Plains All American Pipeline LP agreed on June 8 to the sale of natural gas storage facilities along the U.S. Gulf Coast to an affiliate of Hartree Partners for $850 million in cash.

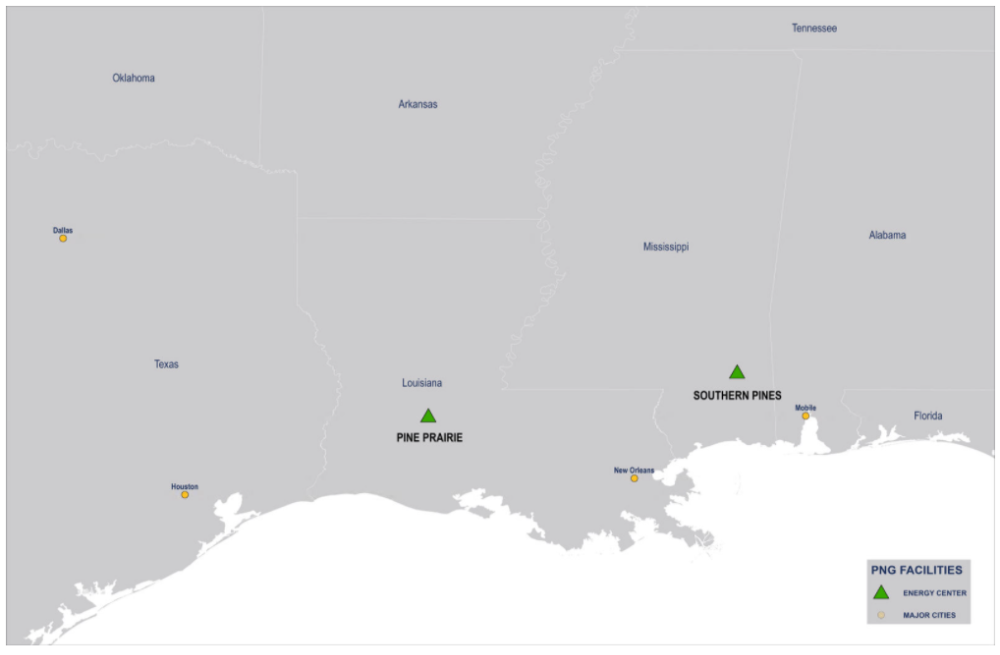

The transaction, according to a release from the Houston-based company, includes the Pine Prairie and Southern Pines energy centers, which Hartree Co-founder Steve Semlitz called “two of the highest performing natural gas storage facilities in the U.S.” The assets consist of approximately 70 Bcf of total working gas capacity across nine caverns in Louisiana and Mississippi, along with associated base gas, header pipelines and compression facilities.

“We are attracted to the facilities’ strategic location in the Gulf Coast and diverse mix of pipeline, utility and LNG customers,” Semlitz said in a statement.

The transaction is expected to close in the third quarter, positioning Plains to exceed its $750 million asset sales target for the year, ultimately marking a key sep in the company’s plan to reduce debt and increase investor returns, said Willie Chiang, chairman and CEO of Plains.

“This is a win-win transaction for both parties,” Chiang said in a statement. “Plains is exiting at an attractive valuation within a timeframe consistent with our expectations, while Hartree is receiving high-quality critical infrastructure in a strategic market.”

As of June 30, Plains will re-classify the Pine Prairie and Southern Pines assets associated with the transaction to “held for sale” on its balance sheet and recognize a corresponding non-cash loss of approximately $480 million in accordance with GAAP requirements, according to the company release.

Wells Fargo Securities LLC served as Plains’ exclusive financial adviser for the transaction. Meanwhile, Vinson & Elkins LLP acted as legal counsel to Plains and Milbank LLP acted as legal counsel to Hartree.

Recommended Reading

E&P Highlights: July 29, 2024

2024-07-29 - Here’s a roundup of the latest E&P headlines including Energean taking FID on the Katlan development project and SLB developing an AI-based platform with Aker BP.

E&P Highlights: Aug. 19, 2024

2024-08-19 - Here’s a roundup of the latest E&P headlines including new seismic solutions being deployed and space exploration intersecting with oil and gas.

E&P Highlights: July 15, 2024

2024-07-15 - Here’s a roundup of the latest E&P headlines, including Freeport LNG’s restart after Hurricane Beryl and ADNOC’s deployment of AI-powered tech at its offshore fields.

E&P Highlights: Aug. 26, 2024

2024-08-26 - Here’s a roundup of the latest E&P headlines, with Ovintiv considering selling its Uinta assets and drilling operations beginning at the Anchois project offshore Morocco.

E&P Highlights: Sept. 16, 2024

2024-09-16 - Here’s a roundup of the latest E&P headlines, with an update on Hurricane Francine and a major contract between Saipem and QatarEnergy.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.