Presented by:

[Editor's note: A version of this story appears in the March 2021 issue of Oil and Gas Investor magazine. Subscribe to the magazine here.]

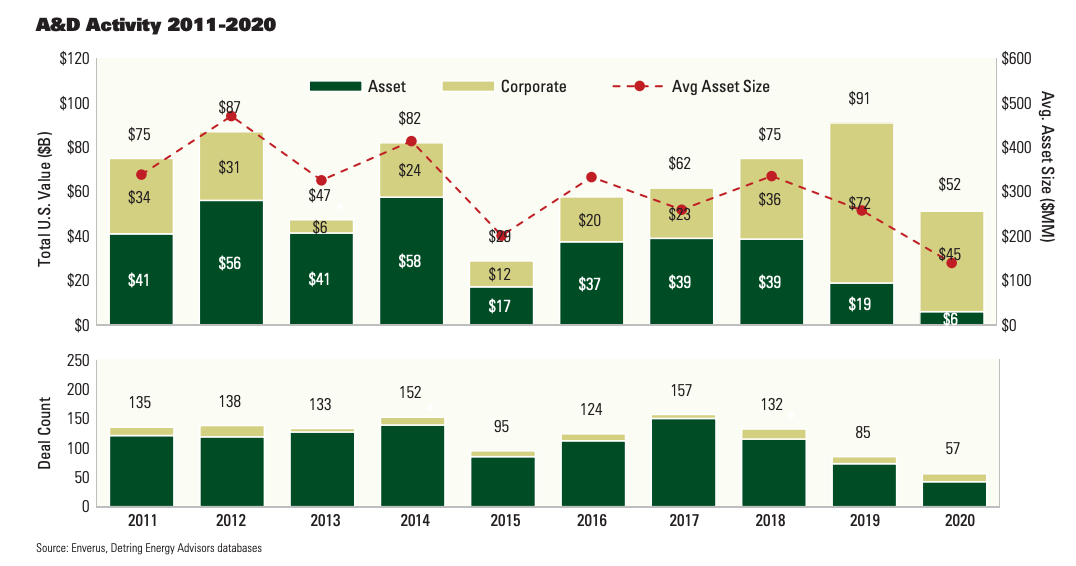

The A&D market in the U.S. fell to a multi-decade low in 2020 on the heels of OPEC+ maintaining crude oversupply while COVID-19 simultaneously dented global hydrocarbon demand. Although headline numbers appeared only moderately down—approximately $50 billion in announced deals versus a “typical” year at $60 billion to $80 billion—the true narrative is revealed after a handful of large M&A transactions are removed.

Eliminating just four of the approximate 60 transactions announced in 2020 (i.e., Chevron Corp./Noble Energy Inc., Devon Energy Corp./WPX Energy Inc., ConocoPhillips Co./Concho Resources Inc., Pioneer Natural Resources Co./Parsley Energy Inc.) results in only some $12 billion in 2020 activity, split roughly 50:50 between asset- and corporate-level transactions.

Asset-level divestitures accounted for less than $7 billion in volume versus a typical year of some $40 billion to $50 billion, while averaging only about $120 million per transaction—the lowest level over the past decade (and approximately 50% lower than 2019).

RELATED:

Oil and Gas Investor US E&P A&D Deal List: Second-half 2020

It was truly a year to forget.

Initial headwinds for oil and gas commenced in late 2018 as the broader investment community began its retreat from the sector amid calls for capital discipline and ESG considerations. This dynamic slowed A&D activity to only some $20 billion in 2019, roughly half of the average level experienced from 2016 to 2018 and in line with 2015 (a depressed year following the 2014 drop in pricing). The OPEC+/COVID-19 combination in early 2020 exacerbated this existing market drought.

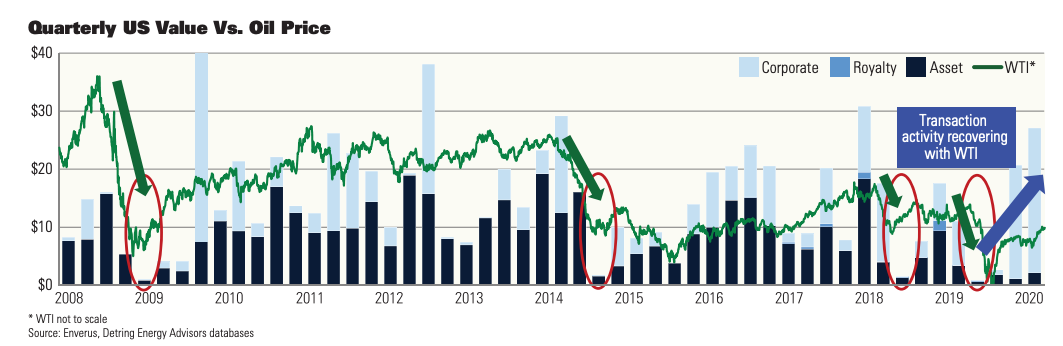

Upstream transaction activity generally correlates with volatility in crude pricing, with periods of higher volatility resulting in reduced deal-making. This dynamic has occurred multiple times in recent memory following the global financial crisis in 2008, the crude pricing collapse in 2014 and the OPEC+/COVID-19 dynamic in 2020.

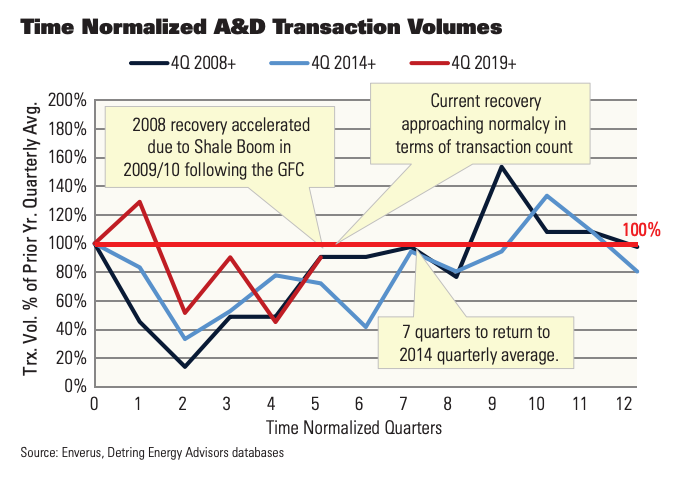

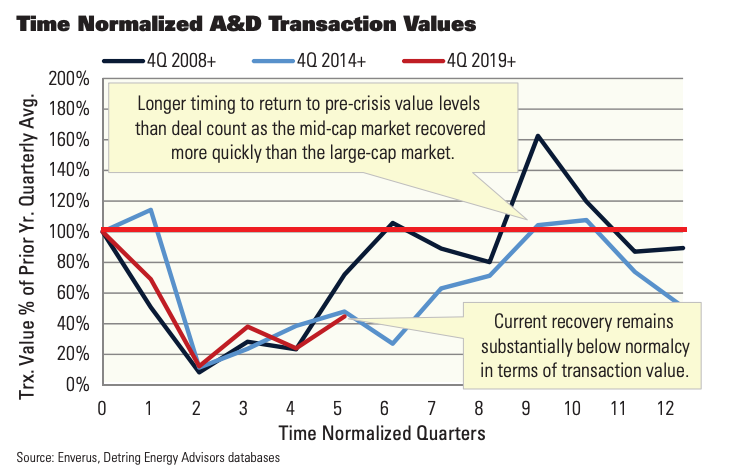

A&D activity slows to a crawl after pricing shocks as sellers/operators focus on maintaining positive cash flow while adjusting transaction expectations to the new market reality, where assets are often worth considerably less. Each crisis eventually unwinds as prices stabilize and the bid/ask spread narrows, with transaction count typically recovering five to seven quarters post-downturn, while transaction value normally requires an additional six to 12 months as the middle market (sub-$200 million) recovers more quickly than the market for larger properties.

This phenomenon can be seen in both 2015 and 2020 with the average deal size in these “crisis” years much lower than the decade average (i.e., transaction value dropped considerably more than transaction count).

In 2019, before the pandemic struck and with capital markets already pulling back from the sector, the A&D market had begun its transformation from almost exclusively unconventional working interest transactions to an increasing share comprising conventional working interest properties and unconventional mineral/royalty assets. Public companies were the primary acquirers of unconventional working interest targets, and this aggressive buyer class began to fall away without access to capital markets. This in turn caused the second most active unconventional acquirer (private equity) to retreat from this space due to exit opportunity concerns for these highly capital-intensive development projects. The public companies were simply full of economic drilling inventory and were no longer acquisitive.

Conventional and minerals

Acquirers of conventional working interest properties, on the other hand, were not publicly listed (following the upstream MLP collapse in 2015) and therefore not funded by Wall Street. The business model for these buyers remains unchanged—they never planned to exit via a sale to a public company—and conventional working interest properties continue to trade freely. These assets typically transact at or near PDP value as buyer and seller agree on undeveloped potential in the current commodity price environment, narrowing the bid-ask spread.

While a discounted cash flow (DCF) analysis is the ultimate driver of value for any asset—which takes into account production declines, operating costs, commodity pricing, development potential, etc.—the transaction multiple providing the best proxy to DCF for conventional working interest assets is “purchase price/operating cash flow.” This is especially powerful when compared to the annual decline rate. While production multiples (e.g., $/boe/d) have traditionally been compared to reserve life (e.g., R/P), the “cash flow multiple” approach outlined above normalizes for many variables including hydrocarbon content and netback, making it a more reliable tool.

The second asset class with continued gains in market share is the minerals and royalties sector, but more notably so in 2019 preceding the decline in commodity pricing and rig count.

Mineral and royalty buyers continue to ascribe value beyond PDP; however, multiple basins are experiencing lower valuations (e.g., $/net mineral acre) due to the pullback in development pace and realized pricing—the two largest drivers of undeveloped value for this asset type.

Further, several operators are raising capital with overriding royalty interest monetizations and structured mineral joint ventures (e.g., Continental Resources Inc., Callon Petroleum Co., EQT Corp. and Range Resources Co.), bypassing traditional (and mostly closed) debt and equity capital markets and PDP-value asset sales. Mineral/royalty divestitures can be more accretive to the seller as buyers generally have a lower cost of capital and are able to allocate value to undeveloped inventory.

Detring Energy Advisors expects 2021 to be a general continuation of 2020: large corporate consolidations (public and private) as operators shore up balance sheets and combine acreage positions within unconventional resource plays; a relatively slow A&D (asset) market driven mostly by conventional working interest assets; and a slightly rebounding mineral and royalty space.

A silver lining

The stabilization and recently increasing nature of the oil price should help to lubricate the asset market with activity hopefully reapproaching 2019 levels at some 50% higher deal count than 2020 (70-80 transactions) and a sharper, 2-3x increase in transaction value ($15 billion to $20 billion). Activity for larger, unconventional working interest assets will likely continue to stagnate outside of the most core, active regions of the Lower 48 as a wide spread remains between market value and intrinsic value.

While market value is being driven by lack of capital and a herd mentality to only pay for production, intrinsic worth can oftentimes be higher than market value in the current environment due to the option value associated with undeveloped resource in place (including potentially economic inventory).

Asset supply in 2021 should be supported by M&A consolidation as larger, combined entities seek to shed noncore properties from their portfolio (both public mergers and private smashcos) as well as continued liquidations and bankruptcies. Detring also anticipates mineral and royalty owners to begin reentering the market as commodity pricing improves and rig count continues its recovery. Corporate-level M&A activity also will continue in earnest with multiple public and private companies seeking to realize the efficiencies of a combined platform.

The silver lining for middle market sellers is that substantial buyer capital remains available for acquisitions. Assets broadly marketed in 2020 at both Detring Energy Advisors and PetroDivest Advisors, Detring’s lower middle market subsidiary, typically experienced an approximate 50% higher number of both evaluators and offers received compared with similar processes in 2019. Detring also continues to see growth in the potential buyer universe for middle market properties, with the most aggressive acquirers typically capitalized with private, family office capital, which generally carries a more constructive view on discount rate due to a lower cost of capital. This results in more optionality for sellers and typically a successful transaction.

Acquirers for larger properties certainly exist, but this buyer pool has been reduced through lack of appetite, balance sheet concerns and/or investor considerations, and it typically carries a higher cost of capital. Again, larger transactions mostly consisted of unconventional assets acquired by public or private equity E&Ps, and there is a limited universe of buyers looking for larger conventional working interest or larger mineral and royalty acquisitions.

This can be evidenced by many larger divestiture processes (and capital raising processes) taking more than one marketing effort to complete, as the seller eventually accepts the new market conditions and terms offered in this environment (e.g., stock consideration in lieu of cash, lower valuation, credit terms and covenants).

Yield buyers

With the market becoming more saturated with conventional working interest, PDP-focused properties, many buyers are raising capital to chase this opportunity. Upstream MLPs were the primary acquirer of this asset type heading into the 2014 pricing collapse, with subsequent buyers having a higher cost of capital and thus the general rumor of “PDP trading for PV15-20.” Detring’s experience, however, shows that PDP assets typically transact in the PV10-15 range when proper buyside parameters are utilized (e.g., forecast production, operating costs, plugging costs and administrative costs), with increasing discount rates applied to assets with certain risks (e.g., concentration risk, inadequate production history and lack of operational control).

Detring also is seeing a new breed of PDP buyer enter the market under private yieldco structures as investors seek dividends in this low-interest rate environment. With the riskfree rate (i.e., U.S. Treasuries) falling to alltime lows, these buyers feel that equity yields of 10% to 12% provide an adequate risk premium for a hedged PDP cash flow stream.

Detring anticipates capital to continue returning to oil and gas as the new, more disciplined approach creates value and importantly distributable free cash flow. One also must wonder when investors will call for “Big Tech” to spend within cash flow after several years outspending for top-line growth—a familiar message to the oil and gas community. We should have a more consolidated sector with an established history of distributions when this occurs, leading to additional rotation back into our space and a further “return to normalcy” in the A&D markets.

Derek Detring founded Detring Energy Advisors in September 2014 and PetroDivest Advisors, Detring’s lower middle market subsidiary, in August 2018. He currently serves as president of both entities. Combined Detring and PetroDivest have completed over 50 transactions throughout the U.S. totaling more than $2.5 billion in aggregate consideration.

Recommended Reading

No Good Vibrations: Neo Oiltools’ Solution to Vibrational Drilling Problems

2024-09-10 - Vibrations cause plenty of costly issues when drilling downhole, but Neo Oiltool’s NeoTork combats these issues, enhancing efficiency and reducing costs.

TGS Releases Illinois Basin Carbon Storage Assessment

2024-09-03 - TGS’ assessment is intended to help energy companies and environmental stakeholders make informed, data-driven decisions for carbon storage projects.

As Permian Gas Pipelines Quickly Fill, More Buildout Likely—EDA

2024-10-28 - Natural gas volatility remains—typically with prices down, and then down further—but demand is developing rapidly for an expanded energy market, East Daley Analytics says.

HNR Increases Permian Efficiencies with Automation Rollout

2024-09-13 - Upon completion of a pilot test of the new application, the technology will be rolled out to the rest of HNR Acquisition Corp.’s field operators.

Liberty Capitalizes on Frac Tech Expertise to Navigate Soft Market

2024-10-18 - Liberty Energy capitalized on its “competitive edge” when navigating a challenging demand environment in third-quarter 2024, CEO Chris Wright said in the company’s quarterly earnings call.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.