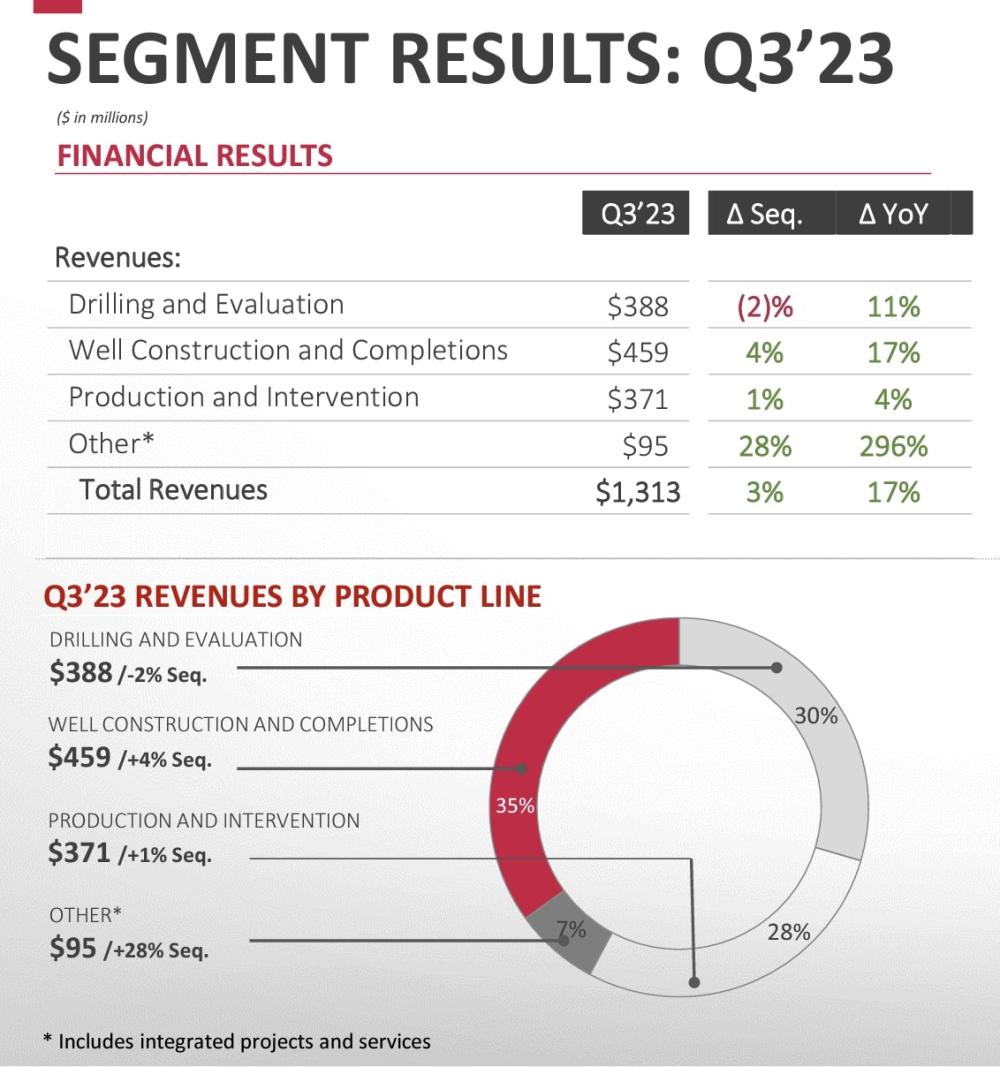

In third-quarter 2023, Weatherford reported net income of $123 million on revenue of $1.31 million, which was up 3% on the second quarter and up 17% year-over-year. (Source: Shutterstock)

International activity and a shift in priorities helped Weatherford International increase its third quarter revenue, even as North America remained a margin-challenged region for the company.

Weatherford declared bankruptcy in June 2019 and emerged from Chapter 11 in December 2019.

Having somewhat reinvented itself by simplifying and improving cost efficiencies, the service company repaid $147 million in debt and on Oct. 24 announced a five-year credit facility with aggregate commitments of $550 million.

In third-quarter 2023, Weatherford reported net income of $123 million on revenue of $1.31 million, which was up 3% on the second quarter and up 17% year-over-year. Net income was up 50% from the second quarter and 339% year-over-year.

“The Weatherford story has been one of demonstrating that it's a different company, of building that credibility,” President and CEO Girish Saligram said in an Oct. 25 conference call discussing the company’s third quarter results. “I will never say that we have achieved it 100%, because we've got to do that quarter in, quarter out.”

Saligram, who was appointed CEO in 2020, said three years of consistent performance “allows us to say that we have a track record now of delivering on our results.”

The turnaround for Weatherford was underscored on Oct. 30, as credit assessment agency Fitch Ratings rated Weatherford with a ‘B+’ and a “stable outlook,” according to the service company.

Gaining efficiencies

The service industry has been caught in an inflationary environment, which creates headwinds on material and labor costs. But Saligram said he believes pricing will be a net positive that helps offset those headwinds.

The company sees innovation as an enabler to grow market share, he said. Weatherford launched new technologies this year with a pipeline in place for new developments, he said.

During the quarter, Weatherford launched ForeSite ReGenX-I, a regenerative variable speed drive for rod-lift systems that reduces emissions and uses untapped energy through recycling otherwise wasted power, he said.

The company also launched the WEL-Core Stabilizer Lost Circulation Material in oil-based drilling fluid, which reduces downhole losses and enhances drilling efficiencies, alongside a new high-performance shale and clay inhibitor called WEL-Hibx that improves drilling by mitigating the impact of drilling fluids on formations, while increasing well productivity, he said.

Weatherford also changed how it runs its operations and delivers to customers.

“Weatherford was never really designed to be what it is today, so we are sort of starting over, and that, we think, will give us a significant amount of cost efficiency and allow us to deliver better to customers and drive better asset utilization,” Saligram said.

Moving forward, the company aims to gain efficiencies through simplification and better technology, he said.

“We've always said it's sort of a three- to four-year journey. This is fairly complicated stuff where you're closing several factories, you are shifting work across the planet, you're creating new supply bases, new logistics channels, you're qualifying vendors, you're getting certifications on quality at different facilities for different product lines, etcetera,” Saligram said. “I would say we're probably about a year, year and a half into a four-year journey.”

Weatherford expects to start seeing some of the initial benefits of that journey next year.

“The really significant benefits of that I expect will really start to show up in ‘25,” he said.

Feeling the pinch from consolidation

Saligram said North America continues to be a challenging market even amidst strong commodity prices.

“Continued capital discipline by both public and large private E&Ps, asset sales and consolidation in U.S. shale, especially in the Permian, were a headwind to incremental rig and well activity,” he said. “We believe we are close to a bottom, and as we move into 2024, we expect activity to improve slightly with growing energy demand and strong energy prices, supportive for both E&Ps and service companies across the well lifecycle.”

Weatherford expects stronger growth in offshore and international regions, leading to double-digit activity growth in 2024, he said.

“It's going to be a little bit mixed by region. We think the Middle East is very strong. We think Latin America will continue to grow. We expect to see continued growth in many offshore markets, in Asia, in Europe,” he said. “So it's going to be a bit of a mixed bag.”

Recommended Reading

Trauber: Inventory Drives M&A, But E&Ps Also Vying for Relevancy

2024-09-26 - Legendary dealmaker Stephen Trauber keeps his eyes open for out of the box ideas: Why not a BP-Shell merger? Or Chevon and ConocoPhillips?

Vivakor to Acquire Endeavor Crude Transport Cos. for $120MM

2024-09-25 - Vivakor said it is buying Endeavor Crude and related companies, which have a series of long-term strategic partnerships with customers in the Permian Basin, Eagle Ford Shale and the STACK play.

Carnelian Backs Williston E&P Zavanna as Bakken M&A Heats Up

2024-09-24 - Carnelian Energy Capital Management LP invested in Zavanna LLC, a longtime producer in the North Dakota Bakken and Three Forks plays.

Macquarie Buys Up to $1.73B Stake in D.E. Shaw Renewable Investments

2024-09-24 - Macquarie Asset Management is acquiring a minority stake in D.E. Shaw Renewable Investments in an equity investment of up to $1.73 billion.

Diamondback, on Hold for Endeavor Deal, Divests in Delaware Basin

2024-08-05 - Diamondback Energy sold non-core assets in the Delaware Basin in the second quarter and collected $375 million for its share of a midstream asset sale as its waits to close a $26 billion acquisition of Endeavor Energy Resources.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.