Oil and gas private equity executives described current E&P investment opportunities as “more favorable than it’s ever been,” “as attractive as it’s ever been” and that it’s “never looked so good.”

But in interviews with Hart Energy, top-level executives also acknowledged much more work and time is required to assemble funds, with some saying raising funds takes twice as long as it has in previous years.

And private equity is nowhere near raising the funds the industry has said are needed.

“The market is not that efficient. There’s a lot of political things that get in the way,” said Tomas Ackerman, co-founder and partner of Carnelian Energy Capital in Houston. “Potential returns in the traditional energy asset class do not drive a lot of these investors. Divestment mandates are really influencing a lot of the decision making.”

Others cited declining returns, and investors fear of getting clobbered on the downside of another boom-bust cycle. Private equity executives said about a third of their peers are done with fossil fuels.

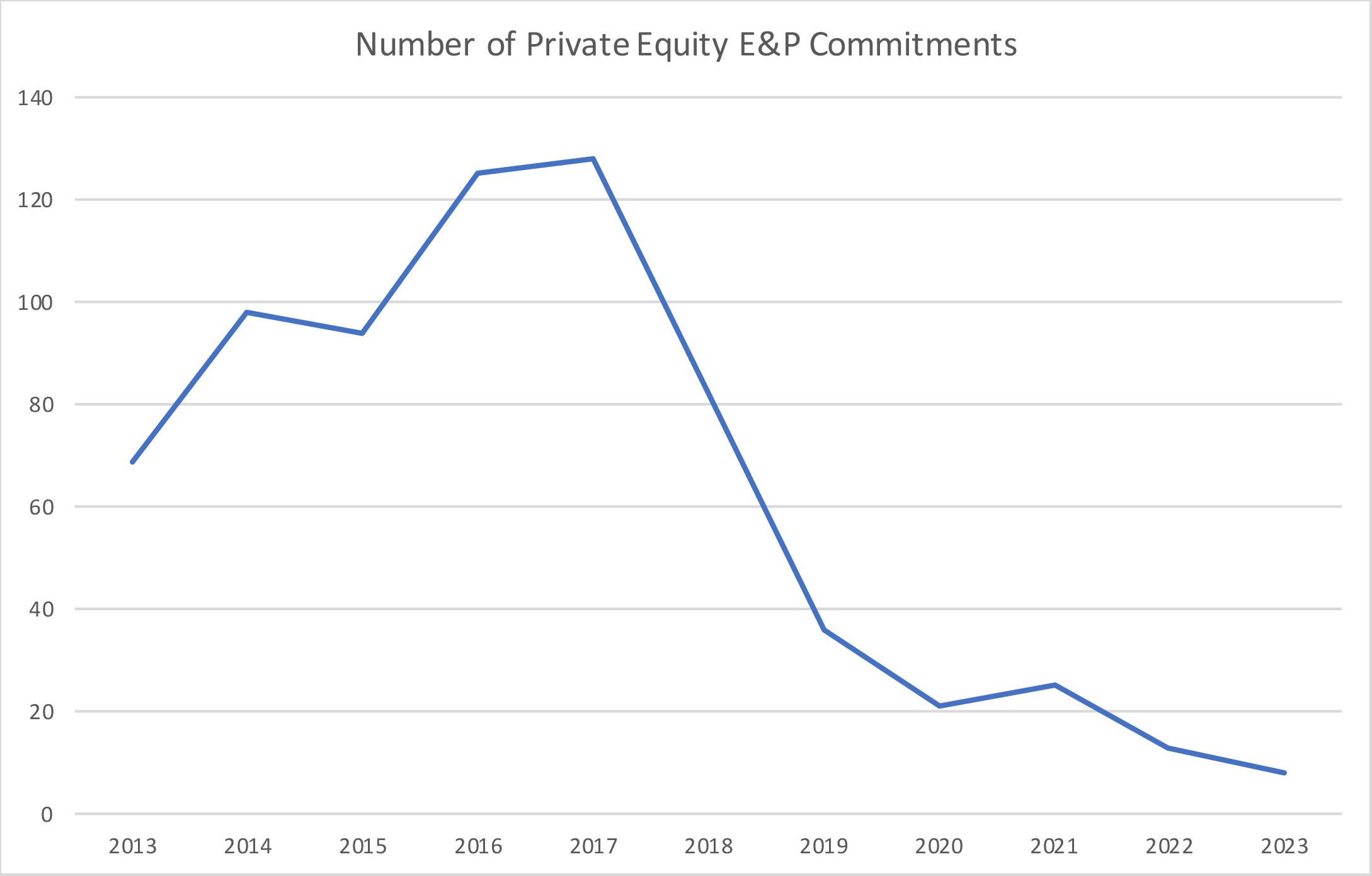

That’s resulted in fewer portfolio companies getting equity commitments. Private equity E&P commitments peaked at 128 in 2017. So far in 2023, just eight have been made, according to numbers provided to Hart Energy by data provider Enverus. Private equity and venture capital’s oil and gas investment peaked at $21.6 billion for the U.S. and Canada in 2017, and is down to just $1.4 billion so far this year, according to S&P Global Market Intelligence.

Some expectations for private equity’s haul in 2023 range $15 billion to $25 billion. Whether those funds come to fruition is another story.

EnCap Investments, which declined to comment for this article, is reported to be raising its first private equity fund in five years. Quantum Energy Partners is, likewise, reported to be nearly halfway toward raising a fund of more than $5.5 billion. In February, Chad Michael, president of Tudor, Pickering, Holt & Co., said private equity was likely raising $15 billion for oil and gas in 2023. In May, Muhammad F. Laghari, senior managing director at Guggenheim Securities LLC, mentioned at the SUPER DUG conference in May that whatever is raised—$15 billion or $25 billion—private equity is clearly busy trying to raise money.

“Pretty much any private equity energy client I have is either raising money or has just raised money,” he said. “So we do expect quite a few folks to raise money. I think what we’ve been hearing from them is positive comments from them are fundraising perspective. They all admit it’s not easy.”

In an interview, Wil VanLoh, founder and CEO of Quantum Energy Partners, said he’s seen some improvements raising money, but firms are certainly putting in more time and work than in years past. VanLoh said it once took four months to six months to raise a fund; now assembling a fund is taking 15 months to 18 months.

“The industry is in a world of hurt because the amount of private equity that used to be available five years ago was probably $100 billion. Today, it’s probably less than $15 billion,” he said. “Does it need to be $50 or $60 billion? Yeah, it does.”

Energy investment remains a tricky proposition, particularly as renewable funds bite into traditional oil and gas private equity.

VanLoh said E&Ps’ equity needs are hurting with banks too. The companies could get 3.5x turns of leverage in recent years, he said, but they cannot get even two turns today. Likewise, in the stock market, public energy companies have boosted stock buybacks and dividend yields higher than any other sector but the sector remains, in many analysts’ views, undervalued.

Billy Quinn, founder and managing partner of Pearl Energy Investments said his Dallas-based private equity firm took 16 months to raise a $705 million energy fund announced in May, despite the fact that he believes he has a great story to tell potential LPs.

“Opportunities and value are driven by less by fundamentals than by flow of capital, so whenever you have a business where capital is effectively leaving the business, you’re generally identifying better values and better investment opportunities there,” Quinn said. “The fundamentals of the day-to-day business and overall price levels never looked so good.”

Private equity potential

VanLoh also said there’s much to tell potential LPs about E&P investing.

“The supply demand dynamic is more favorable than it’s ever been. Multiple valuations on assets is cheaper than it’s ever been … and oil and gas is a phenomenal inflation hedge,” VanLoh said, adding that oil and gas assets can be bought at all-time low valuation multiples.

VanLoh said potential investors respond to this with concerns about money lost in the last decade, and they need to hear what is different this time.

Ackerman said other investors are held back by overly optimistic views of renewable energy’s potential.

“People talk a lot about renewables and electric vehicles, but renewables do not really displace oil demand, they primarily address power demand which oil has a very small share of,” he said. “When you look at the use case, about 25% of global oil demand comes from passenger vehicles. The rest is shipping, trucking, aviation and petrochemicals [these are] very hard sectors to displace with renewables and electrification.”

While private equity investors painted a picture of great investment opportunities, Subash Chandra, an oil and gas analyst at Benchmark, said he does not see it as such a sure bet.

“It’s not a slam dunk. They have to be very careful about how they spend their money. They have to be lucky, and they can't put too much money in the ground. They have to be in the right place and have a tier one resources that someone’s going to want,” Chandra said, adding that exit multiples are lower than ever, which is why it is now harder to build and flip. Unproved assets on acreage acquired by private equity is worth less now, he said.

‘Salivating’ at opportunities

Paul Steen, managing director of First Reserve, a private equity firm with offices in Houston and Connecticut, said many buyers want to rely on the assets’ cash flows to drive much of the return, and the new realities have made hedging more important.

“Hedging is a bigger part of the conversation now because acquisitions have a lot more value in the existing production stream, versus historically where a lot more of it was probably in acreage and upside that you can’t hedge as effectively,” Steen said. “We can design a pretty low-risk business plan underpinned by existing production that’s well engineered and a robust hedge book that typically goes out five to seven years, effectively de-risking the return of invested capital and providing some continued exposure to the long tail production and commodity price. The industry hasn’t really seen asset valuations at these levels historically.”

Some family offices are among private equity’s new energy investors, and some like Andrew Bremner, who manages a natural resource portfolio for the Jaco family office in California, said family offices are rushing to meet needs private equity can’t.

“It is creating opportunities for family office investors like myself. We’re salivating at these opportunities,” Bremner said. “I would expect that a lot of the private equity asset managers are very frustrated because there are excellent opportunities to generate outsized returns.”

Recommended Reading

Dividends Declared in the Week of Aug. 19

2024-08-23 - As second-quarter earnings wrap up, here is a selection of dividends declared in the energy industry.

Gulfport Energy to Offer $500MM Senior Notes Due 2029

2024-09-03 - Gulfport Energy Corp. also commenced a tender offer to purchase for cash its 8.0% senior notes due 2026.

Pembina Completes Partial Redemption of Series 19 Notes

2024-07-08 - The redemption is part of Pembina Pipeline’s $300 million (US$220.04 million) aggregate principal amount of senior unsecured medium-term series 19 notes due in 2026.

Bechtel Awarded $4.3B Contract for NextDecade’s Rio Grande Train 4

2024-08-06 - NextDecade’s Rio Grande LNG Train 4 agreed to pay Bechtel approximately $4.3 billion for the work under an engineering, procurement and construction contract.

SPATCO Energy Exits RF Investment Fund

2024-08-15 - RF investment Partners said it invested in SPATCO Energy Solution’s $230 million continuation fund, which was led by Kian Capital Partners and Apogem Capital.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.