John Spears, market research director for Enverus, said that similar buyout offers for other small-cap E&Ps could emerge. (Source: Roan Resources Inc./Shutterstock.com)

The first major E&P transaction of fourth-quarter 2019 was another combo, this time with private-equity backed Citizen Energy LLC saying Oct. 1 it would purchase Roan Resources Inc. for $1 billion cash.

The deal may portend future take-private offers for public companies that have largely been scorned by the public market—a trend already emerging in the midstream sector. It also follows a pattern set in the third quarter in which no single play or basin dominated transactions. Citizen’s offer for Roan’s Oklahoma assets follows deals announced in the Barnett, Bakken, Eagle Ford, Marcellus and Permian.

The merger, if approved by Roan shareholders, will pay $1.52 per share of common stock, a 24% premium on the company’s Sept. 30 closing price. Most of the cash paid by Citizen, a Tulsa, Okla.-based company backed by Warburg Pincus LLC, would absorb Roan’s $780 million net debt.

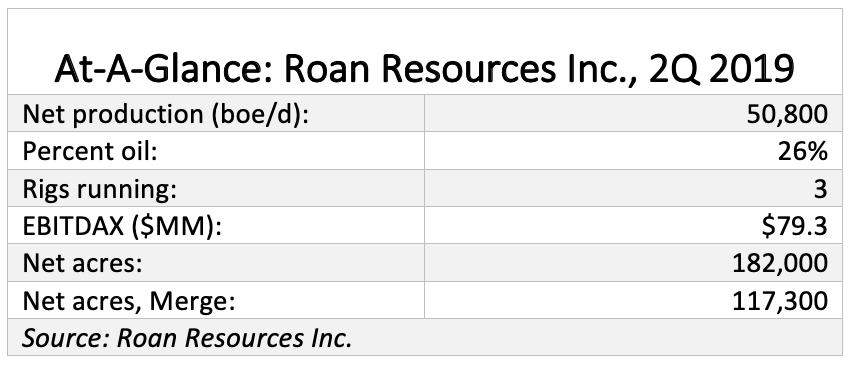

The “deal metrics screen muted” based on the company’s second-quarter production, which averaged about 50,000 barrels of oil equivalent per day (boe/d), including 26% oil, analysts with Tudor, Pickering, Holt & Co. (TPH) said.

TPH priced the transaction at about $20,000 per boe/d or marginal undeveloped value.

“Of note, Roan has also elected to temporarily reduce its drilling and development activity and to suspend all completion activity,” TPH said in an Oct. 1 report. A “private takeout by a PE sponsor amid a depressed valuation is certainly interesting to see as Roan’s story is certainly not unique.”

The midstream sector has seen similar take-private offers, including a May deal by IFM Global Infrastructure Fund to take Buckeye Partners LP private for $6.5 billion. In August, Blackstone Infrastructure Partners made a similar offer to Tallgrass Energy LP for $5.5 billion.

John Spears, market research director for Enverus, noted in an Oct. 2 report that similar deals could emerge.

“We could see other small-cap E&Ps with high debt and low share prices take similar buyout offers,” he said.

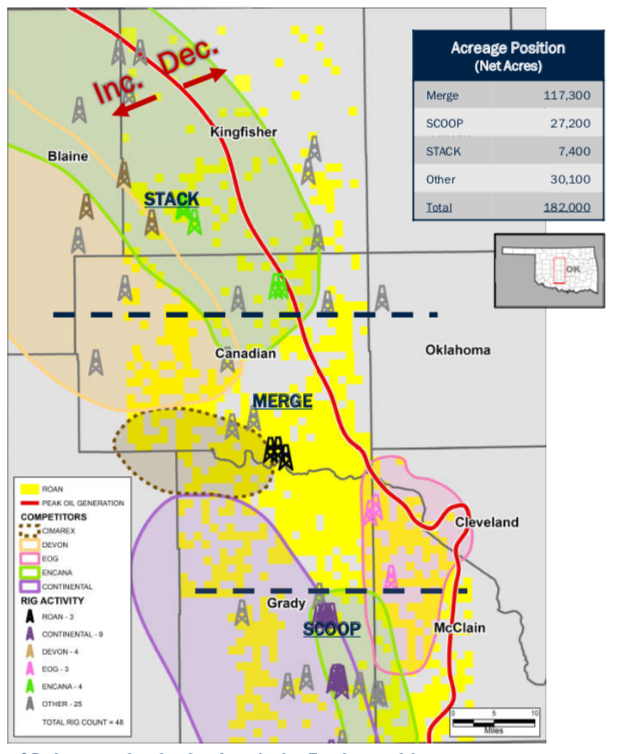

Roan was created in 2017 from the ashes of Linn Energy Inc. in partnership with Citizen when the companies established a position of 140,000 net acres in the Merge, Scoop and Stack plays.

Roan also named Rick Gideon, a former executive at Devon Energy Corp., as CEO on Oct. 1. The company said he would start his new responsibilities immediately.

Joseph A. Mills, Roan’s executive chairman of the board who had been handling chief executive duties following the resignation of the company’s previous CEO Tony Maranto in April, said the Citizen deal was a culmination of its review of strategic alternatives. In April, Roan disclosed that it received multiple, unsolicited “indications of interest” to buy the company and would evaluate a potential sale or merger.

“The board unanimously determined that an all-cash transaction with Citizen Energy is in the best interests of our stockholders and the company and will deliver value to our stockholders at a premium to our recent share price,” Mills said.

Citi and Jefferies LLC are serving as financial advisers to Roan with legal counsel from Vinson & Elkins LLP. BofA Merrill Lynch is serving as financial adviser to Citizen Energy with legal counsel from Latham & Watkins LLP.

Recommended Reading

Freeport LNG Parent Receives Junk-level Credit Score From Fitch

2024-07-25 - Credit-rating firm Fitch Ratings cited the 2 Bcf/d Texas plant’s frequent downtimes among the factors leading to lowering Freeport LNG Investments LLLP’s credit grade on July 25.

NextDecade Appoints Former Exxon Mobil Executive Tarik Skeik as COO

2024-07-25 - Tarik Skeik will take up NextDecade's COO reins roughly two months after the company disclosed it had doubts about remaining a “going concern.”

Petrobras’ 2Q Production Rises 2.4% YOY to 2.7 MMboe/d

2024-07-31 - Brazil’s state-owned Petrobras reported average production of 2.7 MMboe/d in second-quarter 2024 as offshore production continues to ramps up.

CEO: Baker Hughes Lands $3.5B in New Contracts in ‘Age of Gas’

2024-07-26 - Baker Hughes revised down its global upstream spending outlook for the year due to “North American softness” with oil activity recovery in second half unlikely to materialize, President and CEO Lorenzo Simonelli said.

Pemex Hits Debt Target, Struggles to Reverse Production Declines

2024-07-26 - Pemex achieved its long-term debt target, which aimed to gets its financial obligations below the $100 billion, while struggling to halt production declines.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.