper.”

A technology breakthrough could yet disrupt shale innovation and the industry. With the majors able to parlay so many data points and analytics to improve their process, they’ve taken some of the human element out of the equation.

Proving techniques or processes that could make small-scale development more successful could be a disruptor. “Which would be something that a smaller independent—they wouldn’t have the scale—but that could be exactly where they might be able to learn from the majors coming in.”

But it will take time to develop and build Exxon Mobil’s vision. In the meantime, the hurdles facing the majors are likely familiar to shale veterans.

The chain

Eleven months into 2019’s long, slow unraveling of E&P stocks, seemingly one ticker symbol after the next has been ripped apart at the seams. While oil prices in that time have increased by about 12%, according to U.S. Energy Information Administration data, the index of publicly traded oil and gas companies—the XOP—was down nearly 26%.

By contrast, Shell is down 3%, Exxon Mobil by 2% and Chevron is up 6% through 11 months. The downshifting of growth among oil and gas companies in favor of free cash flow has so far proven unconvincing.

“Energy has struggled to gain any sort of traction in the broader market,” wrote Simmons analyst Ryan M. Todd in a Nov. 26 note initiating coverage of six oil majors.

“Investor preferences have evolved to favor moderate growth and shareholder returns,” Todd said, adding that the potential for growth and dividends favored integrated companies through at least 2021.

Sheffield said majors’ inherent advantage is in their integration of upstream, midstream and downstream and the ability to sell their products to their own petrochemical plants and refineries on the U.S. Gulf Coast.

“Their big upside is that they can take their products downstream,” he said.

Mayor agrees that a fully realized upstream and downstream chain gives majors the ability to move crude from the Permian, push polypropylene to Singapore or excess gasoline barrels into South America.

“They can make really fundamentally different margins optimizing choices across their whole value chain. So that’s sort of point number one of why they’re differentiated,” she said.

Supermajors are also less beholden to capital markets. “They have deeper pockets and can do their own financing,” she said. “They’ll have more flexibility as access to capital for some of the smaller players dries up.”

Exxon Mobil sees its integrated model yielding “far more value” than a single sector of oil and gas, Gjervik said. The company structure also provides a more complete understanding of each segment and a knowledge of the market that can make assumptions three to five years out.

“Not too many companies are able to do that,” he said. “As you think about an upstreamer, it’s got to sell its product somewhere.

“Being able to combine what we’re doing in the upstream with the demand centers we have is also something that is very beneficial as you take out commitments and you weather the up and the down. Again, in a very different way than somebody playing only in one end of the value stream.”

That value chain has clearly been of interest to investors, RS Energy’s Gregoris said.

Investors have likely moved toward integrated companies, or at least diversified energy companies “in a big way over the last couple of years,” he said.

In part, that’s due to the variety of assets that immunizes them to the volatility that bucks shale producers.

Hess Corp., with assets in both offshore Guyana and the Bakken, is among the standouts among energy companies. The company’s stock is up 47% from January 2019 through November 2019.

“That stock has held up miraculously well vs. shale peers,” Gregoris said. “It’s sort of a company in transition. That’s a good example of investors flocking to different types of assets.”

The shale space has seemingly lost its luster, he added.

Reid Morrison, PwC’s global and U.S. energy advisory leader, said he’s also seen oil and gas investors “prioritizing the majors over the shale players.” However, PwC hasn’t been able to quantify the shift toward the majors.

Morrison said that integrated companies are built for a market focused on delivering returns and dividends through all market cycles.

“Because the supermajors have assets in upstream, downstream and chemicals industries, they are able to drive free cash flow in all cycles, which is a key characteristic for value investors,” Morrison told Oil and Gas Investor. Companies have also exercised discipline over future capital investments in exploration and development which he said resonates with value investors.

Shale-focused companies will continue to produce their lowest cost wells and respond more to market prices and liquidity.

In initiating Simmons’ coverage of oil majors, Todd wrote on that E&Ps tied to shale continue to suffer “growing pains” due to concerns around long-term resource depth and its economics, “including parent-child issues and well productivity.”

With a slew of majors investing heavily in shale plays, the performance of the majors will either validate those concerns or alleviate them on a grand scale.

PwC’s global

and U.S. energy

advisory leader,

said supermajors

are more

attractive to

investors because

their integrated

upstream,

downstream

and chemical

companies can

drive free cash

flow in all cycles.

So far, Exxon Mobil’s Permian production volumes are rising in line with its guidance, Moody’s Investors Service wrote on Nov. 19. But the financial services company also revised its credit outlook on Exxon Mobil from stable to negative.

Moody’s said the major is using debt to fund expensive campaigns across the globe—in the Permian, offshore Guyana, expansion in its LNG business and improvements to midstream and refineries.

Pete Speer, Moody’s senior vice president, said in a Nov. 19 rating action that the company’s debt is forecast to rise despite asset sales, “causing Exxon Mobil’s credit metrics to weaken for the next few years.”

Barring a substantial change in commodity prices, the outlook estimated that Exxon Mobil’s negative free cash flow will be about $7 billion in 2019 and $9 billion in 2020 as the company funds growth while maintaining a dividend.

Gjervik said the company continues to invest through cycles rather than in response to them—a strategy that has yielded benefits in the past. Exxon Mobil gains “efficiencies and by staying more consistent and you get a better result [at the] end of the day in doing that. And that’s whether it’s unconventional or the more conventional oil and gas around the world.”

During CERAWeek by IHS Markit in March, Gjervik told Bloomberg that its Permian development, operations and land acquisition costs would be “in and around $15 a barrel.” But Gjervik said Exxon Mobil generally prefers to look at the returns it will generate.

“The way to look at it ... is maybe from a 10% return [perspective], and what kind of oil price and how far down can the oil price go and still get a 10% return. For us, this is around $35 per barrel. And then you can calculate from there, as far as what that means from a capital cost and operating cost.”

Gjervik sees that as a better measure than breakeven costs because “when people quote kind of cost levels, you’ve got to be very clear here on what’s included,” he said. “So, I think that’s a good measure.”

Nieboer with RS Energy said that at this stage for Exxon Mobil, the Permian is a rapid growth area where the company is investing a lot of capital for a cash-flow stream that should ultimately materialize.

“You know, not too long ago you would have said that the independents would’ve have an operational advantage over the majors,” he said. “I don’t think that’s nearly as true today. The majors are really coming around quite quickly and becoming pretty good operators in a lot of cases.”

Once the majors steady their investments and drilling programs, the dynamics of largescale production and cash-flow profiles look likely to improve, he said.

“It’s getting to that point and that sort of sustainability ... that becomes the bigger, fundamental question.”

Recommended Reading

Matador Exits Eagle Ford Shale, Preps for ‘Turbulent Times’

2025-04-04 - Matador Resources Co. divested its Eagle Ford Shale assets “in preparation for turbulent times” but doesn’t expect tariffs to affect well costs until the second half of 2025.

Appalachia, Haynesville Minerals M&A Heats Up as NatGas Prices Rise

2025-04-03 - Several large Appalachia and Haynesville minerals and royalties packages are expected to hit the market as buyer interest grows for U.S. natural gas.

RPC Acquires Pintail Completions to Expand Permian OFS Operations

2025-04-03 - RPC Inc. paid $245 million in cash and other considerations for the wireline service provider.

TotalEnergies Grows Renewables Portfolio with Project Acquisitions

2025-04-03 - TotalEnergies has entered into deals with RES, VSB Group and SN Power for assets in North America, Africa and Europe.

INEOS Buys CNOOC’s Gulf Assets, Bringing US Deals Total to $3B

2025-04-02 - INEOS Energy closed an acquisition of U.S. Gulf assets held by a CNOOC subsidiary. Combined with a previous LNG agreement and acquisition of Eagle Ford Shale assets, the British company has spent $3 billion in the U.S.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.