Fieldwood Energy will purchase Noble’s GoM assets in a deal valued at $710 million, including $480 million in cash and $230 million in assumed liabilities.

Fieldwood Energy LLC will buy Noble Energy Inc.’s (NYSE: NBL) Gulf of Mexico (GoM) business and assume other obligations in a deal Noble valued at $710 million, the company said Feb. 15.

In addition to paying $480 million cash, Fieldwood will also assume all abandonment obligations tied to the properties, which Noble estimates at $230 million. Noble may also receive a $100 million payout through 2022 whenever Light Louisiana Sweet (LLS) oil prices exceed $63 per barrel.

The assets were expected to decline as Noble’s focus shifts toward U.S. onshore growth, said Charles Robertson II, an analyst for Cowen.

David L. Stover, Noble’s chairman, president and CEO, said that the assets have delivered outstanding performance during the past couple of years but no longer fit with the company’s portfolio.

“The sale of our Gulf of Mexico business represents the last major step in our portfolio transformation,” he said. “This has been done to focus our go-forward efforts on those assets that will rapidly grow our cash flows and margins, primarily the U.S. onshore business and the Eastern Mediterranean.”

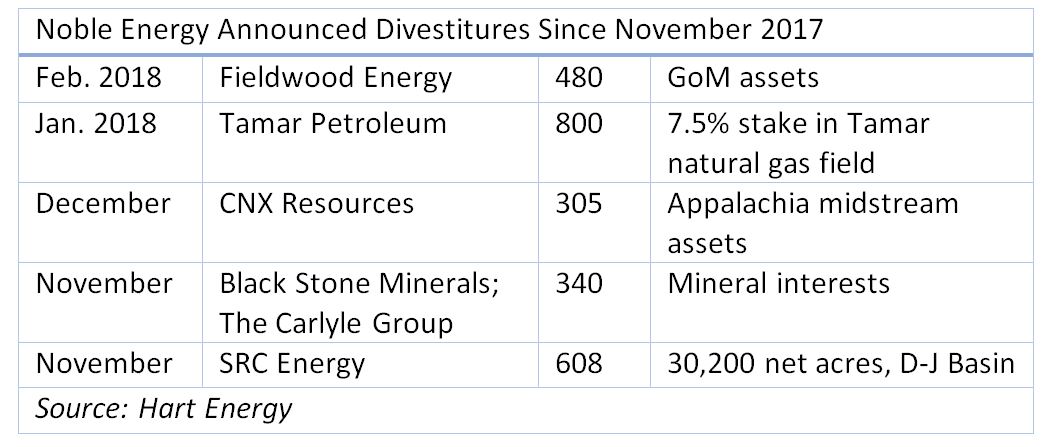

Since November, Noble has divested more than $2.5 billion worth of assets including its pending GoM deal.

The GoM assets include six producing fields and undeveloped leases. Noble projected GoM net production will average more than 20,000 barrels of oil equivalent per day (boe/d) in 2018. At the end of 2017, the company estimated its proved GoM reserves at 23 MMboe.

The effective date of the transaction is Jan. 1, with closing anticipated during second-quarter 2018, contingent upon Fieldwood successfully implementing its contemplated restructuring process.

Fieldwood, headed by CEO Matt McCarroll, bills itself as the largest operator on the GoM shelf with interests in about 500 offshore blocks. Most of its assets are in depths of less than 1,000 ft.

Robertson noted that Nobles’ Leviathan project offshore Israel, with an estimated 22 trillion cubic feet of gas equivalent in gross recoverable resources is estimated to start production in 2020. The company said in November that the project will generate about $650 million of net operating cash flow at startup, which it said it has targeted for first sales by the end of 2019.

In the first 10 years of production, Leviathan is expected to generate more than $5 billion in cash flow, Noble said.

Noble also announced that its board has authorized a $750 million share repurchase program.

“At today's share price, the program covers about 6% of the company's outstanding shares,” Robertson said.

Darren Barbee can be reached at dbarbee@hartenergy.com.

Recommended Reading

US Drillers Cut Oil, Gas Rigs for Fifth Week in Six, Baker Hughes Says

2024-09-20 - U.S. energy firms this week resumed cutting the number of oil and natural gas rigs after adding rigs last week.

E&P Highlights: Oct. 14, 2024

2024-10-14 - Here’s a roundup of the latest E&P headlines, including another delay at one of the largest gas fields in the world and two major contracts in West Africa.

EY: How AI Can Transform Subsurface Operations

2024-10-10 - The inherent complexity of subsurface data and the need to make swift decisions demands a tailored approach.

Kolibri Global Drills First Three SCOOP Wells in Tishomingo Field

2024-09-18 - Kolibri Global Energy reported drilling the three wells in an average 14 days, beating its estimated 20-day drilling schedule.

Baker Hughes to Supply Petrobras' Presalt Fields with Flexible Pipe Systems

2024-10-28 - Baker Hughes said the systems will look to address the issue of corrosion cracking from CO2, which can arise as gas is reinjected into wells.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.