The brothers behind Rice Energy agreed in 2017 to the roughly $8.2 billion merger with EQT, which was set to create the largest natural gas producer in the U.S. (Source: Hart Energy)

Rice brothers, Toby and Derek, are doubling down on their calls to transform EQT Corp. (NYSE: EQT) into the lowest-cost gas operator in the U.S. by taking control of the company and installing Toby as CEO.

The brothers hosted an investor call on Feb. 5 to lay out their turnaround plan for EQT to live up to the promise shareholders were made when the merger between EQT and Rice Energy closed a little over a year ago. The Rice brothers have keenly watched the EQT merger, in part because their fortunes are tied to EQT’s performance as the 2017 merger included a payment of $1.3 billion in cash plus $5.4 billion in EQT equity.

EQT management has said it’s likely they will try to buy back stocks soon as part of an effort to blunt the Rice brother’s return to the executive suite. Though, Toby Rice also offered a rebuttal on Feb. 5 to EQT management’s comments last week, which sought to discredit Rice’s projections as inflated and based on outdated market conditions.

“After believing in the Rice results following extensive due diligence, a five-month integration and a year of operations, EQT now claims that the primary synergy justification it gave for the Rice merger just 14 months ago no longer exists,” he said. “We disagree.”

While EQT has a rich history, Rice said that this history comes with “some baggage—bureaucratic processes, silos and old systems and dated technology. These are the self-described legacy issues that the company has been trying to address for years to no avail.”

While Rice has no personal animus toward EQT management, “we strongly believe that we can remove at least 25% of the costs from the business while meeting EQT's production targets,” he said. “We're going to add new blood and new technology to revive this business so that it can live up to the potential that its asset base merits and generate the results that shareholders deserve.”

On the call, Rice and his brother, Derek, offered a blueprint for realizing EQT’s potential to decrease well costs and improve its free cash flow profile by adding proven leadership, implementing a technology platform and utilizing effective planning.

“We took 80% stock in the merger and we remain major shareholders in the business because we believe these results are possible,” Rice said. “We just don't believe it is possible with the current leadership.”

Rice Energy Merger

Rice Energy was started in 2007 by the Rice brothers, Daniel, Toby and Derek, who quickly grew the company from a family-owned operation into a billion-dollar enterprise in the span of a decade.

During the call on Feb. 5, Rice noted that Rice Energy exited 2017 as a top 10 producer of natural gas in the U.S. and also outperformed its Appalachian peers by 95% as a public company.

“This did not happen overnight and was the result of an organizational technological and cultural transformation that I led at Rice Energy,” he said. “This transformation allowed Rice to deliver basing leading well costs and well productivity with confidence and consistently beating guidance.”

As the company’s president and COO, Rice established a focus on technology with a data-driven approach to operations in the field and office. He also created a digital work environment, which enabled the company to grow with fewer people and streamlined processes.

The brothers eventually agreed to the sale of Rice Energy to EQT for roughly $8.2 billion in what was the most expensive U.S. shale merger of 2017. The transaction included $6.7 billion cash and stock plus about $1.5 billion in debt or preferred equity. Also, Daniel Rice, CEO of Rice Energy, and former Rice director Robert F. Vagt joined the EQT board following closing of the merger in November 2017.

RELATED: Q&A: Rice Energy Brothers Return To Oil And Gas

At the time of the sale, Rice Energy was producing and gathering more than 2 billion cubic feet per day of gas from a 250,000 net acre Appalachian Basin position in the core of the Marcellus and Utica shale plays.

The merger was not only set to create the largest natural gas producer in the U.S. but also result in savings of overhead and capital efficiency creating an expected $2.5 billion in synergies.

According to Rice, he and his brothers spent the five months following the announcement of the merger with EQT management laying out the blueprint that led to Rice Energy’s operational success—their people, technology and planning.

However, Rice claims EQT ignored their assistance and instead decided to move forward without the internal systems and critical personnel who were responsible for Rice Energy’s success.

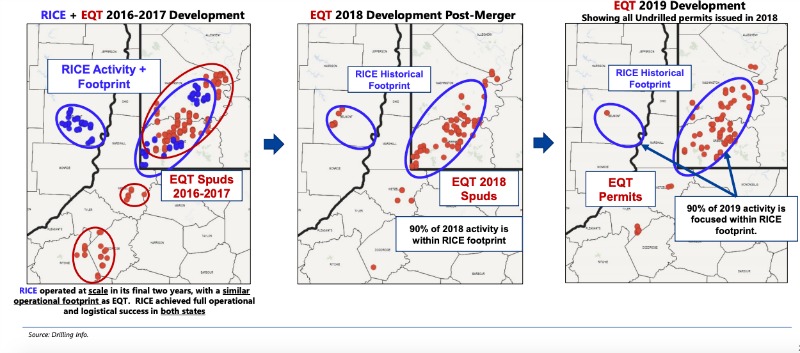

As a result, despite the new scale gained by the merger, EQT’s performance has lagged this past year including a 2018 operational miss. Still, Rice pointed out that 90% of EQT’s 2018 and 2019 activity is focused within Rice Energy’s footprint.

“From the outside looking in, it feels like EQT is a big company with this large unwieldy asset but when you dig into what is actually being developed it’s not,” he said. “In this footprint, we successfully managed all aspects of a large-scale development program including sand and water logistics, midstream takeaway, leasehold obligations. Essentially all of the operational issues that have challenged EQT, we successfully handled at Rice Energy.”

EQT Rebuttal

In response to the Rice team’s plans, which were first announced in December, EQT management held an analyst call on Jan. 22 where CEO Robert McNally denounced Rice’s plan calling it “fundamentally flawed.” Instead, the company laid out its own initiative for 2019.

Under its plan, EQT expects to generate around $2.7 billion of accumulated adjusted free cash flow over the next five years. Aiding cash flow generation would be $100 million of cost savings, an initiative to trim a further 10% of costs across its development program, as well as an up-to-21% decline in forecasted capex this year vs. 2018.

Further, Reuters reported McNally as saying it was “highly likely” EQT would seek to buy back shares in the “near term.”

However, shareholder reaction to EQT’s plan was broadly negative, with EQT shares ending 5.5% lowers, according to the Reuters report on Jan. 22.

Rice said EQT’s 2019 development plan would set up EQT to be one of the highest cost operators amongst its peers. He added that he is now even more confident in the Rice team’s ability to generate $500 million per year of additional free cash flow over EQT’s current plan. Though, execution of the Rice plan still requires experience and a track record of operating at scale in true manufacturing mode, something Rice said he acquired from building Rice Energy.

“This is not a personal attack on the current management team, but they simply do not possess the necessary experience or track record to navigate this path forward…In my opinion, this transformation is not going to come from legacy leadership, a generic goal setting initiative or simply hiring a new COO,” he said. “This transformation starts with the right vision and goals—a vision that reflects the potential of the asset base and translates to goals that are achievable.”

Rice’s plan has attracted support from fellow EQT shareholders including D. E. Shaw, who publicly released a letter to the EQT board in early January expressing its support for the Rice team.

In the event EQT continues not to engage with the Rice team in “a meaningful and constructive manner,” Rice said they plan to challenge EQT’s board at the company’s upcoming annual meeting.

Reuters contributed to this article. Emily Patsy can be reached at epatsy@hartenergy.com.

Recommended Reading

Cheniere’s Corpus LNG Stage 3 Project on Track for Year-end Start

2024-08-09 - Cheniere Energy., which boasts 45 mtpa of LNG production capacity, is on schedule for first LNG production from its Corpus Christi LNG Stage 3 project by year-end 2024, the company’s CEO Jack Fusco said during a quarterly earnings webcast.

Freeport LNG Parent Receives Junk-level Credit Score From Fitch

2024-07-25 - Credit-rating firm Fitch Ratings cited the 2 Bcf/d Texas plant’s frequent downtimes among the factors leading to lowering Freeport LNG Investments LLLP’s credit grade on July 25.

Souki’s Saga: How Tellurian Escaped Ruin with ‘The Pause,’ $1.2B Exit

2024-09-11 - President Biden’s LNG pause in January suddenly made Tellurian Inc.’s LNG export permit more valuable. The company’s July sale marked the end of an eight-year saga—particularly the last 16 months, starting with when its co-founder lost his stock, ranch and yacht in a foreclosure.

YPF, Petronas Target FID for Argentine LNG Facility in Late 2025

2024-08-16 - Argentina’s long-envisioned LNG export facility is closer to becoming a reality as state-owned YPF SA and Malaysia’s Petronas will look to reach a final investment decision in the second half 2025 on development in Sierra Grande on the country’s Atlantic Coast.

NextDecade Appoints Former Exxon Mobil Executive Tarik Skeik as COO

2024-07-25 - Tarik Skeik will take up NextDecade's COO reins roughly two months after the company disclosed it had doubts about remaining a “going concern.”

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.