Privately-held PennEnergy Resources agreed to acquire substantially all of Rex Energy’s Appalachia-focused assets, which includes the assumption of certain liabilities. (Source: Hart Energy/Shutterstock.com)

[Editor's note: This story was updated at 7:43 p.m. CST Aug. 30.]

After more than a decade operating as a public oil and gas producer, State College, Pa.-based Rex Energy Corp. has agreed to sell itself to fellow Appalachia shale player PennEnergy Resources LLC for $600.5 million.

As part of the agreement, PennEnergy will acquire substantially all of Rex’s assets plus assume certain liabilities of the company which filed for bankruptcy earlier this year, according to filings with the U.S. Securities and Exchange Commission on Aug. 27.

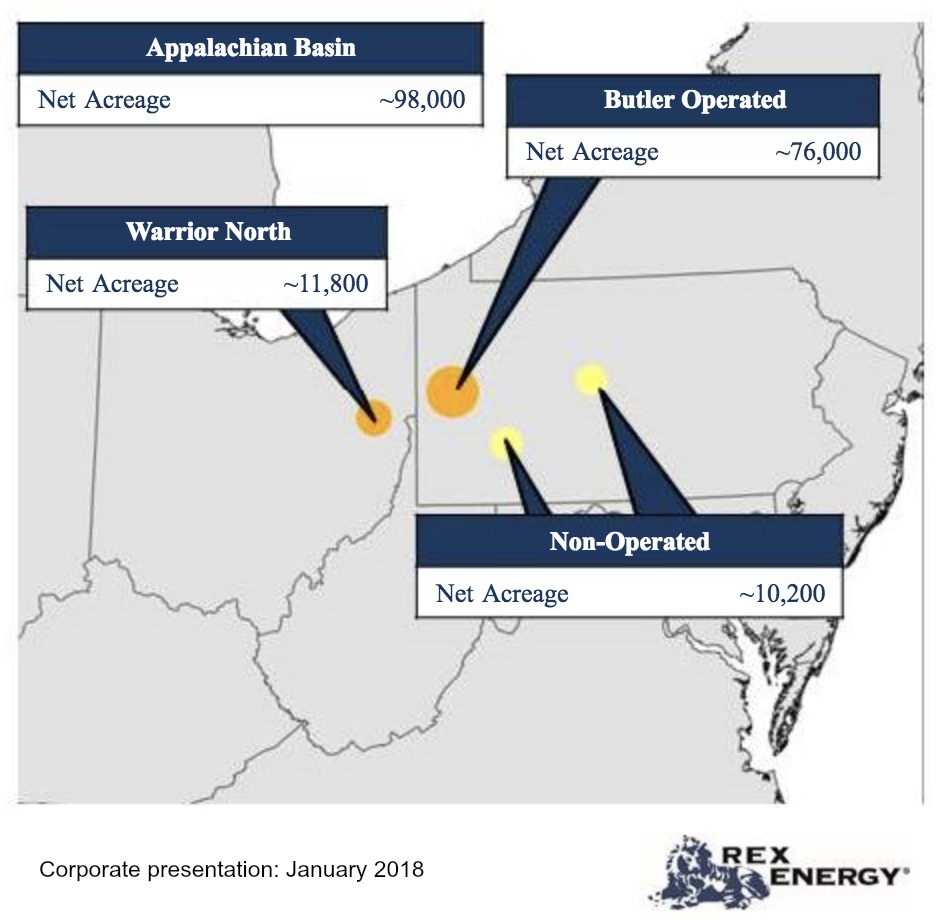

Rex is a pure-play Appalachian Basin-focused company targeting wet gas windows in the Pennsylvania Marcellus and Ohio Utica shales. The company had previously traded on the NASDAQ since its IPO in July 2007.

However, Rex struggled with debt woes since the 2014 commodities downturn when the company faced several possible delisting notices. Eventually, its stock was delisted in April, and a month later Rex filed for Chapter 11 bankruptcy. The company simultaneously launched a sale process for its remaining assets, which comprised roughly 98,000 net acres as of January.

Rex had previously sold a bulk of its assets, including a position in the Illinois Basin, as it coped with lower commodity prices. In March, the company sold certain nonop Appalachia interests in Westmoreland, Centre and Clearfield counties in Pennsylvania for $17.2 million.

Through the purchase of Rex’s assets, PennEnergy will more than double its holdings in Appalachia, where the company focuses on the acquisition and development of unconventional shale resources.

As of August, PennEnergy’s assets covered roughly 91,000 gross acres of oil and gas leasehold in southwest Pennsylvania’s Butler, Beaver, Armstrong and Allegheny counties with production from 86 Marcellus and Upper Devonian wells.

Upon closing of the Rex acquisition, though, PennEnergy will control 203,500 gross leasehold acres, primarily in the Pennsylvania counties of Butler, Beaver and Armstrong, north of Pittsburgh, where its headquarters are located. Additionally, The company will operate 329 horizontal shale wells with net production of roughly 450 million cubic feet per day of natural gas equivalent.

In total, PennEnergy will boast estimated net proved reserves of 8.5 trillion cubic feet of natural gas equivalents (Tcfe), of which 1.7 Tcfe are proved developed producing. About 34% of the reserves will be derived from NGL.

“Almost all of the combined assets of the two companies are in the core of the Marcellus Shale, and with nearly 20-years of drilling inventory we have the opportunity to continue delivering growth at attractive rates of returns for many years to come,” Richard D. Weber, chairman and CEO of PennEnergy, said in a statement on Aug. 30.

PennEnergy was founded in 2011 by Weber and the company’s COO, Gregory D. Muse, who together have more than 50 years of combined industry experience, according to PennEnergy’s website.

Muse added that most of the Rex assets are contiguous to the company’s existing operations and PennEnergy plans to operate two horizontal rigs on the combined properties. The Rex assets acquired also include cash accounts of $29.5 million held by Rex used to collateralize firm transportation contracts that will be released to PennEnergy at close.

PennEnergy is capitalized with $532 million of equity commitments from EnCap Investments LP and Wells Fargo Energy Capital, and it has access to a $375 million revolving credit facility. The company is majority-owned by funds controlled by Houston-based EnCap.

The company said it intends to fund its acquisition of Rex’s assets with equity contributions from its existing owners and from its revolving line of credit from a consortium of banks co-led by Wells Fargo and JP Morgan. Pro forma for the transaction, PennEnergy will have total funded debt of roughly two times EBITDA and expects to generate free cash flow immediately upon closing.

The transaction has been approved by the U.S. Bankruptcy Court for the Western district of Pennsylvania and PennEnergy expects to close the acquisition on Sept. 28. The company received financial advice from JP Morgan Securities and legal advice from Vinson & Elkins.

Emily Patsy can be reached at epatsy@hartenergy.com.

Recommended Reading

Chord Announces $750MM Notes Offering to Reduce Debt

2025-03-05 - Chord Energy said it will use part of the funds to reduce its credit facility borrowings. The company is also looking to sell its Marcellus non-operated gas interests.

USD Partners Expects to Sell Final Asset by Mid-April

2025-01-22 - USD Partners was obligated to sell the Hardisty terminal after entering a forbearance agreement with its lenders in June 2024.

Mach Prices Common Units, Closes Flycatcher Deal

2025-02-06 - Mach Natural Resources priced a public offering of common units following the close of $29.8 million of assets near its current holdings in the Ardmore Basin on Jan. 31.

Plains All American Prices First M&A Bond of Year

2025-01-13 - U.S. integrated midstream infrastructure company Plains All American Pipeline on Jan. 13 priced a $1 billion investment-grade bond offering, the year's first to finance an acquisition.

Independence Contract Drilling Emerges from Chapter 11 Bankruptcy

2025-01-21 - Independence Contract Drilling eliminated more than $197 million of convertible debt in the restructuring process.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.