Dos Picos’ Train II, targeted for commercial operation during fourth-quarter 2024, will add 220 MMcf/d of processing capacity in the Midland Basin. (Source: Shutterstock)

Houston’s Pinnacle Midstream II LLC announced July 11 it will expand its Dos Picos System and Processing Complex in the Midland Basin with the construction of an additional natural gas processing plant.

Dos Picos’ Train II, targeted for commercial operation during fourth-quarter 2024, will add 220 MMcf/d of processing capacity, bringing the company’s total operated processing capacity to more than 400 MMcf/d.

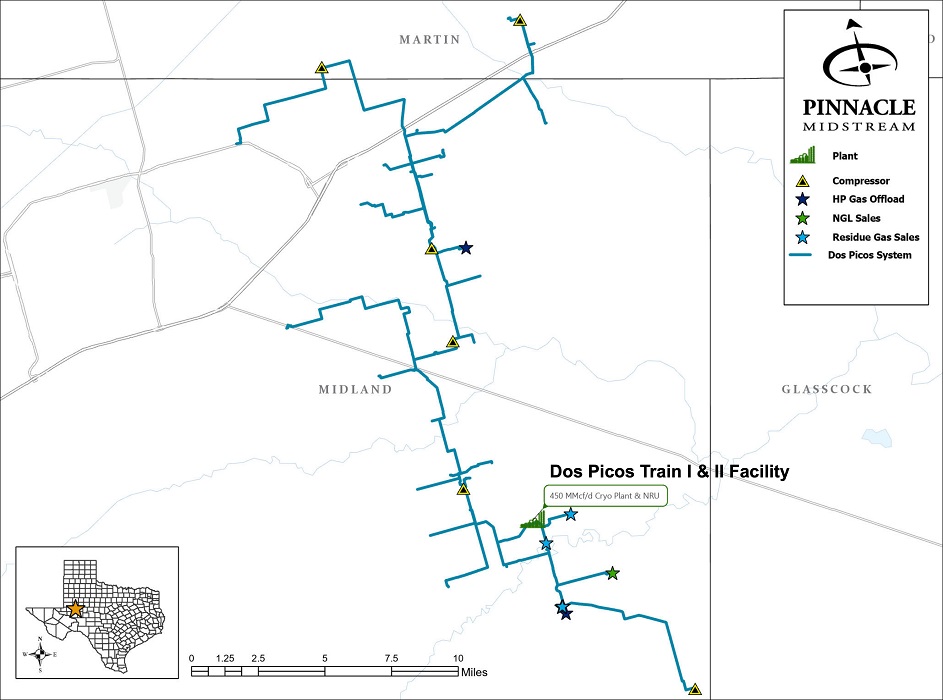

Pinnacle will also expand its gathering and compression facilities throughout Midland, Martin and Glasscock counties, Texas, to accommodate expected and future volumes, the company said.

The company’s infrastructure is anchored by long-term acreage dedications with highly active private and public Permian operators. Pinnacle, backed by Energy Spectrum Capital, said it designed and operates the Dos Picos infrastructure with a focus on air quality preservation and safety, and to enable efficient expansions that support high intensity pad development and increasing gas/oil ratio throughout Midland.

The Train II facility will be collocated in Midland County and will complement Pinnacle’s existing processing facilities and high-pressure, large diameter gathering and compression infrastructure, which began operations during first-quarter 2021.

Pinnacle’s expansion will serve its growing base of Midland Basin producers, said J. Greg Sargent, Pinnacle’s founder and CEO.

“Expanding the Dos Picos capacity by 220 MMcf/d ensures we can provide the best service to our current and future customers, maximize their recoveries and help limit flaring across the basin,” he said.

Pinnacle also provides multiple bi-directional and high-pressure third-party interconnects with peer companies within the region, allowing the company to maximize flow assurances for its producers and third-party midstream customers.

“The expanded processing capacity will continue to provide top of class operational efficiencies, continued access to the most competitive downstream markets and maximize netbacks for Pinnacle’s customers,” the company said in a press release.

Recommended Reading

Dividends Declared Week of Nov. 4

2024-11-08 - Here is a compilation of dividends declared from select upstream and midstream companies in the week of Nov. 4.

TC Energy Appoints Two Independent Directors to Board

2024-11-07 - TC Energy Corp. appointed Independent Directors Scott Bonham and Dawn Madahbee Leach to its board, the company announced Nov. 7 in a press release.

OMS Energy Files for IPO, Reports Revenue Growth

2024-11-06 - Singapore-based OMS Energy, a wellhead system manufacturer, has not yet determined its price range and number of shares.

Record NGL Volumes Earn Targa $1.07B in Profits in 3Q

2024-11-06 - Targa Resources reported record NGL transportation and fractionation volumes in the Permian Basin, where associated natural gas production continues to rise.

Twenty Years Ago, Range Jumpstarted the Marcellus Boom

2024-11-06 - Range Resources launched the Appalachia shale rush, and rising domestic power and LNG demand can trigger it to boom again.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.