Presented by:

[Editor's note: A version of this story appears in the March 2021 issue of Oil and Gas Investor magazine. Subscribe to the magazine here.]

The energy sector remains wary following a calamitous 2020 that saw significant slowdown in drilling activity as energy prices plunged. But drillers are casting a hopeful eye toward modest recovery this year.

According to Enverus data, 2021 kicked off to a good start as the U.S. oil and gas rig count rose to 430 in the week ending Jan. 20.

Permian Basin rigs in West Texas and New Mexico rose to 194, continuing their upward trend since the August trough of 127. The largest basin’s rig count is the highest since May 2020, when the entire U.S. fleet was plunging rapidly due to low oil prices brought on by the spreading pandemic.

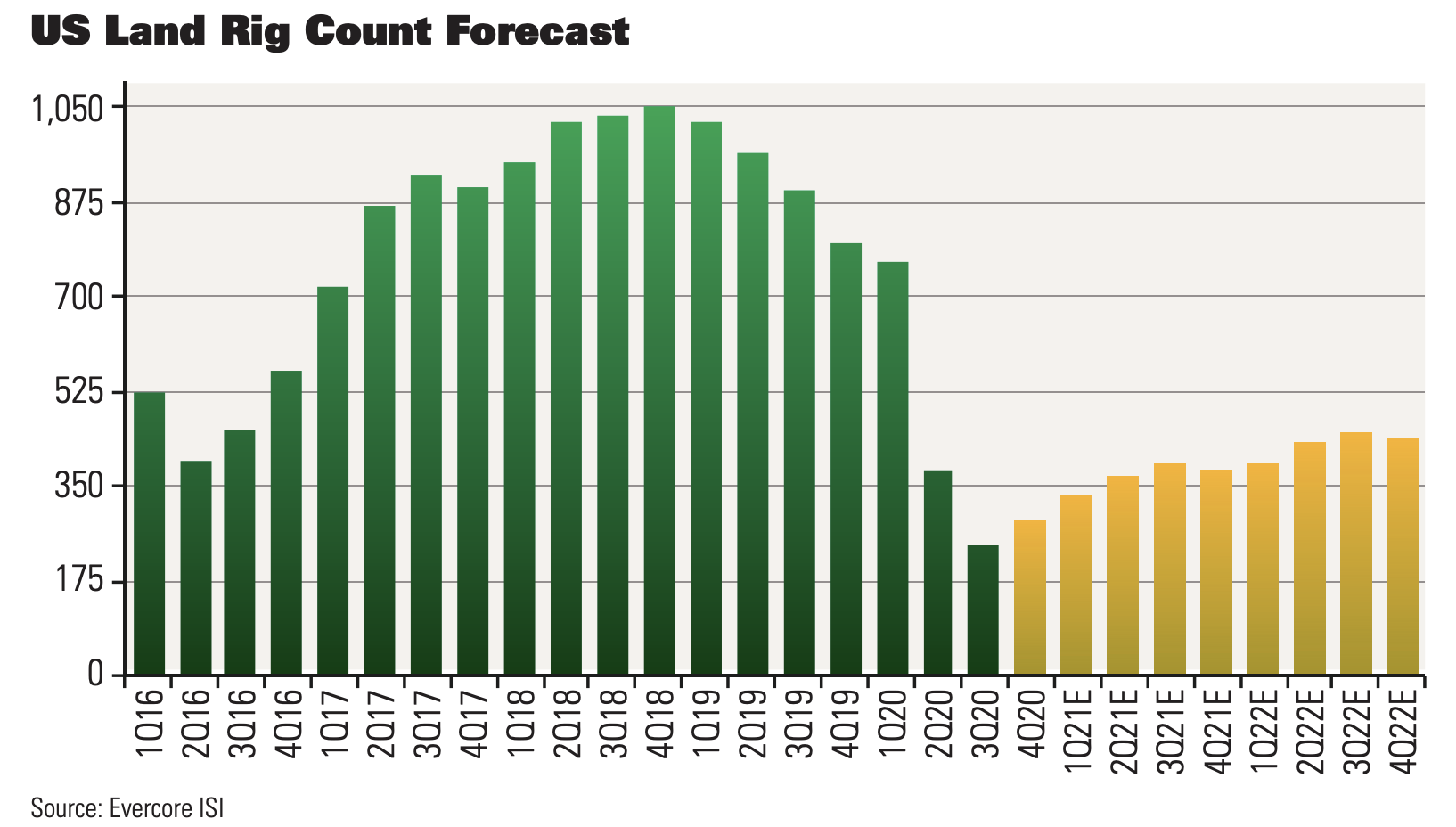

Even though the rig count is inching up, the U.S. land market is likely to be structurally smaller going forward as producers live within cash flow and move to a returns-focused business model, according to James West, senior managing director with Evercore ISI.

“The current U.S. rig working count is well below recent peaks in the 800 range. Over 400 rigs, which worked in the last 18 months, are idle, and we expect the overhang to continue,” he said. “Some of the lost production is also permanently impaired, and we see the U.S. land market as likely producing only 10 million to 11 million barrels per day going forward, down from well over 13 million barrels per day at the peak. This will require roughly 350 to 400 oil-directed rigs and perhaps 200 to 250 frac spreads.”

‘Fastest reduction of activity in history’

Analysts agree that the U.S. shale has been the hardest hit during the downturn, with its active rig count dropping down to historic levels. Strained by a double whammy of excess oil supply and the Saudi-Russian oil price war, cash-strapped producers slowed drilling activity as soon as the oil prices began plunging.

Patterson-UTI Energy Inc. CEO William Andrew Hendricks said his company started 2020 on a fairly positive note with more than 100 drilling rigs in operation.

“Oil was trading at $60 to $62 per barrel,” he said. “Patterson-UTI had 126 drilling rigs working at the peak of January, so our year started with a positive tone. But like everybody else, things changed very quickly with the global pandemic. As soon as there was a demand scare and the oil traded off, we began shutting down operations as fast as we could.”

Among Patterson-UTI’s service offerings, which include drilling rigs, pressure pumping, wireline and cement services, and directional drilling, Hendricks said hydraulic fracturing shut down the fastest, followed by the drilling rigs and directional drilling, which came down roughly together.

“We went from 126 rigs at the peak in January all the way down to 59 rigs in the summertime,” he said. “That reduction in activity happened faster and deeper than it ever happened in the history of our industry.”

For the Houston-based oilfield service provider, it was a huge challenge to shrink the size of the business and operations to stay in line with the rig count falling at unprecedented levels.

“When [rig count] is coming down that fast, you have no visibility on when it’s going to stop, when it’s going to level out and what kind of recovery will happen on the other side,” Hendricks said.

While some land drillers were quick to cut costs and layoff crews as rigs were released, others slashed senior management compensation, cut overhead and temporarily reduced salaries and bonuses for rig hands who remained employed, Evercore ISI’s West explained.

“There was an effort to retain top talent by offering jobs on working rigs but at a lower position,” he continued. “Once the rig count stabilized and began to improve, the contract drillers were quick to resume their expansions into directional drilling and technology-oriented capabilities at the well site. As technology and digitalization becomes increasingly important in the oil field, the largest land drillers are uniquely positioned to add value and capture more share. Digital efforts have become increasingly important tools to drill and compete better, higher return wells.”

Permian continues its reign

According to the U.S. Energy Information Administration’s (EIA) Short Term Energy Outlook released on Jan. 12, recent increases in the oil price and in active drilling rigs will contribute to Lower 48 production beginning to grow in the second quarter of 2021, most of which will occur in the Permian region.

The EIA forecasts a combination of relatively high average production per well combined with high rig counts to make the Permian region’s growth higher than the Eagle Ford or Bakken. In 2022, the EIA expects almost two-thirds of Lower 48 onshore growth to come from the Permian.

Out of the 68 rigs that Patterson-UTI is currently operating, 33 are in the Permian Basin and 15 are in the Appalachian Basin, Hendricks said.

“Undoubtedly, half of the rigs, which is half of the industry spend, is going to the Permian Basin right now,” he added.

West echoed similar sentiments, noting that almost half of all the working rigs are located in the Permian, and the giant field will continue attracting the most capital.

“We expect this trend to continue as the Permian is the lowest cost basin in the country and offers the best returns profile,” he said. “We are already hearing about shortages of truckers and sand as the basin gets back to work.

“While ultimately supply shortages related to transport and commodities like sand will ease, water may become an increasing concern. The water business is in the early phase of technical breakthroughs related to recycling, and this will be key to ensuring water supply in the Permian of the future,” West said.

Looking toward recovery

Patterson-UTI is currently operating 68 rigs, which Hendricks said has shown some recovery from the bottom but still “not a lot of recovery.”

He added that the recovery of drilling activity will be subject to WTI crude prices.

“If WTI stays at $50 per barrel for a couple of months, I expect the rig count will keep moving up somewhat,” Hendricks said. “But I don’t expect a big increase in rig count in 2021 unless WTI moves in the upper $50s range.”

However, despite the lower price environment, West noted that the land drillers with high-specification rigs are able to produce a cash margin at the rig level.

“The high end of the market is heavily consolidated, and all of the major companies are focused on generating a return on their assets,” he said. “This forces the companies to be disciplined with pricing, which continued even in the dark days of March and April 2020. We expect this discipline to continue.”

West added that the rig market is already fairly consolidated in the high-spec category, but there are smaller companies that could be tuck-in targets.

“The land drillers are also increasingly trying to capture more of the wallet at the well site and may seek other services or technology tuck-ins,” he said.

However, West pointed out that a major challenge is that the rig count is expected to stabilize in the mid-400s range, well below the roughly 650 high-spec rigs in the market. As a result, pricing traction will be difficult.

“The market will remain oversupplied for a long period of time,” he said. “And while we expect pricing to remain disciplined, there is always the chance of a market share war.”

Recommended Reading

Not Sweating DeepSeek: Exxon, Chevron Plow Ahead on Data Center Power

2025-02-02 - The launch of the energy-efficient DeepSeek chatbot roiled tech and power markets in late January. But supermajors Exxon Mobil and Chevron continue to field intense demand for data-center power supply, driven by AI technology customers.

Transocean President, COO to Assume CEO Position in 2Q25

2025-02-19 - Transocean Ltd. announced a CEO succession plan on Feb. 18 in which President and COO Keelan Adamson will take the reins of the company as its chief executive in the second quarter of 2025.

Ovintiv Names Terri King as Independent Board Member

2025-01-28 - Ovintiv Inc. has named former ConocoPhillips Chief Commercial Officer Terri King as a new independent member of its board of directors effective Jan. 31.

Independence Contract Drilling Emerges from Chapter 11 Bankruptcy

2025-01-21 - Independence Contract Drilling eliminated more than $197 million of convertible debt in the restructuring process.

Stonepeak Backs Longview for Electric Transmission Projects

2025-03-24 - Newly formed Longview Infrastructure will partner with Stonepeak as electric demand increases from data centers and U.S. electrification efforts.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.