The following information is provided by Opportune Partners LLC. All inquiries on the following listings should be directed to Opportune. Hart Energy is not a brokerage firm and does not endorse or facilitate any transactions.

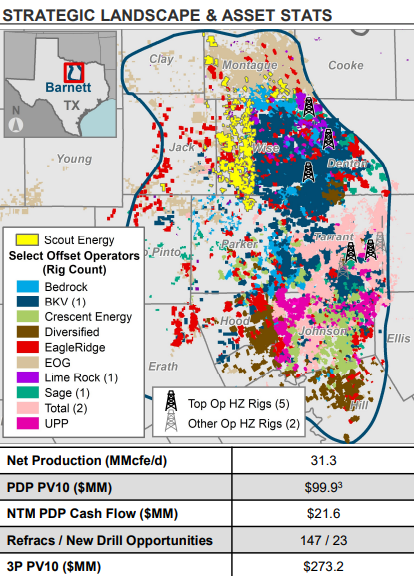

Scout Energy Partners has retained Opportune Partners LLC for the sale of certain oil and gas assets in the Barnett shale. The opportunity includes 468 gross operated PDPs yielding net production of 31.3 MMcfe/d (53% liquids) across approximately 100,000 contiguous net acres.

Highlights:

- Net prod. of 31.3 MMcfe/d (53% liquids, 97% operated), from 468 gross operated PDPs, and a PV10 of $99.9MM

- Shallow NTM decline of 12%; NTM PDP EBITDA of $21.6MM will help fund future development

- Clearly identified artificial lift and produced water optimization that add significant value as wells mature

- ~100,000 contiguous net acres with high average WI and NRIs of 95% and 75%, respectively

- Fully HBP acreage grants the ability to control pace of development

- Less than 9% of acreage in a high-density population area

- Existing infrastructure with capacity enables growth

- Undercapitalized asset has preserved upside since initial acquisitions in 2018

- No Scout drilling or refrac activity – direct offset activity points to quality return

- 23 modeled operated locations with IRRs up to ~80% at current strip

- 147 horizontal wells identified as refrac candidates

- Self-funding development plan generates ~$112MM in FCF over the next five years

Bids are due at 12:00 p.m. CST on March 2. The Virtual Data Room will be available beginning Jan. 19, with data presentations beginning Jan. 27 (virtual or in-person options available). Send executed confidentiality agreement and any Q&A regarding the properties to ProjectLucchese@opportune.com.

Recommended Reading

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.