Oil and gas mineral and royalty players are adjusting the value markers of potential M&A transactions with the market’s evolution.

Minerals teams, and the methods those teams use to determine oil and gas minerals valuations, have become more sophisticated, said Derek Detring, president of Detring Energy Advisors, at the World Oilman’s Mineral & Royalty Conference this spring.

“One thing that we’ve seen really across the majority of our clients, potential buyers, is they’ve got a geology team now,” Detring said. “That’s kind of new. You definitely didn’t see that from minerals buyers five years ago.”

Outside of geological work, minerals buyers are assessing well spacing, decline rates, remaining inventory runway, pace of development and other key metrics when developing cash flow analyses for potential deals, he said.

Minerals and royalties teams have also gotten larger over time. RBC Richardson Barr Managing Director Rusty Shepherd said most of the firm’s minerals clients today have teams of 20 or more employees, including landmen, engineers and geoscientists, as well as accounting and finance staff.

That, at least, doubles the size of a typical team in the past, which topped out at 10 members, Shepherd said.

Minerals valuations

Just as minerals and royalties teams have evolved, so have the methods used to determine valuations for potential minerals deals.

Consider the prolific Permian Basin, for example. Early during the basin’s emergence as the nation’s top shale producer, acreage prices reflected the nascent value of assets.

Permian minerals transactions would typically trade within a narrow band of between $10,000 per acre and $20,000 per acre from about 2015 through 2020, according to RBC data.

“In 2018, if you got $18,000 a royalty acre in the Delaware [Basin], that’s a high five. That’s top of the market,” Detring said. “Whereas right now, you may turn that down.”

Permian deals are trading in a narrow band between 5x and 7x cash flow multiples today, per RBC data. Detring Energy Advisors is seeing Permian minerals transactions trade at $40,000 per acre.

The Permian’s development and production profile is more mature today, and mineral opportunities are screened more for their ability to produce sustainable cash flows and multiples than on dollar-per-acre metrics.

That’s in line with what buyers paid to scoop up Permian minerals acreage in the past year, including Kimbell Royalty Partners’ $270 million deal with Hatch Royalty and Brigham Minerals’ $132.5 million deal with Avant Natural Resources.

“The Hatch and Avant deals traded for $35,000 to $40,000 a royalty acre,” Detring said.

The change in how assets are screened isn’t just limited to the Permian–it’s happening more broadly across the Lower 48, Shepherd said.

Location, location, location

The payoff for mineral and royalty interests largely still depends on location.

Owners of vintage acreage with plateaued oil and gas production and no remaining undrilled locations will make less money per acre than owners in, for instance, a Tier 2 resource play with a high decline rate and a large inventory of undeveloped locations.

And Tier 2 acreage owners will generally make less money per acre than owners with acreage in the core of the play, where production is stronger and new wells are being developed at a rapid pace.

Core mineral acreage can trade for approximately 10x the value of vintage producing acreage, regardless of basin, according to a Detring Energy Advisors analysis.

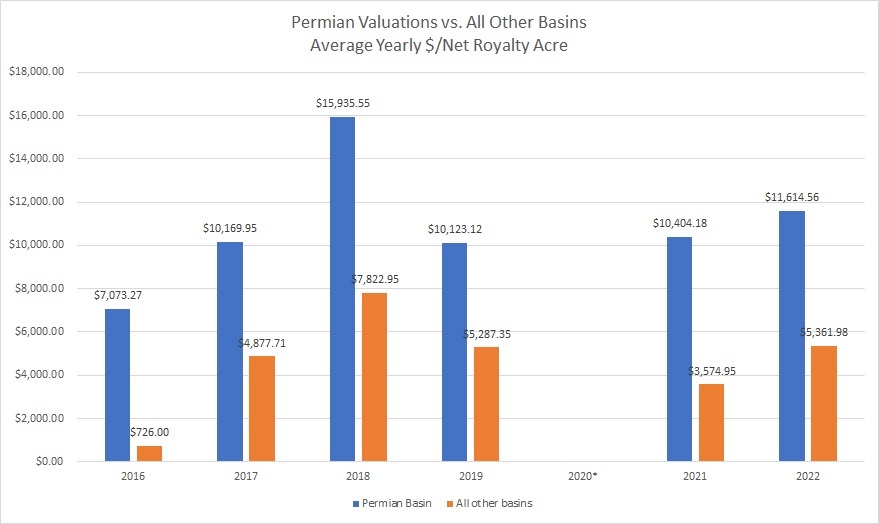

Buyers fork over a premium for Permian acreage, according to Enverus data. Adjusting for the value of existing oil and gas production, the price per net royalty acre in the Permian can nearly double valuations in other Lower 48 basins.

Recommended Reading

Offshore Guyana: ‘The Place to Spend Money’

2024-07-09 - Exxon Mobil, Hess and CNOOC are prepared to pump as much as $105 billion into the vast potential of the Stabroek Block.

Endeavor Energy Founder Autry Stephens Dies at 86

2024-08-16 - Stephens created a legacy in the Permian Basin that Endeavor said will continue to shape the future of the company.

Superior Sees Executive Leadership Changes

2024-08-15 - Superior Energy Services’ president, CEO and chairman Brian Moore is retiring, and his roles are to be split between the two people succeeding him.

CEO: Baker Hughes Lands $3.5B in New Contracts in ‘Age of Gas’

2024-07-26 - Baker Hughes revised down its global upstream spending outlook for the year due to “North American softness” with oil activity recovery in second half unlikely to materialize, President and CEO Lorenzo Simonelli said.

Dividends Declared in the Week of July 22

2024-07-25 - Second quarter earnings are underway, and companies are declaring dividends.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.