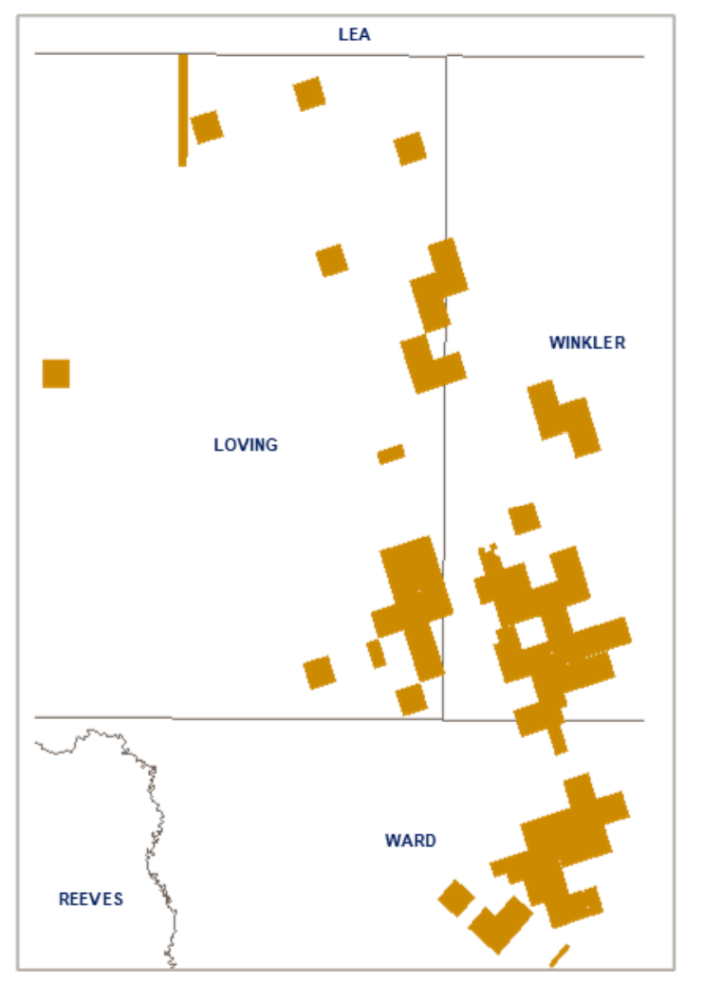

Oasis Petroleum’s Permian position consists of approximately 24,000 net acres in the core of the Delaware Basin in West Texas. (Source: Hart Energy; Shutterstock.com)

Oasis Petroleum Inc. is bidding farewell to the Permian Basin in a sale, divided into three transactions, which it expects to result in total proceeds of $481 million that include contingency payments tied to future oil prices.

Danny Brown, CEO of Oasis, explained the company’s decision to exit its Permian position was due to limited opportunities to grow in the prolific oil and gas region unlike the Williston Basin, where the Houston-based independent E&P company recently expanded its footprint by acquiring Diamondback Energy Inc.’s Bakken asset for $745 million in cash.

“The decision to exit the Permian Basin while building scale in the Williston Basin is fundamentally based on aligning company resources with our core competitive strengths and strategic focus of building a sustainable enterprise which generates significant free cash flow for the benefit of the company and shareholders,” Brown said in a statement in a May 20 company release.

The sale of Oasis’ Permian position consists of approximately 24,000 net acres in the core of the Delaware Basin in West Texas. The company reported 7,200 boe/d of production from its Permian Basin asset in the first quarter.

Oasis, which completed a financial restructuring last year, entered the Permian Basin in 2017 with the acquisition of Forge Energy for a mix of cash and stock equivalent worth approximately $946 million.

(Source: Oasis Feburary 2021 Investor Presentation)

The primary transaction in Oasis’ divestiture process is expected to close around June 30. The two smaller transactions have already closed, according to the company release. The total consideration for the sale consists of $406 million at closing and up to three $25 million annual contingent payments if WTI averages over $60/bbl in each calendar year. None of the buyers were disclosed.

The exit of the Permian positions Oasis exclusively in the Williston Basin. Including its acquisition of 95,000 net acres in North Dakota from Diamondback expected to close in July, Oasis’ position in the Williston covers 402,000 net acres, making it one of the largest operators in the basin.

“The successful conclusion of our Permian divestiture process,” Brown continued, “allows us to bring substantial value forward from an asset that was difficult to scale, strengthens our balance sheet from already peer-leading levels, and allows us to focus our attention on driving significant value from our world-class Williston acreage position, where we see great upside opportunity and long-term running room.”

In the May 3 announcement of the Williston acquisition, Oasis said it planned to finance the transaction through cash on hand, revolver borrowings and a $500 million fully committed underwritten bridge loan.

J.P. Morgan Securities LLC is strategic and financial adviser to Oasis in the primary divestiture process of its Permian position and McDermott Will & Emery acted as legal adviser.

Recommended Reading

Solaris Stock Jumps 40% On $200MM Acquisition of Distributed Power Provider

2024-07-11 - With the acquisition of distributed power provider Mobile Energy Rentals, oilfield services player Solaris sees opportunity to grow in industries outside of the oil patch—data centers, in particular.

Archrock Offers Common Stock to Help Pay for TOPS Transaction

2024-07-23 - Archrock, which agreed to buy Total Operations and Production Services (TOPS) in a cash-and-stock transaction, said it will offer 11 million shares of its common stock at $21 per share.

The ABCs of ABS: Financing Technique Shows Flexibility and Promise

2024-07-29 - As the number of ABS deals has grown, so have investors’ confidence with the asset and the types of deals they are willing to underwrite.

The ABCs of ABS: Financing Technique Shows Flexibility and Promise

2024-07-29 - As the number of ABS deals has grown, so have investors’ confidence with the asset and the types of deals they are willing to underwrite.

Cibolo Energy Closes Fund Aimed at Upstream, Midstream Growth

2024-09-10 - Cibolo Energy Management LLC closed its second fund, Cibolo Energy Partners II LP, meant to boost middle market upstream and midstream companies’ growth with development capital.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.