Energy Transfer LP agreed on March 1 to sell its Western Canadian gas processing business to a joint venture (JV) between Pembina Pipeline Corp. and KKR, marking the Dallas-based company’s exit from Canada.

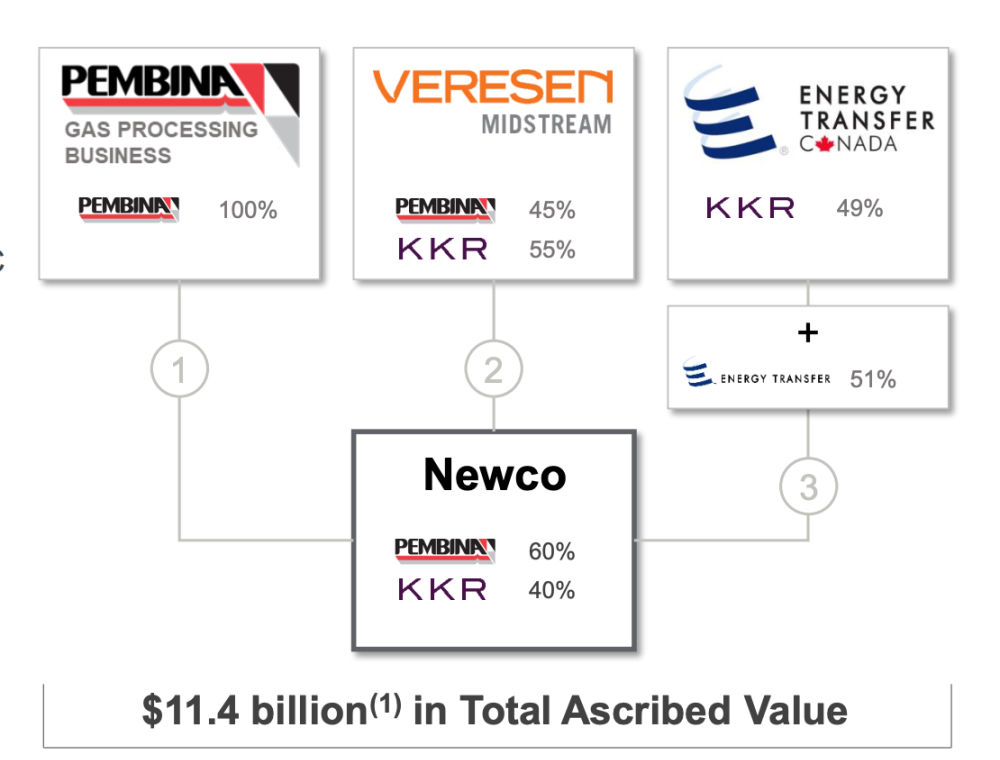

According to a release, the companies signed a definitive agreement for Energy Transfer to sell its 51% interest in Energy Transfer Canada to the JV, which includes participation by Pembina Pipeline and global infrastructure funds managed by KKR, at a valuation of approximately CA$1.6 billion (US$1.3 billion) including debt and preferred equity. The remaining stake is already owned by KKR’s funds.

“The agreement allows Energy Transfer to divest its high-quality Canadian assets at an attractive valuation to further deleverage its balance sheet and redeploy capital within its U.S. footprint,” Energy Transfer said in the release.

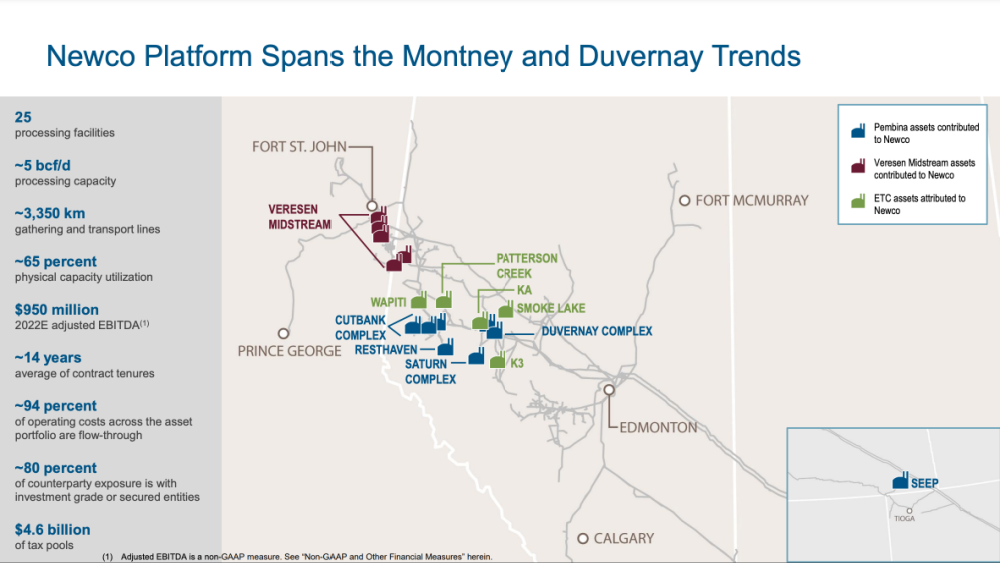

Energy Transfer Canada, based in Calgary, Alberta, is one of Alberta’s largest licensed gas processors, according to the release. Its assets include six natural gas processing plants that have a combined operating capacity of 1,290 MMcf/d and a network of approximately 848 miles of natural gas gathering and transportation infrastructure in the Western Canadian Sedimentary Basin.

The sale is expected to result in cash proceeds to Energy Transfer of approximately CA$340 million (US$270 million), subject to certain purchase price adjustments, and close by third-quarter 2022.

Separately, Pembina and KKR on March 1 agreed to form a JV, merging their Western Canadian gas processing assets in deals worth CA$11.4 billion (US$8.99 billion), which included the Energy Transfer Canada transaction.

“Pembina is always interested in creative M&A projects,” COO Jaret Sprott said on a call discussing the deal, even as the Calgary-based company focuses on integrating the assets of the venture.

The combined venture is expected to have natural gas processing capacity of about 5 Bcf/d, or about 16% of Western Canada’s total processing capacity. Pembina will operate the new company and own 60% of the JV while KKR’s global infrastructure funds will own the rest.

The new company will also include the Veresen Midstream business, in which funds managed by KKR have a 55% stake while Pembina owns the rest.

The deals are expected to close late in the second or third quarter. Pembina said it intends to sell its interest in its Key Access Pipeline System to finance the deal, and is evaluating its portfolio to look for other noncore, nonoperating assets to sell.

Pembina also said it plans to increase its dividend by 3.6% after the deal closes, and that the deal allows it to raise full-year share repurchase target to CA$350 million (US$275 million) from CA$200 million.

Reuters contributed to this article.

Recommended Reading

Lake Charles LNG Selects Technip Energies, KBR for Export Terminal

2024-09-20 - Lake Charles LNG has selected KTJV, the joint venture between Technip Energies and KBR, for the engineering, procurement, fabrication and construction of an LNG export terminal project on the Gulf Coast.

Macquarie Sees Potential for Large Crude Draw Next Week

2024-09-19 - Macquarie analysts estimate an 8.2 MMbbl draw down in U.S. crude stocks and exports rebound.

EIA Reports Natural Gas Storage Jumped 58 Bcf

2024-09-19 - The weekly storage report, released Sept. 19, showed a 58 Bcf increase from the week before, missing consensus market expectations of 53 Bcf, according to East Daley Analytics.

Electrification Lights Up Need for Gas, LNG

2024-09-20 - As global power demand rises, much of the world is unable to grasp the need for gas or the connection to LNG, experts said.

Woodside to Maintain at Least 50% Interest in Driftwood LNG

2024-09-18 - Australia’s Woodside Energy plans to maintain at least a 50% interest in the 27.6 mtpa Driftwood LNG project that it's buying from Tellurian, CEO Meg O’Neill said during a media briefing at Gastech in Houston.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.