The following information is provided by Detring Energy Advisors. All inquiries on the following listings should be directed to Detring Energy Advisors. Hart Energy is not a brokerage firm and does not endorse or facilitate any transactions.

Stephens Natural Resources, LLC & Stephens Energy Group, LLC (“Stephens”) are offering for sale their oil & gas producing properties, leasehold, and related assets located in Blaine, Kingfisher, Garfield, Payne, and Logan Counties, Oklahoma. The assets offer an attractive opportunity to acquire a large, contiguous, and HBP ~21,900 net acre majority operated position underpinned by a balanced production base garnering ~$10MM of annual cash flow, coupled with a highly economic drill-ready development program targeting multiple de-risked formations. Stephens has retained Detring Energy Advisors as its exclusive advisor relating to the transaction.

Asset Highlights:

- Substantial Production Base | ~1.4 MBoed & $10MM Operating Cash Flow

- Balanced net production comprised of ~300 Bod (oil), 4.0 MMcfd (gas), and 460 Bbl/d (NGL) (52% liquids)

- PDP PV10: $50MM

- PDP Net Reserves: 6.0 MMBoe

- Well Count: 111 current producers

- Sizeable base of predictable, high-margin cash flow

- $10MM NTM (PDP Only)

- Healthy returns with an operating cash flow margin of $21/Boe at current commodity prices

- 78 operated producers account for 95% of PDP value (average 58% WI)

- Balanced net production comprised of ~300 Bod (oil), 4.0 MMcfd (gas), and 460 Bbl/d (NGL) (52% liquids)

- ~21,900 Net Leasehold Acres | 100% Held By Production

- Majority operated and concentrated position allows for ease of operations and capital budget control

- Extensive and high-quality infrastructure in place

- High-quality operated SWD pipeline system with nine SWD wells supporting on-going operations

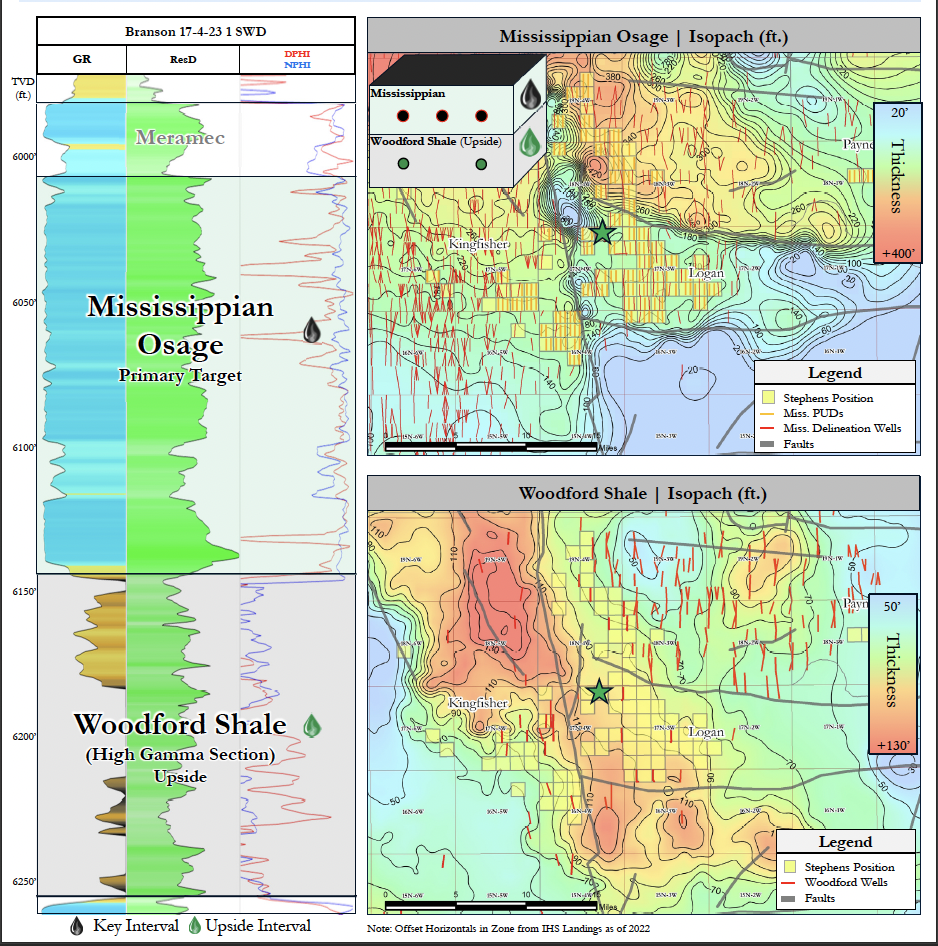

- Robust Upside Inventory | >150 Mississippian Locations

- Stacked-pay with multiple de-risked targets across the position

- Drill-ready development program focuses on the prolific Mississippian with further upside potential in the Oswego reservoir

- 150+ highly-economic development locations (avg. 45% WI) generating >100% IRRs + >2x ROI (Disc. 10%)

- 3P PV10: $122MM

- 3P Net Reserves: 25 MMBoe

- Stacked-pay with multiple de-risked targets across the position

Bids are due on April 12. Evaluation materials available via the Virtual Data Room (“VDR”) on Wednesday, March 15th. For complete due diligence information or to request a confidentiality agreement, please contact Melinda Faust, managing director, at mel@detring.com.

Recommended Reading

Dividends Declared the Week of Oct. 21

2024-10-25 - With third-quarter 2024 earnings underway, here is a compilation of dividends declared from select midstream and service and supply companies in the week of Oct. 21.

BP Profit Falls On Weak Oil Prices, May Slow Share Buybacks

2024-10-30 - Despite a drop in profit due to weak oil prices, BP reported strong results from its U.S. shale segment and new momentum in the Gulf of Mexico.

Private Producers Find Dry Powder to Reload

2024-09-04 - An E&P consolidation trend took out many of the biggest private producers inside of two years, but banks, private equity and other lenders are ready to fund a new crop of self-starters in oil and gas.

Utica Oil E&P Infinity Natural Resources Latest to File for IPO

2024-10-05 - Utica Shale E&P Infinity Natural Resources has not yet set a price or disclosed the number of shares it intends to offer.

ConocoPhillips Hits Permian, Eagle Ford Records as Marathon Closing Nears

2024-11-01 - ConocoPhillips anticipates closing its $17.1 billion acquisition of Marathon Oil before year-end, adding assets in the Eagle Ford, the Bakken and the Permian Basin.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.