(Source: Shutterstock.com)

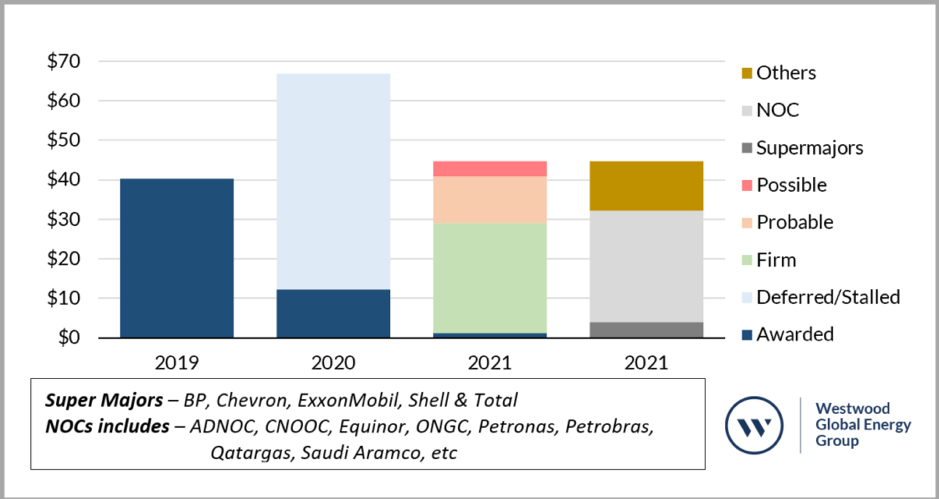

2020 will be remembered as one of the most challenging years in the history of the oil and gas sector. Oil consumption fell to levels not seen since 2001 and, at one point, U.S. producers were paying to offload crude as the WTI price went negative for the first time ever. In the offshore sector, investment in new field developments was the lowest in over 30 years as companies of all sizes reacted quickly to the commodity price crash by slashing on average 30% from planned 2020 capex and postponing/stalling $54 billion of 2020 offshore EPC contract awards.

Westwood counts $12.3 billion of offshore engineering, procurement and construction (EPC) contracts awarded in 2020 in 32 sanctioned projects. The firm said EPC awards last year were down from $40.3 billion in 80 projects in 2019. Five E&Ps accounted for 75% of the award value in 23 projects. The five largest projects contributed 57% of the total value, including Woodside Energy’s Sangomar, Exxon Mobil Corp.’s Payara, Equinor ASA’s Breidablikk, CNOOC’s Lufeng 14-1/4/8 and Petrobras’ Mero III.

Upstream capex overall in 2021 is likely to be flat or decline from 2020 based on company guidance but increased spending by a few E&Ps, notably Petrobras, Royal Dutch Shell Plc and Woodside is driving a forecast increase in offshore EPC awards in 2021. Our base case outlook for 2021 (which assumes Brent averaging at $50/bbl) currently forecasts firm and already awarded offshore EPC contracts of around $29 billion with a further $12 billion of probable awards and $4 billion of possible awards, compared to the $12.3 billion awarded in 2020.

This outlook may appear optimistic, particularly to an industry still reeling from the latest downturn-within-a-downturn, but a significant proportion of the 2021 market is made-up of those projects deferred in the second quarter of 2020 which in many instances had already seen significant pre-FID commitment. Notable examples of these “half-pregnant” projects include Shell’s Whale, Equinor’s Bacalhau and Qatar Petroleum’s North Field projects, which have all commenced partial construction of long-lead EPC items such as FPSO’s or wellhead platforms. These projects account for an estimated $7.7 billion of projected EPC value alone in 2021. Another $4.6 billion tranche of deferred awards are those critical to backfilling LNG trains or supporting existing gas sales agreements such as Woodside’s Scarborough, Shell’s Crux and Santos’ Barossa all offshore Australia.

National oil companies (NOCs) account for 62% of potential awards in 2021 and supermajors only 10%. This compares with 59% and 20% in 2019. Petrobras in particular, is expected to step up contract awards this year after reaffirming in November its commitment to the development of its prolific pre-salt basins. The Brazilian NOC is expected to contribute around $6.5 billion of EPC awards in 2021, the highest of all E&Ps, across its Buzios 5, 6, 7 & 8, Mero 4, Itapu and Marlim Revitalisation projects.

After a torrid 2020, the outlook for the offshore EPC market in 2021 looks promising, boosted by projects deferred from 2020. With a forecast of $29 billion firm or already awarded contracts and a further $16 billion of probable and possible awards, 2021 could match 2019’s $40 billion total.

About the Author:

Thom Payne is head of offshore energy services at Westwood Global Energy Group. Payne is based in Westwood’s Singapore offices where he leads the firm’s research and analysis coverage on global offshore energy markets spanning rigs and marine, subsea, floating production and renewables. He is also an experienced industry consultant, having provided market, commercial and strategic advice to support over $10 billion of M&A and debt raising activities across the global oil and gas sector over the past 15 years.

Recommended Reading

Dividends Declared in the Week of Aug. 19

2024-08-23 - As second-quarter earnings wrap up, here is a selection of dividends declared in the energy industry.

Gulfport Energy to Offer $500MM Senior Notes Due 2029

2024-09-03 - Gulfport Energy Corp. also commenced a tender offer to purchase for cash its 8.0% senior notes due 2026.

Pembina Completes Partial Redemption of Series 19 Notes

2024-07-08 - The redemption is part of Pembina Pipeline’s $300 million (US$220.04 million) aggregate principal amount of senior unsecured medium-term series 19 notes due in 2026.

Offshore Guyana: ‘The Place to Spend Money’

2024-07-09 - Exxon Mobil, Hess and CNOOC are prepared to pump as much as $105 billion into the vast potential of the Stabroek Block.

Bechtel Awarded $4.3B Contract for NextDecade’s Rio Grande Train 4

2024-08-06 - NextDecade’s Rio Grande LNG Train 4 agreed to pay Bechtel approximately $4.3 billion for the work under an engineering, procurement and construction contract.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.