Presented by:

[Editor's note: A version of this story appears in the March 2021 issue of Oil and Gas Investor magazine. Subscribe to the magazine here.]

Energy-focused private equity funds always scout around for the next way to hit a home run. Beyond shale plays, digitalization or M&A, today many private equity scouts are chasing alternative energy opportunities, and that means a lot more than backing gas producers to feed a power plant.

Several factors are driving their march toward a greener portfolio. Last year, as a Biden presidency came into view and the energy transition became the talk of the town, public and private investors increasingly turned to renewable energy (solar, wind, biogas) or energy transition ideas (electric vehicles [EVs], battery storage, distributed power generation).

When these private equity fund managers looked to public markets for guidance, the traffic lights were flashing green in a big way. Refinitiv’s Global Renewable Energy Equipment & Services Index rose more than 200% last year; the WilderHill Clean Energy Index (ECO) rose 300% in 2020, not counting the stock of Tesla, which soared an astounding 700%-plus in 2020.

The public market has gotten too frothy though, which may be a yellow caution signal: The iShares Global Clean Energy ETF (ICLN) saw an inflow of $990 million in one week recently. EnPhase Energy Inc., a solar equipment maker that joined the S&P 500 in January 2021, traded at nearly an 80x multiple of EBITDA at one point, so it was clearly “priced to perfection,” said Raymond James analyst Pavel Molchanov in a report on renewables.

Simmons Energy analyst Pearce Hammond, commenting on Plug Power Inc. recently, said, “At some point we need to see some convergence between the thematic thrust of an embryonic sector with valuation realism in relation to plausible estimated normalized earnings.”

Whether valuations are realistic or not in today’s heated atmosphere, many of the biggest private equity firms for energy believe in an “all of the above” approach and thus have invested in alternatives for several years, usually led by a separate in-house origination team using dedicated capital that is separate from their oil and gas funds.

At press time, EIG Global Energy Partners’ new energy transition fund was nearing the $1 billion mark, and EnCap Investments LP’s new transition effort was passing $1 billion. An Apollo Global Management affiliate’s special purpose acquisition corporation (SPAC) was about to merge with a solar company in a $1.3 billion deal. Riverstone Holdings, which has invested in low-carbon ideas for 15 years, recently joined a $50 million Series C funding commitment for FreeWire Technologies, an EV charging company, along with bp ventures and other investors.

Many players

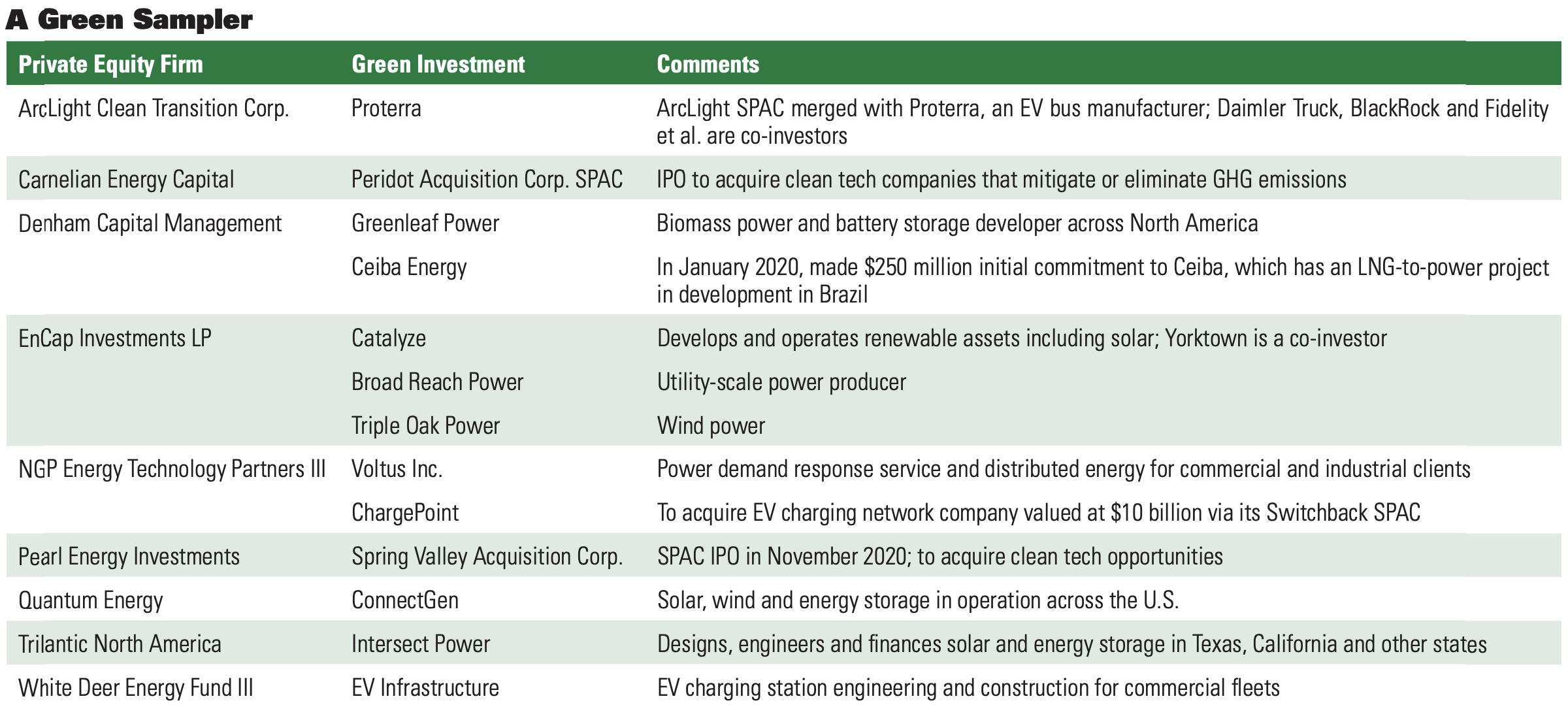

There are plenty of other examples. EnCap Investments LP, NGP Energy Capital Management, Quantum Energy Partners, Arc-Light Energy Capital and many others have added green business verticals to their traditional oil and gas portfolios. GEC Energy and White Deer Energy have said green technology investing will be their main—or only—strategy from now on, ditching E&P. GEC IV was to begin fundraising anew sometime this year for the company’s fourth fund.

“It’s clear that the energy industry is in a transition and that creates new challenges,” said Mark McCall, managing director with Lime Rock New Energy LP. “We are looking for companies that are solving those challenges.”

Formed in July 2019, it has already closed on about $100 million toward a $600 million goal. Its first two commitments were made in fourth-quarter 2019 to Smart Wires, a grid modernization company, for $75 million, and Qmerit, a nationwide provider of installation, maintenance and repair of EV charging equipment for residential and light commercial use.

“Renewables have been moving along for a while, but it’s a hockey stick now,” said Shawn Cumberland, managing partner with EnCap Energy Transition. “EnCap is a proven energy investment manager with more than 32 years of success. It was wise of EnCap to respond to the market by expanding their remit to include an energy transition platform.”

Alongside its existing upstream and midstream portfolios, EnCap has created a third portfolio to focus on low-carbon opportunities. The company is already the largest financial investor of equity in battery storage (facilities that are operating or under construction) out of the entire financial sector, he said.

Private equity players that understand energy see renewables as the next great vertical to complement their oil and gas business, not replace it.

Although EnCap Investments is now investing from Fund XI for upstream and its midstream vehicle, EnCap Flatrock, is on midstream Fund IV, to enter the green space the firm on boarded a new team with deep power and renewables experience to lead its third investment vertical. According to SEC filings, the firm is in the midst of raising a new energy transition fund of up to $1.5 billion. To enter the green space, the firm created an internal “skunk works” team to look at energy transition opportunities.

“It was apparent that this was going to explode. The amount of capital that will be dedicated to the energy transition globally is going to be in the trillions,” EnCap’s Cumberland said. “As long as opportunities continue to be there for renewables, we’ll be in it for the long haul.”

To go green, EnCap Investments approached the team at Prisma Energy in 2019, which was already backing distributed solar for residential use, among several other alternative energy themes. Each of the four partners at EnCap Energy Transition have at least 25 or 30 years of experience in the power sector, bringing those skills and contacts to the new team, including Jim Hughes, who was CEO of First Solar and Prisma Energy, among other career highlights.

“The courtship was pretty fast,” Cumberland told Oil and Gas Investor. “The way we both look at risk management and creating value is similar.”

EnCap’s current investments include two deals made in 2020, Triple Oak Power LLC and Solar Proponent LLC, as well as four made in 2019 that include Broad Reach Power, Catalyze and Jupiter Power. They are involved in utility-scale solar power, battery storage and wind power. It has upsized its commitments to Broad Reach, Jupiter and Catalyze as the opportunities expanded beyond initial expectations, Cumberland said.

Three SPACs

Recently, traditional private equity firms focused on upstream or midstream deals have also entered the energy transition field by sponsoring SPACs dedicated to renewable opportunities, with the goal to mitigate or reduce greenhouse-gas (GHG) emissions and add another vertical to their E&P portfolio.

For example, Carnelian Energy Capital Management is still investing on both sides of the energy coin. In June 2020, it funded Hawthorne Energy LLC, a new E&P run by former executives from Three Rivers Operating. But then in September, its alt-energy SPAC aimed at reducing GHG, Peridot Acquisition Corp., went public, raising $300 million gross.

The SEC filing described Peridot this way: “While our target opportunity set captures a broad range of business profiles, we have identified several specific sectors on which we intend to focus, including electrification, clean fuel transportation, self-directed and autonomous mobility and related infrastructure, energy storage and efficiency, smart grid technology, renewable energy, biofuels and synthetic fuels management, reuse and recycling of waste and water, as well as related environmental infrastructure, air emissions and carbon capture, utilization and storage.”

Pearl Energy Investment II LP took Spring Valley Acquisition Corp. public on Nasdaq in November, and it raised $230 million to pursue sustainability, clean energy and water-related themes. Last year, it continued its upstream business as well by committing to AVAD Energy Partners II and Eagle Mountain Energy Partners; both deals were done in connection with NGP.

NGP has sponsored two SPACs called Switchback, with the second one raising $316 million in January. Both will target energy transition opportunities.

No problem, no fad

Fear not, for private equity funds’ interest in oil and gas is not gone, even if investing in green energy is gathering a big head of steam. One does not exclude the other; although sources admit that the poor returns oil and gas have generated certainly encourage more investment in emerging alternative ideas. Plenty of credible forecasts show global oil demand continuing to rise for years to come. Besides, every private equity person Investor spoke with said oil and gas and alternative energies can, and should, coexist.

“We firmly believe that economic fundamentals are driving this; it’s not just a regulatory push,” Lime Rock’s McCall said. “Our view is that the energy transition will take decades. We see the energy transition as a good area to invest in, but we also believe fossil fuels will be around for a long time. And no, we haven’t gone negative on oil and gas.”

The folks at NGP would agree.

“One way to think about it is everyone’s investing in traditional energy,” said Phil Deutch, CEO and managing partner with NGP Energy Technology Partners III. “There’s always going to be new energy technology for oil and gas, and there’s energy transition opportunities. So I don’t see this as an either-or. It comes back to an ‘all of the above’ solution for energy demand.”

The Silicon Valley alum has invested in power plays for years, and he helped advise, found or co-found NGP’s first two energy technology funds, dated 2005 ($148 million) and 2009 ($348 million). While these two funds invested in conventional energy businesses such as frac equipment manufacturing (DynaPump Inc.) or oil and gas software (GeoDigital), the areas of focus and majority of dollars invested targeted renewable energy, energy efficiency, environmental services and power electronics. Early investments included Renewable Energy Group (biodiesel) and TPI Composites (wind blade manufacturer), now each $1 billion-plus in revenue and publicly traded. NGP ETP III will focus exclusively on energy transition themes, Deutch said. Although NGP has stayed under the radar since starting to invest in alternative technologies 15 years ago, it has over an aggregate $500 million invested.

“We were country before country was cool,” Deutch joked.

Among NGP’s green investments is Voltus Inc., which advises commercial and industrial companies on how to lower energy costs by using its cloud-based energy usage tracking software.

“This is an opportunity, not a problem,” for traditional oil and gas companies and their private equity sponsors, said Justin Stolte, partner with law firm Latham & Watkins. “I don’t think this is a fad. I think this is something that picks up the pace on a go-forward basis.”

Last summer the firm began a series of webcasts about the energy transition, and it reorganized its traditional oil and gas, power and infrastructure verticals into one group. It has been advising SPACs and others that are investing in green energy.

Most recently it advised Proterra Inc., which manufactures electric buses for municipal fleets and the related charging systems. In January it went public with a value of $1.6 billion (including debt) after being acquired by ArcLight Clean Transition Corp., a SPAC. ArcLight is well known for its upstream and midstream portfolio, which it retains, but it is branching out.

The added focus

A number of the private equity firms focused on oil and gas have expanded into alternative forms of energy or renewables.

“They see the energy transition occurring and they are positioning themselves to be key participants, and so are we,” Stolte said. “An increasing amount of what we do is focused on renewables.”

That holds true for Quantum Energy Partners as well.

“We are going green,” CEO Wil VanLoh said. “We will continue to increase our investment allocation to the energy transition. I’ve looked at the science on both sides, but it doesn’t matter—the Western world has made a decision about reducing greenhouse-gas emissions. You can either fight it—and lose—or get with the program.”

Fortunately, “the program” offers multiple opportunities. Going forward, Quantum will target investing between 25% and 50% of its next fund in energy transition themes, but that still leaves a lot of capital to invest in oil and gas.

“The majority of our capital is still going to the upstream and midstream sectors, and we are still big believers that oil and natural gas produced and transported in an ESG-friendly way has a vital part to play in the global energy mix for many decades to come,” VanLoh told Oil and Gas Investor.

Quantum began investing in renewables about 10 years ago, going slowly to build up internal expertise. These investments, which total more than 8 GW of operating and development projects, span the U.S. and several countries in Europe with plans for Asia. All of these investments have been made from the same funds as the upstream, midstream and oilfield services (OFS) investments, although VanLoh said Quantum may consider creating a separate energy transition fund at some point.

“The returns in oil and gas are higher; that’s no surprise. But there are so many other factors at play,” said Quantum’s Sean O’Donnell, the partner who focuses on the firm’s energy transition efforts, mainly through a platform called 547. He was previously president and CFO of Quantum Utility Generation, a portfolio company of QEP V that he co-founded.

“We look for the highest risk-adjusted returns we can find,” O’Donnell said. “In renewables, that means you have to accept development risk to earn sufficient returns.

“But there are some markets and some technologies that we will not pursue given the risk. The fight for market share in New England is fierce because it’s a small market, so there we compete with battery storage, and we choose not to compete in wind and solar. But in California, we compete much differently given the political and regulatory landscape …,” he said.

“Here’s the challenge,” VanLoh added: “Our LPs want to do the right thing on ESG and climate, but at the end of the day, they still have pension or endowment obligations that require them to generate high rates of return. So we are very focused on enabling them to do both.”

Investors say that energy is energy, whatever form it comes in.

“We say we’ll follow the economic margin in the energy value chain, because much about it is changing” O’Donnell said.

Green returns, economics

By going green, oil and gas private equity managers have a lot to unpack. They are learning how to value solar, wind, batteries and other investments, whether greenfield projects, related equipment, software or services, with different metrics than for oil and gas reserves. They say they intend to deliver private equity-level returns in the double digits. Although in general, full-cycle returns for engineering, construction and contracts of a wind or solar project are lower than for a greenfield oil and gas project.

“What you see in the market is there is a rate of return [ROR] for taking on development risk and a different ROR for investing in a project that is already operating,” EnCap’s Cumberland explained.

While wind and solar farm projects have one set of returns, manufacturing investments (e.g., for wind blades, EV charging stations or consumer-oriented businesses) deliver different ROR.

As more people dive into the opportunity pool, the competition has become intense, and private equity is trying to avoid a race to the bottom. O’Donnell cited that as a reason it focuses on larger, more complex projects and why it has expanded its portfolio to a number of markets outside of the U.S. where supportive regulation exists but severe competition does not yet.

Long-dated power contracts are valuable. However, while oil reserves are a global commodity, power is much more localized, with the valuation linked to the specific location. You can’t transfer a kilowatt from Texas to New York, sources say, and market dynamics differ in every state.

Irony

The price of crude oil has recovered by about 30% since last July, making E&P investors happy, hopeful and relieved, but ironically, that run-up also makes alternative energy sources with lower costs more competitive. Costs for wind and solar equipment, battery storage and other alternative energy sources keep coming down. In December Congress extended some of the tax credits that underpin the economics.

NGP was looking at the space a long time ago, raising its first such fund in 2005 for energy technology, although it also invested in companies that aid in drilling and production of oil and gas.

“Ken [Hersh, NGP founder] told me that one day energy transition funds could be as big as traditional energy funds,” Deutch said. “That was an amazing thing to say at the time, and that day may be here sooner than many people think.”

Meanwhile, Quantum has hit a home run with its recent involvement with ChargePoint Inc., formed in 2007, in what VanLoh calls a “ten-bagger.” Switchback Energy Acquisition Corp. announced it will merge with ChargePoint, thus valuing the EV charging company at more than $10 billion. The public deal was to close in February. It provides charging equipment, services and software to the majority of the Fortune 50 companies that use EVs and boasts a North American market share in excess of 70%. Interestingly, NGP sponsored the SPAC, Switchback, that merged with ChargePoint. Lately, several private equity firms have partnered to close their energy transition deals.

VanLoh said energy companies should figure out how to work with governments and nongovernmental organizations during the transition. Many people who oppose fossil fuels understand that the so-called energy transition is going to take 25 or 30 years and that during that time, oil and gas will continue to be important, with the demand for hydrocarbons still growing to meet energy needs.

Infrastructure capital required for power generation, transmission lines, batteries and EV charging stations will be massive, VanLoh said. A lot of new businesses that we are not even thinking about today will need to be created as the energy transition megatrend gains momentum.

A dual approach

GEC, formerly known as Global Energy Capital LP, has invested in Stage Completions, Flowco Production Solutions and other OFS or technology companies, but it has also invested in wind and solar over the last nine years.

“Two of our current three portfolio companies are in these areas, and the third decarbonizes the traditional energy space,” said Patrick Yip, GEC managing director.

Before founding GEC in 2008, managing partner Jonathan Fairbanks was a founder of the first offshore wind installation company in the North Sea. More recently, GEC co-invested growth capital in Cumulus Digital Systems with Shell, from which Cumulus was spun out. Cumulus is a software-as-a-service company that provides mission-critical safety and environmental assurance for traditional and renewable energy assets, including wind and solar.

“All facets of the energy complex need better software to achieve their goals for heightened safety, greater efficiencies and enhanced profitability,” Yip said. “We believe that clean energy technology investing can provide significant societal benefits by moving the industry toward the energy transition as well as create material economic incentives.”

Yip said that although traditional energy is still expected to generate 50% to 70% of global energy resources over the next several decades, investors such as GEC can make a significant impact on the energy transition by seeking solutions in both traditional and renewable energy technologies.

“For traditional energy, we seek out companies that decarbonize, reduce GHG emissions and improve cost efficiencies, which are often carried out through digitalization, automation and remote operations; for renewable energy, we seek out technologies that enable more efficient energy production including wind, solar, water, etc.,” he said. “We believe that applying this dual traditional/renewable energy focus across all stages of energy sourcing, production and distribution presents opportunities to facilitate and accelerate the energy transition globally.”

Lime Rock’s McCall said that while the opportunities are huge and long-lasting, the challenges are too. The alternative energy world is relatively new and evolving rapidly. It’s been easy to identify good E&P teams with track records, but less so to find teams in the emerging green world.

“The fact is, within the energy space we are casting a fairly broad net, whereas the oil and gas industry is mature and has hundreds of qualified teams,” he said.

Investing is always a jigsaw puzzle between opportunity, risk, markets and public sentiment. Right now, green investing attracts a lot of attention, but where it is going to go, and how much banks and private equity firms want to participate, is evolving rapidly.

“Many investors tell us that energy is energy, as long as it is produced responsibly,” Quantum’s O’Donnell said. “We generally agree that we will require oil, gas and renewables for a long time. We are simply looking for the best margin in the different value chains while we are on this journey.”

More and more private equity firms are on the journey, which will be long, innovative and no doubt profitable.

Recommended Reading

Now, the Uinta: Drillers are Taking Utah’s Oily Stacked Pay Horizontal, at Last

2024-10-04 - Recently unconstrained by new rail capacity, operators are now putting laterals into the oily, western side of this long-producing basin that comes with little associated gas and little water, making it compete with the Permian Basin.

With Montney Production Set to Grow, US E&Ps Seize Opportunities

2024-10-02 - Canada’s Montney Shale play has already attracted U.S. companies Ovintiv, Murphy and ConocoPhillips while others, including private equity firms, continue to weigh their options.

Matador May Tap Its Haynesville ‘Gas Bank’ if Prices Stabilize

2024-10-24 - The operator holds 8,900 net Haynesville Shale acres and 14,800 net Cotton Valley acres in northwestern Louisiana, all HBP, that it would drill if gas prices stabilize—or divest for the right price.

Northern’s O’Grady: Most of ‘Best’ Acres ‘Already Been Bought’

2024-10-24 - Adding new-well inventory going forward will require “exploration or other creative measures,” said Nick O’Grady, whose Northern Oil and Gas holds interests in 10,000 Lower 48 wells.

US Drillers Cut Oil, Gas Rigs for Third Week in a Row, Baker Hughes Says

2024-08-30 - The rig count is 8% below this time last year, according to Baker Hughes.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.