Martin Midstream Partners LP is moving closer to achieving its strategic goals with another multimillion-dollar sale on Aug. 12 of noncore assets which have been idle for nearly a year.

An undisclosed buyer agreed to buy Martin Midstream’s East Texas Pipeline for about $17.5 million. The proceeds will be used to reduce outstanding borrowings under the Kilgore, Texas-based company’s revolving credit facility, which stood at $225 million as of June 30.

The divestiture follows a strategy set forth by Martin Midstream last year to delever the balance sheet and simplify its portfolio through noncore asset sales.

Pro forma the East Texas Pipeline sale, the company has received net proceeds since mid-2018 of about $283 million from a series of divestitures and the dropdown acquisition of Martin Transport Inc. More recently, Martin Midstream closed the sale of its Gulf Coast gas storage assets, which helped refocus its operational expertise on the refinery services industry, according to the company.

“The East Texas Pipeline sale is one more step along the partnership’s strategic path of selling noncore assets and using the proceeds to reduce leverage,” Ruben Martin, president and CEO of Martin Midstream’s general partner, said in a statement on Aug. 12.

In his statement, Martin also noted the pipeline had been idle since September 2018 and negatively weighing on net loss by roughly $1.6 million and about $900,000 on EBITDA on a trailing 12-month basis.

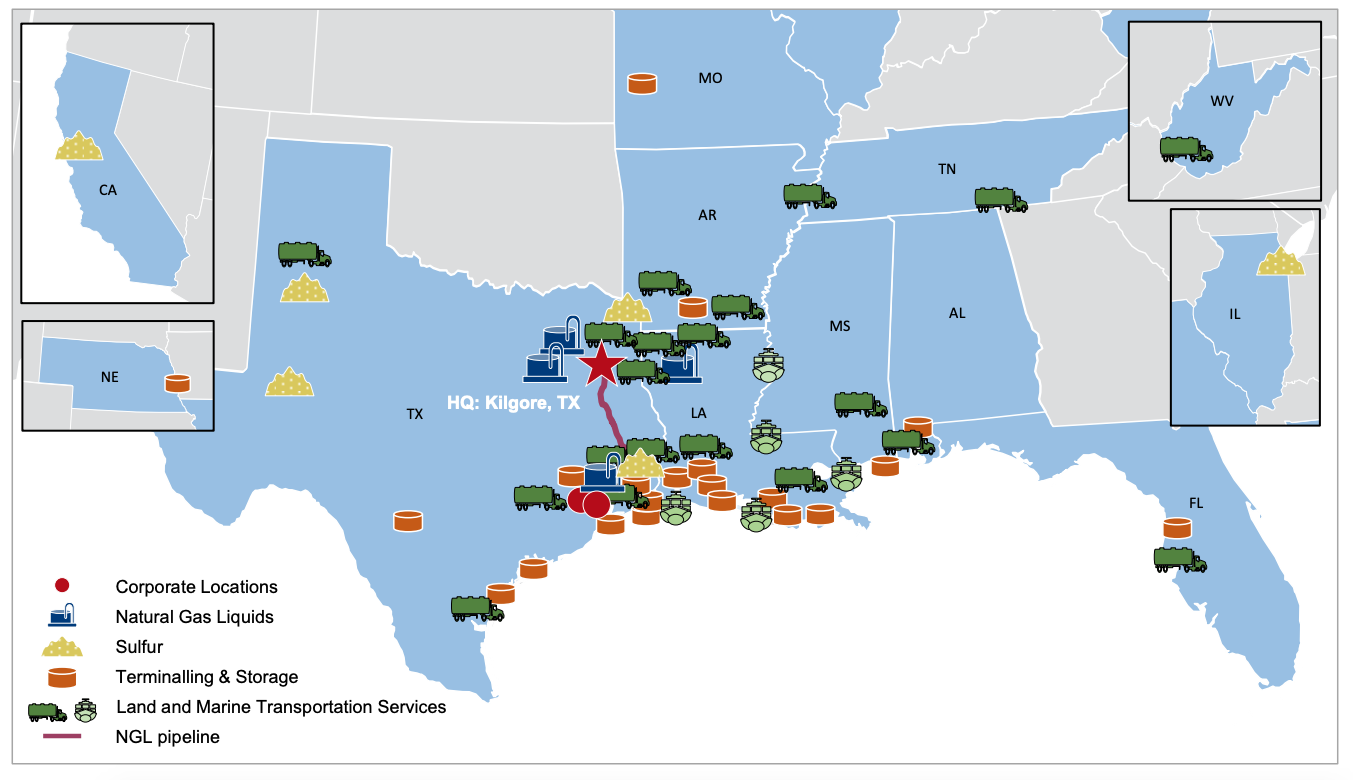

The East Texas Pipeline is a 200-mile NGL pipe from Kilgore, Texas, to Beaumont, Texas, according to analysts with Capital One Securities Inc. in an Aug. 13 research note.

“We think [Martin Midstream] may have similarly idle or noncore asset sales to further improve the balance sheet before year-end,” the Capital One analysts added.

In its press release on Aug. 12, Martin Midstream listed its primary business lines include:

- Terminalling, processing, storage, and packaging services for petroleum products and by-products;

- Land and marine transportation services for petroleum products and by-products, chemicals, and specialty products;

- Sulfur and sulfur-based products processing, manufacturing, marketing and distribution; and

- NGL transportation, distribution and marketing services.

Emily Patsy can be reached at epatsy@hartenergy.com.

Recommended Reading

Energy Transfer Confirms La Porte Fire, Report of 'Unknown' Vehicle

2024-09-16 - Energy Transfer acknowledged reports of a vehicle striking a valve on a natural gas liquids line, potentially leading to a large fire in La Porte, Texas, on the morning of Sept. 16.

Brazos Completes Permian G&P Plant, Announces Another

2024-08-15 - Privately held Brazos Midstream completed a 200 MMcf/d cryogenic gas processing plant in the Midland Basin and plans to build a larger gas processing plant in the second half of 2025.

WoodMac: Permian Producers Eye Mexico’s Saguaro Energía LNG FID for Takeaway Relief

2024-07-17 - Wood Mackenzie expects Mexico Pacific to take FID on the first phase of its Saguaro Energía LNG project in either the second half of 2024 or early 2025.

Alaska Approves Plan to Build $56.6MM Pipeline for LNG Imports

2024-07-24 - Natural gas utility Alaska Pipeline Co., an affiliate of Enstar Natural Gas, received approval from the state to build the 16-mile pipeline, which will be connected to a terminal at Port Mackenzie, near Anchorage.

Report: TC Energy Close to Selling $726MM Pipeline Stake to Indigenous Groups

2024-07-24 - The Canadian government has given preliminary approval for a loan to indigenous groups to buy a stake in TC Energy’s NGTL pipeline system.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.