Permian Resources added assets in the Permian Basin while also divesting operated and non-op assets, including midstream assets, in transactions totaling $293 million. (Source: Shutterstock.com)

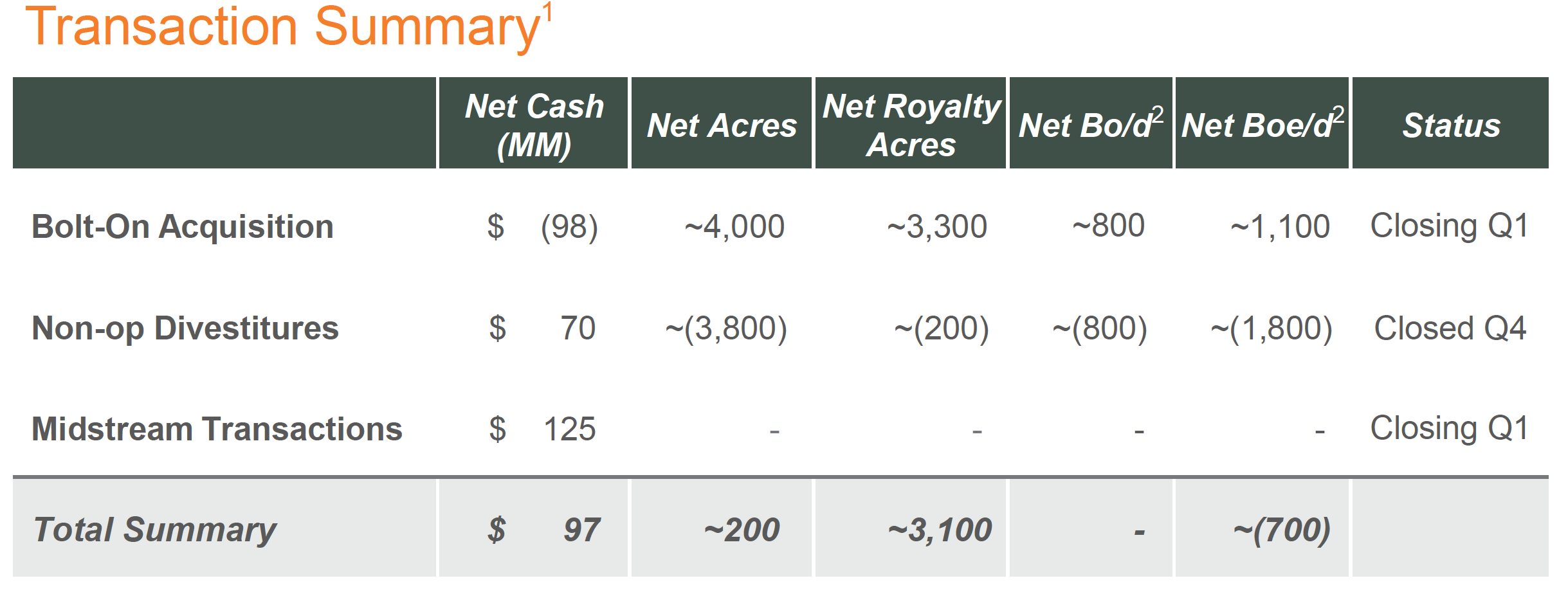

Permian Resources Corp. announced A&D transactions totaling $293 million, including a Permian Basin bolt-on as well as sales of assets in the Delaware Basin and Southern Delaware midstream water assets, the company said Jan. 17.

Oliver Huang, an analyst with Tudor, Pickering, Holt & Co., said in a Jan. 18 report he expects the transactions to be viewed positively by the market.

“This lays out a potential blueprint for how the company could continue to create value through smaller-scale transactions via the M&A market in the future,” he said. “In summary, deals net the company $97 million of cash, add ~45 top quartile 2-mile lateral locations that immediately compete for capital, while adding ~3.1k net royalty acres with net PDP on divestitures only ~700 boe/d.”

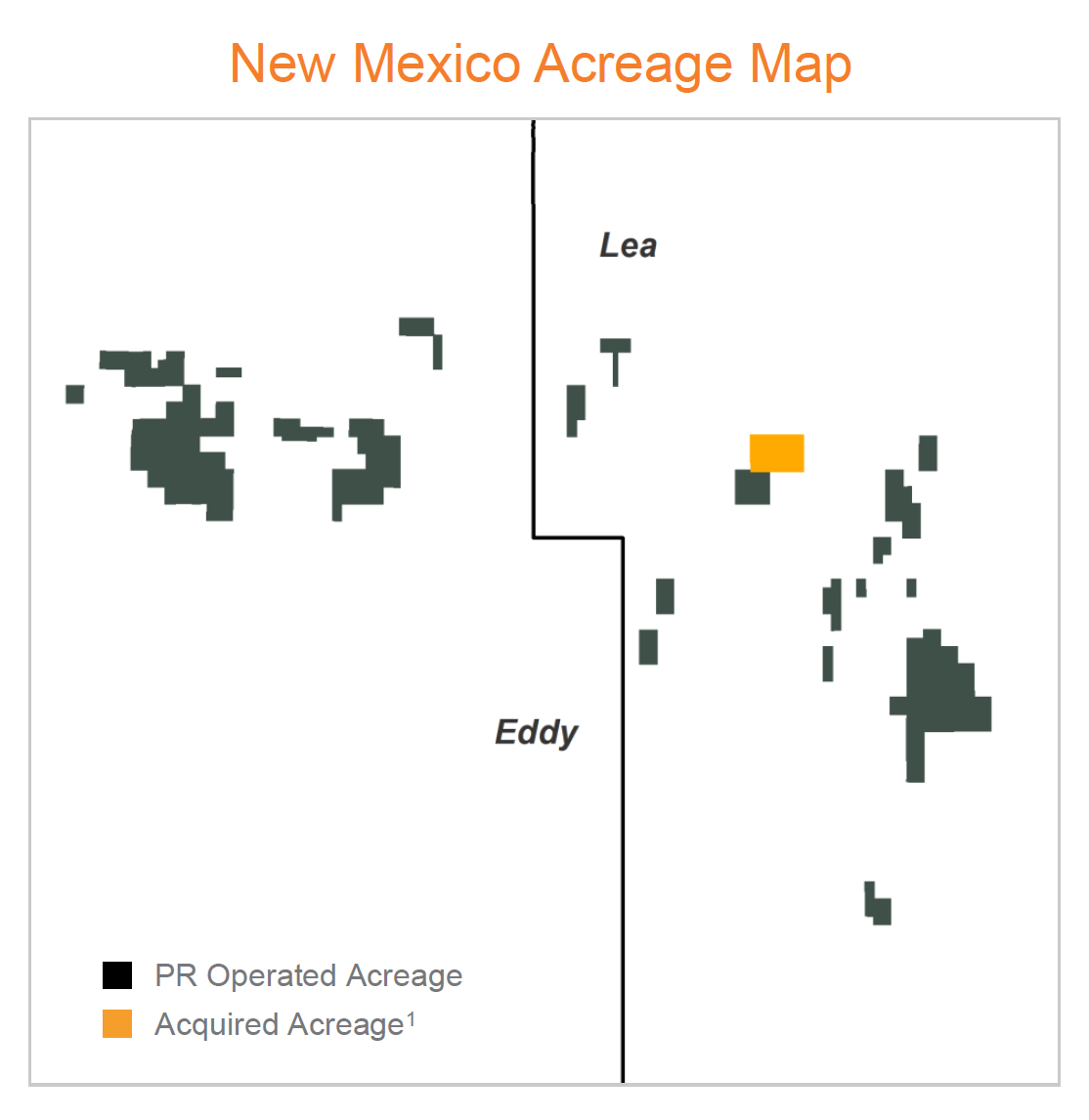

In its bolt-on deal, Permian Resources entered into a definitive agreement to acquire 4,000 net leasehold acres, 3,300 net royalty acres and average net production of 1,100 boe/d (73% oil). The assets are located predominantly in Lea County, New Mexico, from an undisclosed third-party for a total purchase price of $98 million, according to a press release.

The purchase price reflects an acquisition value of approximately $8,000 per net leasehold acre and approximately $7,000 per net royalty acre.

The properties’ operated position consists of largely undeveloped acreage and is contiguous to one of the company’s existing core blocks in Lea County.

Permian Resources said it identified approximately 45 gross operated two-mile locations from the acquired properties that immediately compete for capital within the existing portfolio. The properties also include non-operated acreage largely adjacent to and surrounding its position. The company plans to engage in future acreage trades and other portfolio management transactions.

Non-operated Delaware Basin divestitures

Permian Resources also said it had divested producing, non-operated properties in Reeves County consisting of an average 1,800 boe/d (44% oil) and 3,500 net leasehold acres to an undisclosed third-party for $60 million. The price, according to Permian Resources, reflects a valuation multiple of greater than 5x [GW1] 2023 estimated EBITDA.

The divested acreage represents most of the company’s non-operated positions in Texas, which the company said included minimal remaining inventory. Additionally, the company sold a non-operated position consisting of 300 net leasehold acres in Eddy County, New Mexico, for $35,000 per net acre, resulting in approximately $10 million of net proceeds.

Midstream infrastructure transactions summary

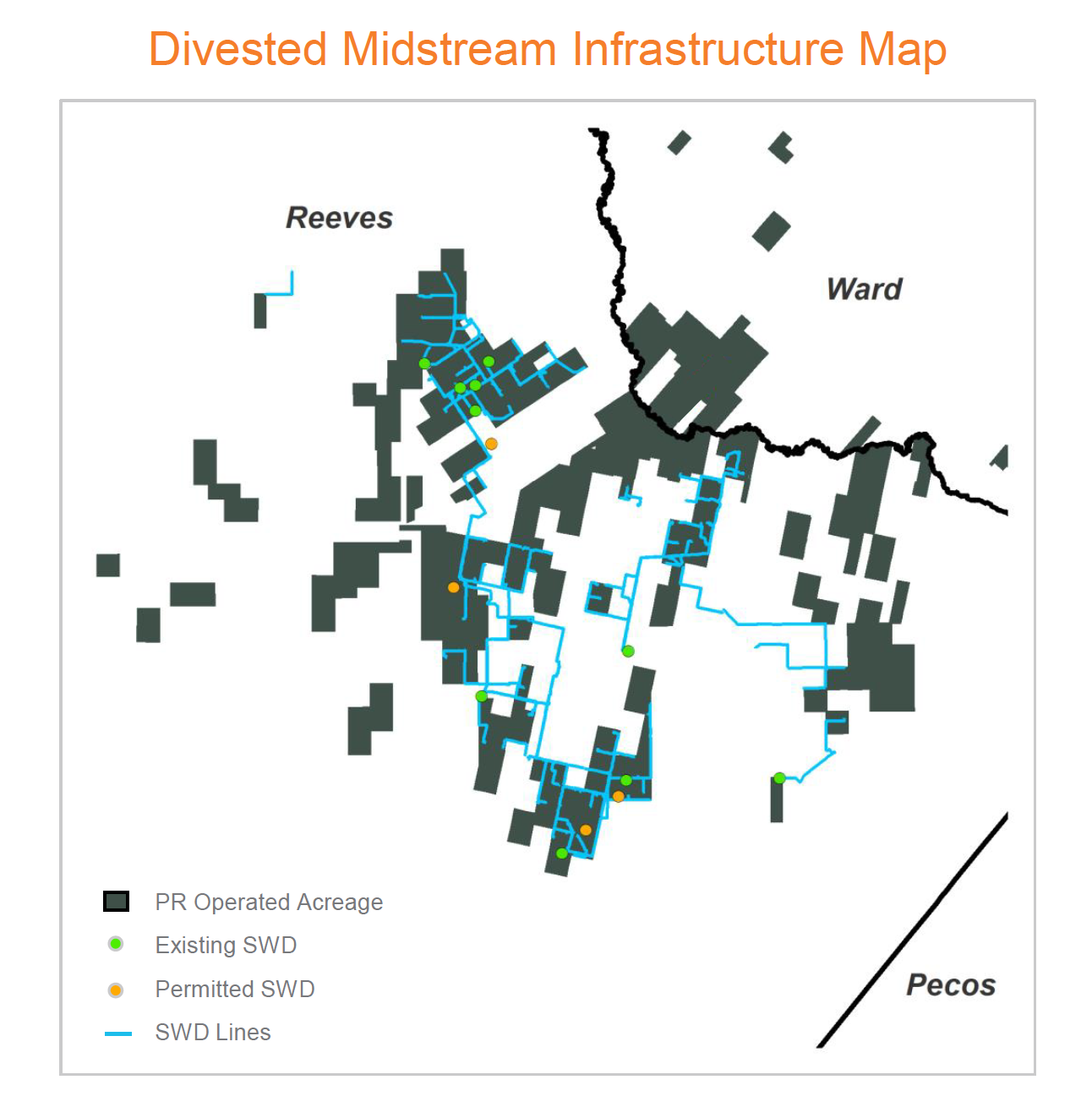

Permian Resources also signed definitive agreements with an undisclosed third-party to divest a portion of its saltwater disposal wells and associated produced water infrastructure in Reeves County. The total consideration is $125 million.

The full consideration will be received at closing with $60 million subject to repayment if certain thresholds tied to Permian Resources’ future drilling activity in the service area over the next several years are not met. The company expects to retain the full consideration based on its current development plan.

The counterparty has a strong record of operating midstream assets, and the divested infrastructure has ample additional capacity to service the Company’s future produced water disposal needs. The transaction is expected to close during the first quarter of 2023, subject to regulatory approval.

“At Permian Resources, we believe our focus on portfolio management will continue to drive value for our shareholders,” said James Walter, Co-CEO of Permian Resources. “The combined transactions high-grade our portfolio, adding 45 top-quartile locations, 4,000 net acres with significant development potential and 3,100 net royalty acres while generating approximately $100 million in net cash proceeds.”

Recommended Reading

Exclusive: Camino Steps Back from $2B Midcon Sale Process—Sources

2025-04-08 - NGP-backed Camino Natural Resources, which had reportedly been seeking a $2 billion sale of its Midcontinent assets, has paused marketing the company, sources told Hart Energy.

Exclusive: Kinder Morgan’s Fore on Pipeline Permitting Momentum in Past Year

2025-04-07 - Kinder Morgan’s Allen Fore, vice president of public affairs, delves into how the Trump administration’s initiatives to achieve energy dominance is a “game changer” for pipeline projects, in this Hart Energy Exclusive interview.

Citgo Stalking Horse Bidder Draws Ire from Investors

2025-04-07 - A court-appointed special master recommended a stalking horse bidder for the parent of Citgo Petroleum, which drew objections from Gold Reserve and other investors.

Infinity’s Utica Oil Output Rising as Play M&A, Expansion Underway

2025-04-07 - Securities analysts expect some M&A may be coming from the growing oil and wet-gas results in eastern Ohio, they report, including by newly public Infinity Natural Resources.

How Elk Range Took the Leap to Buy Oxy’s $905MM D-J Heirloom

2025-04-07 - Elk Range Royalties closed on a $905 million purchase of Occidental’s assets in the Denver-Julesburg Basin in March— a once-in-a-lifetime purchase, CEO Charlie Shufeldt told Hart Energy.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.