The following information is provided by Eagle River Energy Advisors LLC. All inquiries on the following listings should be directed to Eagle River. Hart Energy is not a brokerage firm and does not endorse or facilitate any transactions.

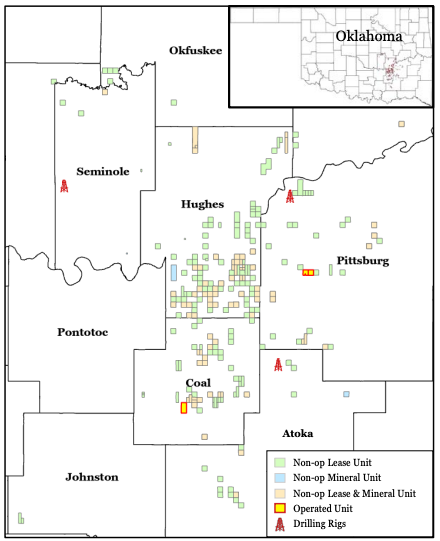

Eagle River Energy Advisors LLC has been exclusively retained by SOGC Inc. (formerly Sinclair Oil & Gas Co.) to divest certain operated and nonoperated working interest and overriding royalty interest (ORRI) assets in the Arkoma Basin.

The assets provide the opportunity to acquire a gas-weighted production stream of 4,500 Mcfe/d diversified across multiple basin-leading operators. Additionally, this package has stable production from wide-ranging well vintages with 98% of wells producing for over 3 years and generated $3.7 million of cash flow during the last 12-month period ending November 2021. Lastly, 11,117 net acres of leasehold provides significant exposure to future development of the Woodford Shale.

Highlights:

- Significant Gas Weighted Production Base

- ~4,500 Mcfe/d net production averaged over trailing 12-months November 2021

- Gas weighted production (Gas 80% / NGL 19% / Oil < 1%)

- $3.7 million cash flow during trailing 12-months November 2021

- ~ 300 gross (22 net) PDP wells generated 1.6 net Bcf (trailing 12-months November 2021)

- Stable Cash Flow with Significant Upside

- Stable production created by wide-ranging well vintages

- 98% of wells producing for 3+ years

- Diversified across multiple basin-leading operators

- ~11,117 Net acres of leasehold provides significant exposure to future development including one DUC location

- Three operated DSUs with at least eight development locations

- Stable production created by wide-ranging well vintages

- High Margin Production

- Low lifting cost ($1.32 / Mcfe) leading to high margin production

- GTP: $0.79 / Mcfe & LOE: $0.53 / Mcfe

- High margin net cash flow of $2.50 per Mcfe (trailing 12-months November 2021)

SOGC Inc. (formerly Sinclair Oil & Gas Co.) is a privately held, vertically integrated oil company involved in all aspects of the oil and gas industry, from exploration to marketing. Founded in 1916 by Harry F. Sinclair, Sinclair Oil & Gas Co. is one of the oldest continuous brands in the oil business, with their dinosaur being one of the most recognized icons in the U.S.

Bids for the acquisition opportunities with SOGC Inc. are due April 28. A virtual data room will be available starting April 7. The transaction effective date is May 1.

For information contact Chris Martina, technical director at Eagle River, at 720-726-6092 or cmartina@eagleriverea.com.

Recommended Reading

Midstream M&A Adjusts After E&Ps’ Rampant Permian Consolidation

2024-10-18 - Scott Brown, CEO of the Midland Basin’s Canes Midstream, said he believes the Permian Basin still has plenty of runway for growth and development.

Post Oak-backed Quantent Closes Haynesville Deal in North Louisiana

2024-09-09 - Quantent Energy Partners’ initial Haynesville Shale acquisition comes as Post Oak Energy Capital closes an equity commitment for the E&P.

Analyst: Is Jerry Jones Making a Run to Take Comstock Private?

2024-09-20 - After buying more than 13.4 million Comstock shares in August, analysts wonder if Dallas Cowboys owner Jerry Jones might split the tackles and run downhill toward a go-private buyout of the Haynesville Shale gas producer.

Aethon, Murphy Refinance Debt as Fed Slashes Interest Rates

2024-09-20 - The E&Ps expect to issue new notes toward redeeming a combined $1.6 billion of existing debt, while the debt-pricing guide—the Fed funds rate—was cut on Sept. 18 from 5.5% to 5%.

Dividends Declared Sept.16 through Sept. 26

2024-09-27 - Here is a compilation of dividends declared from select upstream, midstream and service and supply companies.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.