The following information is provided by PetroDivest Advisors. All inquiries on the following listings should be directed to PetroDivest. Hart Energy is not a brokerage firm and does not endorse or facilitate any transactions.

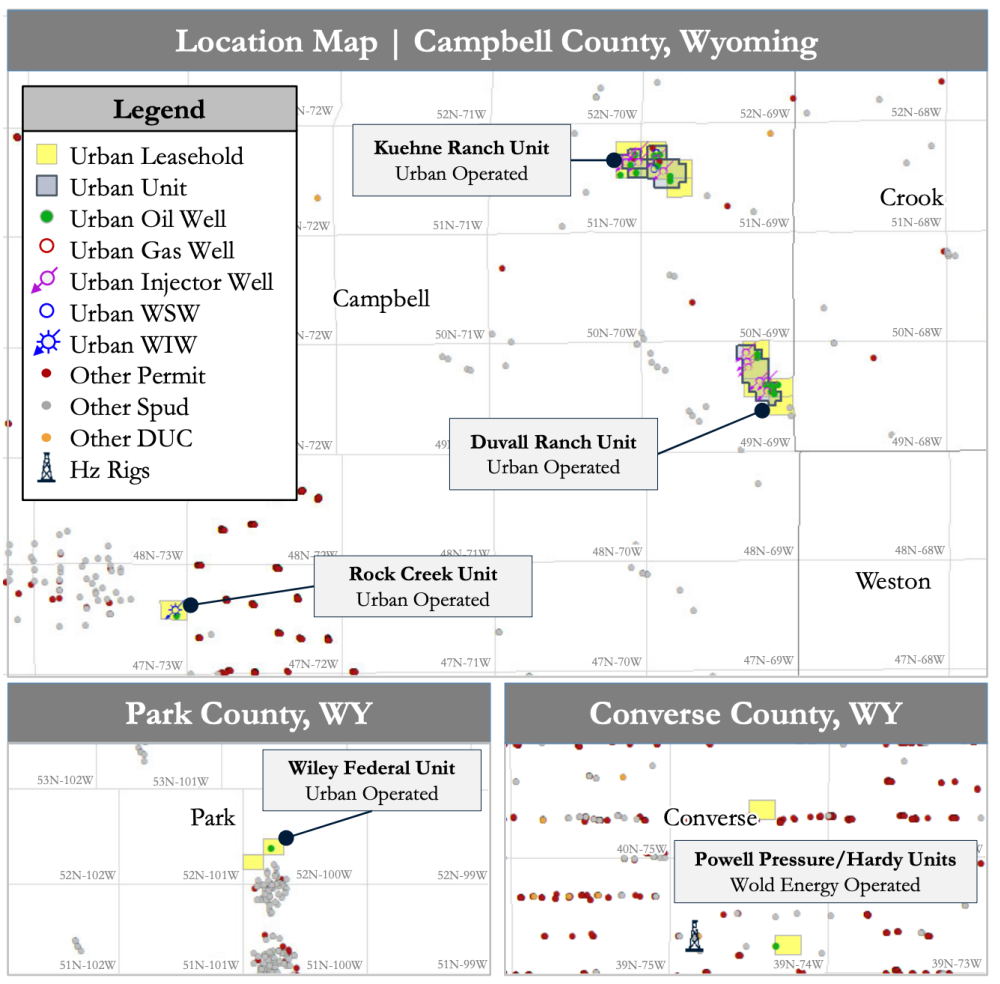

Urban Oil & Gas retained PetroDivest Advisors to market for sale certain of its operated oil and gas leasehold, producing properties and related assets located in Campbell, Converse and Park counties, Wyoming.

The assets offer an attractive opportunity to acquire consistent, low-decline, waterflood properties underpinned by a 97% oil-weighted production stream generating meaningful next 12-month cash flow of about $5 million, with multiple economic development projects including waterflood optimization, operational efficiencies and vertical infill drilling, according to PetroDivest.

Asset Detail:

- Long-Life Oil Production (97% Oil)

- Current net production of ~210 boe/d (97% oil) from vertical producers across 10 regional fields

- PDP PV-10: $20 million

- PDP Net Reserves: 1.5 million boe

- PDP NTM Cash Flow: $5 million

- R/P: 20 years

- Legacy production base boasts NTM decline of ~5%, which is underpinned by decades of historical production

- Low lifting costs of $17/boe

- Current net production of ~210 boe/d (97% oil) from vertical producers across 10 regional fields

- Operated, HBP Footprint

- 98% Average Working Interest

- 96% HBP

- Extensive infrastructure in-place allows for ease of operations across the active waterflood position

- Assets include 13 active injectors and three water source wells

- Ample upside opportunities include additional upsize workovers, tubing, and fishing jobs, providing near-term production uplift potential

- Total 2P EUR: 1.7 million boe

- Total 2P PV-10: $22 million

Process Summary:

- Evaluation materials are available via the Virtual Data Room on June 22

- Proposals are due on July 27

For information visit petrodivest.com or contact Jerry Edrington, director of PetroDivest, at jerry@petrodivest.com or 713-595-1017.

Recommended Reading

Marketed: Berlin Resources’ Anadarko Basin Opportunity

2024-07-22 - Berlin Resources has retained EnergyNet for the sale of an Anadarko Basin opportunity in the Montgomery 18/19 BO #1H, located in Ellis County, Oklahoma.

Exxon Explores Sale of Conventional Permian Basin Assets

2024-08-27 - Exxon Mobil, which closed a $60 billion takeover of Pioneer Natural Resources this year, is exploring selling legacy conventional assets in the Permian Basin.

Mike Wirth: The ‘Remarkable’ Rise Of Chevron’s Permian Portfolio

2024-08-20 - Chevron aims to grow Permian volumes past 1 MMboe/d in 2025—less than a decade after it averaged less than 100,000 boe/d from legacy holdings in West Texas and New Mexico, Chevron CEO Mike Wirth said.

APA Executive: After Recent Divestitures, ‘More to Come’

2024-08-19 - At the EnerCom Denver conference, an APA Corp. executive didn’t address reports that APA was shopping up to $1 billion in Permian Basin assets, but he said the company is looking to shed $2 billion in term loans associated with its purchase of Callon Petroleum.

APA Divests $950 Million in Non-core Permian Basin Assets

2024-09-13 - APA Corp. said it would sell assets in the Central Basin Platform, Texas and New Mexico Shelf and Northwest Shelf that average 21,000 boe/d, 57% oil.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.