Northern Oil and Gas Inc. is partnering with Vital Energy Inc. on an acquisition in the Permian Basin. (Source: Shutterstock.com)

Northern Oil and Gas Inc. is partnering with Vital Energy Inc. on an acquisition in the Permian Basin.

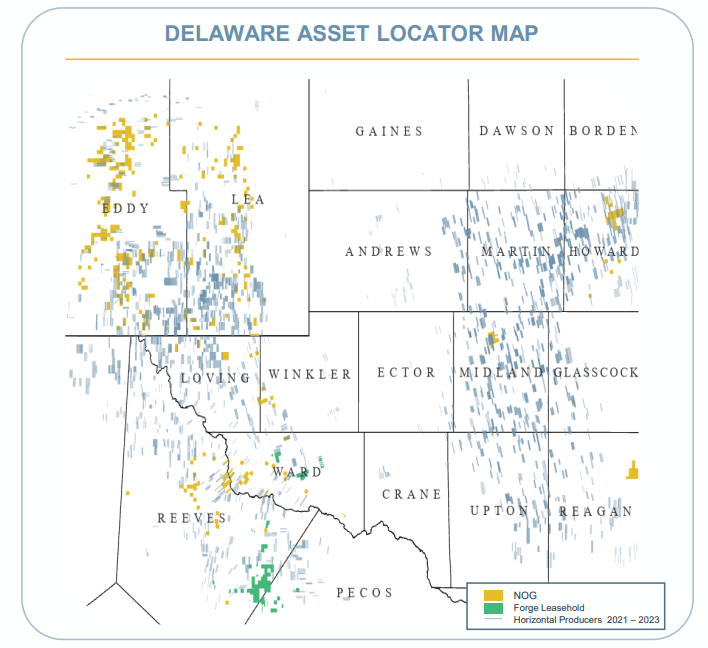

Minnesota-based Northern Oil and Gas, or NOG, and Oklahoma-based Vital Energy have jointly agreed to acquire Forge Energy II Delaware LLC’s assets in the Delaware Basin.

Under terms of the agreement, Vital will purchase 70% of Forge’s assets for $378 million. NOG will acquire a 30% undivided stake in the Forge assets for a purchase price of $162 million in cash, the company said after markets closed on May 15.

“This transaction crystallizes NOG’s position as a reliable and consistent partner for the purchase and development of high-quality properties,” said NOG CEO Nick O’Grady in a press release. “We are excited to work alongside our partners at Vital to develop the Forge assets with strong alignment and cooperation.”

Forge is a portfolio company of energy private equity firm EnCap Investments LP.

The Forge assets will be operated by Vital when the deal closes by the end of June, the company said.

For NOG, the transaction adds around 20 undeveloped drilling locations in Pecos, Reeves and Ward counties, Texas, across 10,200 net acres.

The deal also includes 30.5 net producing wells; Recent production on the acquired assets was approximately 3,400 barrels of oil-equivalent per day (boe/d).

NOG anticipates production of more than 3,750 boe/d (79% oil) from the acquired assets during the second half of the year. The company plans to spend about $17 million on the assets later this year and about $38 million over the next twelve months.

“As we enter into this joint acquisition, we are taking NOG’s capabilities and opportunity set to the next level, adding yet another arrow to our M&A quiver,” said NOG President Adam Dirlam.

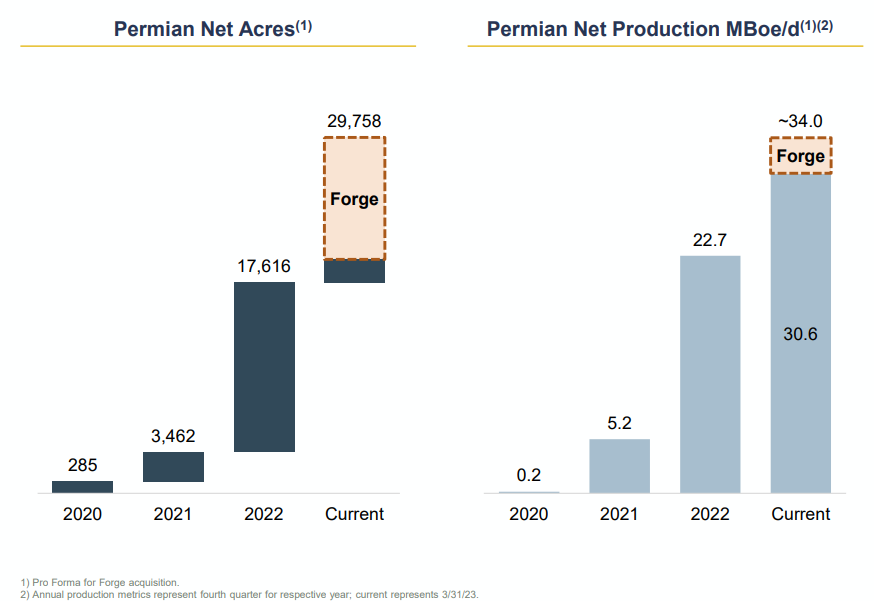

With the addition of Forge, NOG continues to add scale in the Permian. NOG’s Permian acreage is expected to grow to 29,758 net acres from 17,616 net acres after the acquisition.

NOG significantly boosted its Permian footprint through acquisitions in 2022, including a $406.5 million acquisition of Veritas Energy’s non-operated Permian position.

RELATED: NOG Closes Northern Delaware Basin Acquisition

Fundraising through secondary offering

NOG plans to use proceeds from a public offering to pay for the acquisition’s $162 million price tag.

In conjunction with the deal, NOG announced an underwritten public offering of 6.65 million shares of its common stock. NOG also granted the underwriters a 30-day option to purchase up to an additional 997,500 shares.

The company is primarily planning to cover the $162 million cash portion of the Forge acquisition using proceeds from the equity offering. After funds have been deployed toward the acquisition, NOG may temporarily use proceeds to repay borrowings under its revolving credit facility.

RBC Capital Markets and Morgan Stanley are serving as joint book-runners for the share offering.

Houlihan Lokey served as financial adviser to Vital and NOG in acquiring the Forge assets. Kirkland & Ellis LLP is serving as legal adviser to NOG. Forge is represented by RBC Richardson Barr as financial adviser and O’Melveny & Myers as legal counsel.

RELATED: Vital Energy Enters Delaware Basin in $540 Million Deal

Vital enters Delaware Basin

Vital announced the acquisition of Forge Energy with an unnamed third-party late last week, ending the E&Ps status as a Midland Basin pure play.

The deal expands Vital’s Permian footprint to about 198,000 net acres and adds and average production of 9,500 boe/d, 65% oil, net to Vital.

The transaction adds locations in the 2nd and 3rd Bone Spring and Wolfcamp A formations. Vital said the wells breakeven at an average price of about $50 per Nymex WTI barrel.

It’s the second deal the company, formerly known as Laredo Petroleum, has made this year: Vital acquired assets from Midland Basin E&P Driftwood Energy Operating LLC for $214 million in April.

Recommended Reading

Private Equity Looks for Minerals Exit

2024-07-26 - Private equity firms have become adroit at finding the best mineral and royalties acreage; the trick is to get public markets to pay more attention.

How Liberty Rolls: Making Electricity, Using NatGas to Fuel the Oilfield

2024-08-22 - Liberty Energy CEO Chris Wright said the company is investing in keeping its frac fleet steady as most competitors weather a downturn in oil and gas activity.

Permian Resources Closes $820MM Bolt-on of Oxy’s Delaware Assets

2024-09-17 - The Permian Resources acquisition includes about 29,500 net acres, 9,900 net royalty acres and average production of 15,000 boe/d from Occidental Petroleum’s assets in Reeves County, Texas.

VAALCO Reports Increased Reserves After Svenska Deal

2024-07-16 - VAALCO acquired Swedish E&P Svenska’s 27.39% non-operated working interest in the deepwater Baobab Field in Block CI-40, offshore Côte d’Ivoire.

Crackin’ It at Kraken: Inside the Bakken’s Ramped-up Private E&P

2024-07-24 - Kayne Anderson-backed Kraken Resources is producing more than 80,000 boe/d today and has a new Fitch Ratings credit score to take to the M&A bank.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.