The oil and gas industry entering 2022 could have been described as cautiously optimistic, and that phrase holds true as the industry nears 2023.

Deloitte’s 2023 Oil and Gas Industry Outlook sees an industry that is flush with cash exercising capital discipline as it works to produce more energy while heading toward a lower carbon future.

Just a year ago, the industry was starting to emerge from the pandemic and was cautiously optimistic about the future. Now, Kate Hardin, executive director of Deloitte’s Research Center for Energy and Industrials, said the industry is “still cautiously optimistic, but they’re cautious about different factors.”

She said the most recent outlook shows interesting trends across the different segments of the oil and gas industry.

One of the trends is that while free cash flow is projected to be 70% higher than 2021 levels, the expectation is that capex will rise by only 30% over 2021 spend, she said. At the same time, production is up.

“Even with lower capital expenditures, we’re getting the production increase,” she said. “It’s a real efficiency play and an automation play that is contributing.”

According to the outlook, the oil and gas industry will likely enter 2023 with its healthiest balance sheet yet. With continued capital discipline, companies could overcome underinvestment of recent years and help accelerate the energy transition.

The results of the 2023 outlook survey show that 93% of respondents remain positive or cautiously positive about the industry in the coming year. Years of underinvestment, rapid recovery in demand and geopolitical developments have driven oil prices to 2014 highs and upstream cash flows to record levels, the outlook noted.

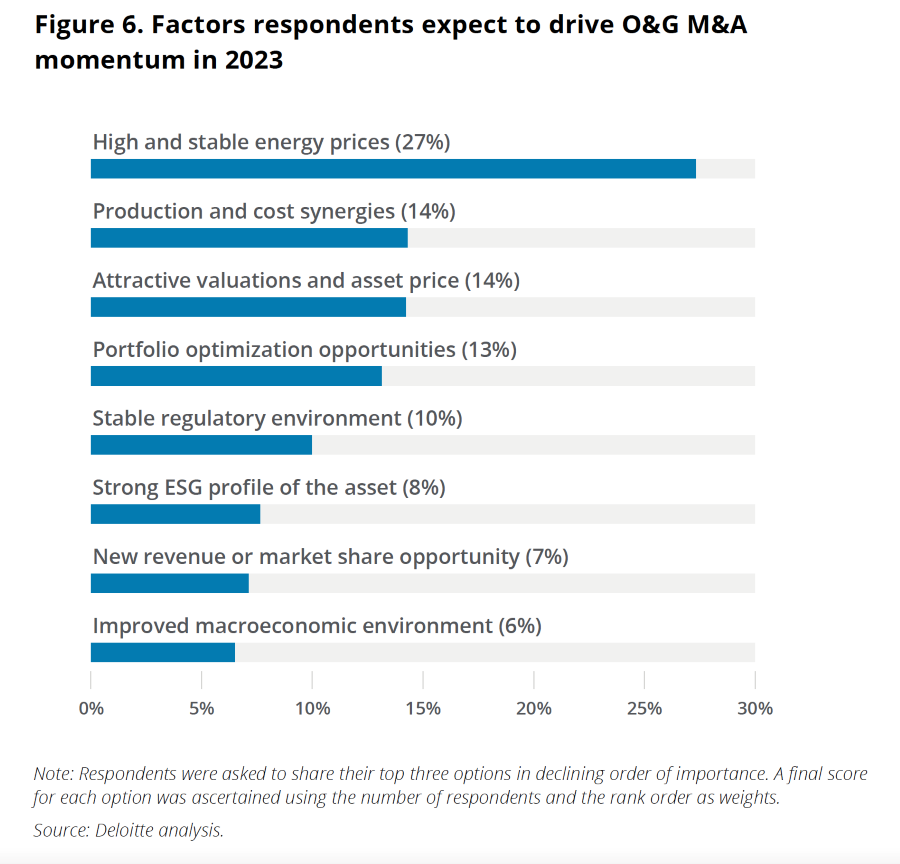

momentum in 2023. (Source: Deloitte)

Hardin said 40% of the 100 executives surveyed for the annual outlook indicated that balance sheet strength was one of their immediate priorities. She said some of that focus reaches back to “what 2014 and 2015 taught us and what 2020 taught us.” As a result, companies are focused on paying down debt.

One of the upsides of that, Hardin said, is that “their spending is not surpassing what they have on their balance sheet” so they may be able to pursue M&A activity with less reliance on outside funding and debt than in the past. “That may open up some interesting opportunities,” she continued.

Clean energy future

As the world focuses on moving toward a lower carbon future, companies are seeking ways to be part of the solution. In the survey, Hardin said, nearly a quarter of respondents indicated an interest in investing in emission abatement technology or increasing investment in clean energy sources.

Clean energy investment by oil and gas companies has risen by an average of 12% each year since 2020, according to the outlook. In 2022, clean energy investment is expected to account for an estimated 5% of total oil and gas capex spending, up from less than 2% in 2020.

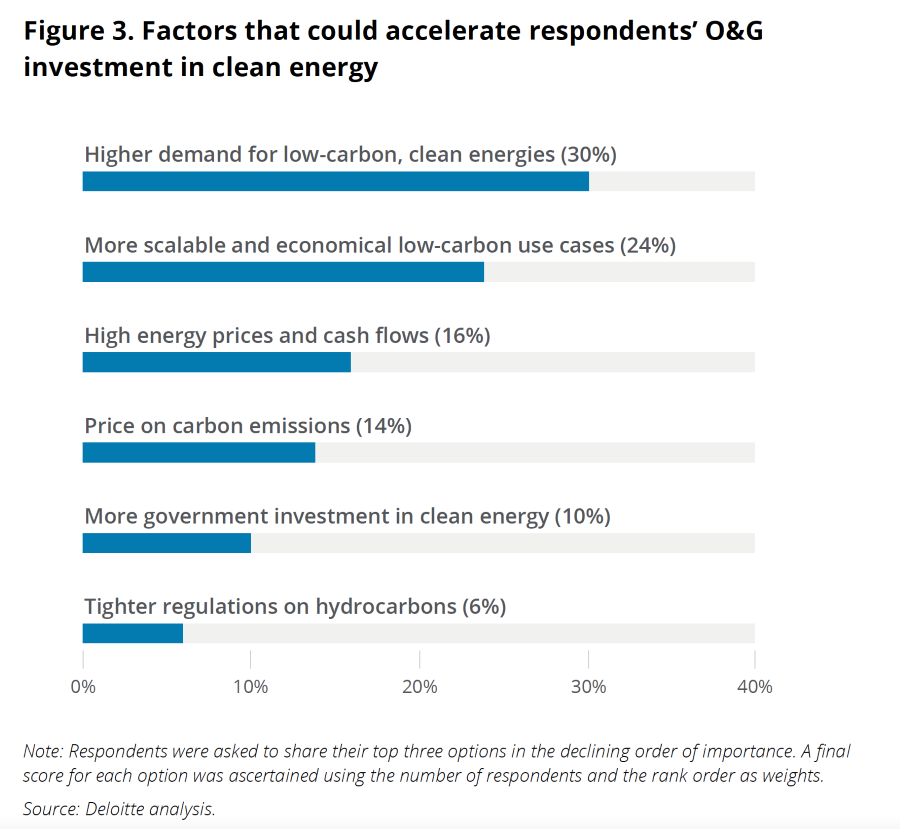

While the outlook expects investment to continue increasing in 2023, 30% of survey respondents indicated higher demand for low-carbon clean energies, and 24% selected more scalable and economical low-carbon use cases that would enable increased investment in clean energy.

However, following Russia’s invasion of Ukraine earlier this year, energy policy in the U.S. and Europe began to pivot. Momentum is now shifting away from phasing out natural gas to reducing emissions from natural gas while cleaner alternatives are developed and deployed, the outlook noted.

“Clearly we’re seeing a short-term increased reliance on natural gas” related to Russia’s invasion of Ukraine, Hardin said.

While the longer-term focus will be on reducing emissions and transitioning to those clean energy sources, natural gas is viewed as a bridge fuel to the future, she said.

Natural gas markets, according to the outlook, are expected to remain tight in 2023 with European and Asian demand absorbing incremental LNG export volumes coming online.

The outlook suggests potentially increasing investment in the natural gas market.

For example, in 2022, North American LNG developers signed nearly 34 million tons per annum of long-term LNG contracts, a 68% increase over 2021. Most of the contracts are anchoring new or expanded liquefaction projects expected to reach financial investment decisions in late 2022 and 2023.

Further, natural gas exporting countries like Qatar and Israel have announced plans to boost production, and in the U.S., natural gas-directed rigs are at their highest level since September 2019, the report stated.

Additionally, eight floating storage regasification units are expected to become operational in late 2022 through 2023. The outlook said this increases total European import capacity by more than 20%. More than 103 LNG vessels were ordered globally during the first seven months of 2022, the report stated.

And with all that demand for natural gas, there is an expectation the market will seek to meet those needs. The question, Hardin said, is whether regulatory hurdles will ease.

“Do we have a sense that it may become easier for the permitting to be easier for us to do an LNG project?” she asked. It’s possible that increased demand for natural gas “may play out with policy decisions,” she added.

Recommended Reading

Lake Charles LNG Selects Technip Energies, KBR for Export Terminal

2024-09-20 - Lake Charles LNG has selected KTJV, the joint venture between Technip Energies and KBR, for the engineering, procurement, fabrication and construction of an LNG export terminal project on the Gulf Coast.

Macquarie Sees Potential for Large Crude Draw Next Week

2024-09-19 - Macquarie analysts estimate an 8.2 MMbbl draw down in U.S. crude stocks and exports rebound.

EIA Reports Natural Gas Storage Jumped 58 Bcf

2024-09-19 - The weekly storage report, released Sept. 19, showed a 58 Bcf increase from the week before, missing consensus market expectations of 53 Bcf, according to East Daley Analytics.

Electrification Lights Up Need for Gas, LNG

2024-09-20 - As global power demand rises, much of the world is unable to grasp the need for gas or the connection to LNG, experts said.

Woodside to Maintain at Least 50% Interest in Driftwood LNG

2024-09-18 - Australia’s Woodside Energy plans to maintain at least a 50% interest in the 27.6 mtpa Driftwood LNG project that it's buying from Tellurian, CEO Meg O’Neill said during a media briefing at Gastech in Houston.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.