The following information is provided by Detring Energy Advisors LLC. All inquiries on the following listings should be directed to Detring. Hart Energy is not a brokerage firm and does not endorse or facilitate any transactions.

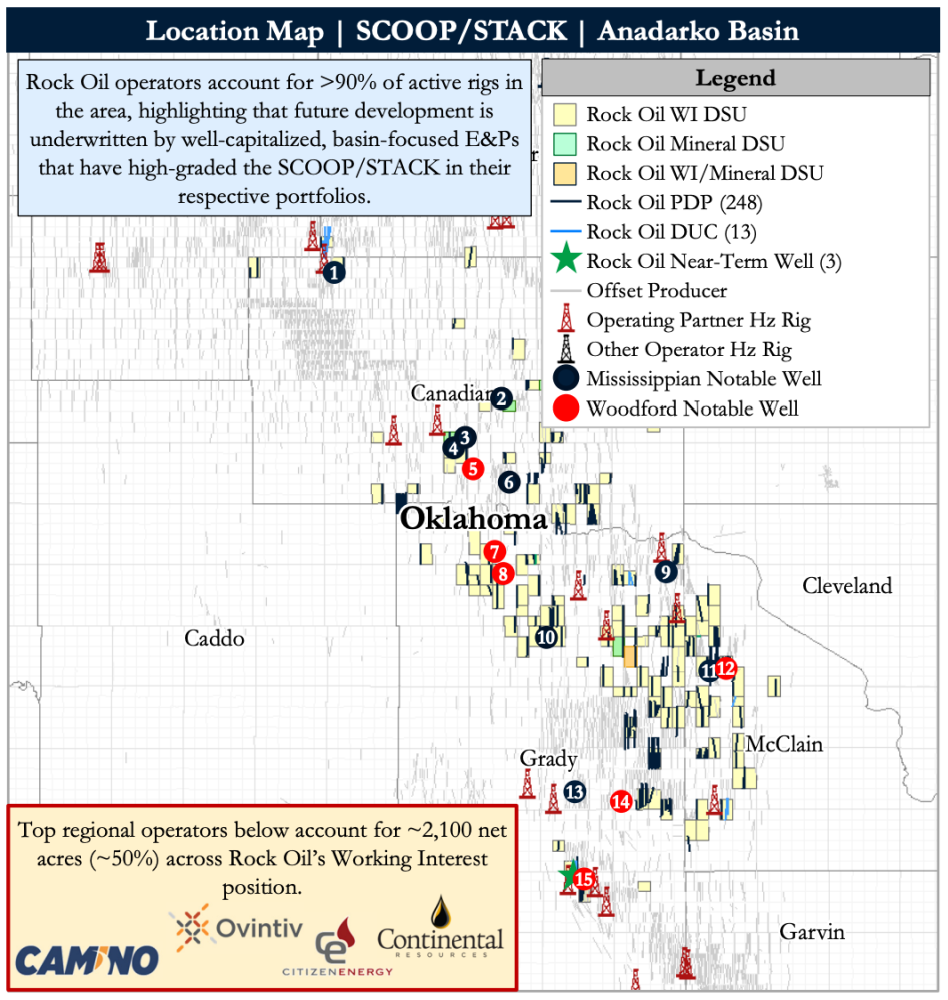

ESP EOC Rose Rock LLC retained Detring Energy Advisors to market for sale its roughly 4,100 net acres of nonoperated working interest and 415 net royalty acres of mineral interest in the heart of the SCOOP and STACK plays of the Anadarko Basin.

The combined assets offer a 100% HBP footprint spanning the core of the play with exposure to over 100 drilling units plus a blended hydrocarbon production base projected to generate EBITDA of about $10 million (PDP/DUC/Near-Term) over the next 12 months. Additionally, the offering includes roughly 600 highly-economic undeveloped locations throughout the prolific Mississippian and Woodford formations.

The assets are being offered in two packages: nonoperated working interest and minerals.

Highlights:

- Nonoperated Working Interest Package

- ~4,100 net acres with 244 PDP wells, 13 DUCs, 3 Near-Term wells and 563 PUD locations

- October 2021E PDP Production: ~5,700 Mcfe/d

- Next 12-month EBITDA: ~$10 million (PDP, DUC, Near-Term)

- PV-10 of $79 million

- PDP: $27.3 million

- DUC and Near-Term: $3.2 million

- PUD: $48.5 million

- Net reserves of 121.5 Bcfe

- PDP: 19.6 Bcfe

- DUC and Near-Term: 2.7 Bcfe

- PUD: 99.2 Bcfe

- Minerals Package

- 413 net royalty acreage with four PDP wells and 30 PUD locations

- October 2021E PDP Production: ~75 Mcfe/d

- Next 12-month EBITDA: ~$0.2 million (PDP)

- PV-10 of $3.6 million

- PDP: $0.7 million

- PUD: $2.9 million

- Net reserves of 2.6 Bcfe

- PDP: 0.3 Bcfe

- PUD: 2.3 Bcfe

Process Summary:

- Evaluation materials available via the Virtual Data Room on Sept. 21

- Proposals due on Oct. 18

- Separate proposals requested by package

- Offers for both packages as presented will be at a significant advantage to non-conforming bids

For information visit detring.com or contact Melinda Faust at mel@detring.com or 512-296-4653.

Recommended Reading

E&P Highlights: Aug. 19, 2024

2024-08-19 - Here’s a roundup of the latest E&P headlines including new seismic solutions being deployed and space exploration intersecting with oil and gas.

Breakthroughs in the Energy Industry’s Contact Sport, Geophysics

2024-09-05 - At the 2024 IMAGE Conference, Shell’s Bill Langin showcased how industry advances in seismic technology has unlocked key areas in the Gulf of Mexico.

E&P Highlights: July 29, 2024

2024-07-29 - Here’s a roundup of the latest E&P headlines including Energean taking FID on the Katlan development project and SLB developing an AI-based platform with Aker BP.

E&P Highlights: Sep. 2, 2024

2024-09-03 - Here's a roundup of the latest E&P headlines, with Valeura increasing production at their Nong Yao C development and Oceaneering securing several contracts in the U.K. North Sea.

E&P Highlights: Aug. 12, 2024

2024-08-12 - Here’s a roundup of the latest E&P headlines, with a major project starting production in the Gulf of Mexico and the latest BLM proposal for oil and gas leases in North Dakota.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.