The following information is provided by Energy Advisors Group (EAG). All inquiries on the following listings should be directed to EAG. Hart Energy is not a brokerage firm and does not endorse or facilitate any transactions.

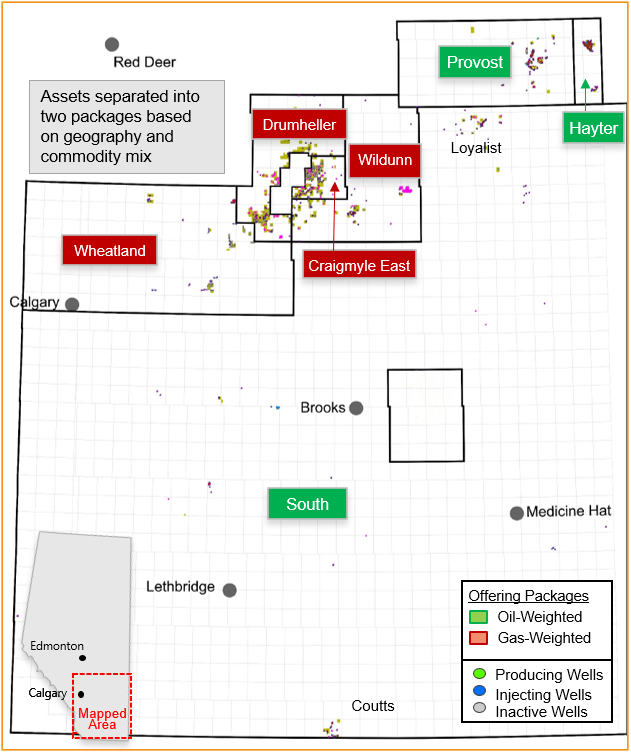

Energy Advisors Group (EAG) has been retained by Prairie Provident Resources to market its working interests and some royalties located in central Alberta, including, Craigmyle East, Drumheller, Hayter, Provost, South, Wheatland and Wildunn areas. These wells are producing from Banff, Belly River, Cummings, Detrital, Dina, Lloyd and McLaren formations.

The offering is characterized, according to EAG, by a large footprint of more than 92,880 gross acres and underwritten by an attractive combination of production (1,070 boe/d), behind-pipe exploitation targets, waterflood expansion, and low-risk development drilling. The plays historical base production and cash flow growth has been driven by its proven stacked pay zones allowing peer-leading balance sheets and the current increased development activity seen today.

The divestiture properties represent an ideal entry vehicle for those seeking to transact in the Western Canadian Sedimentary Basin, and a good bolt-on opportunity for those wishing to consolidate in the area, EAG said. Prairie Provident Resources plans to use the proceeds from the sale of these assets to continue development of their core properties.

This is an asset sale. Upon execution of a confidentiality agreement, EAG will provide access to confidential evaluation material in the virtual data room. Check virtual data room frequently for new supplemental material.

Highlights:

- Central Alberta operation for sale

- Seven areas. ~93,000-net acres. 181-producers. 10-injectors. Significant inventory/running room

- Banff, Belly River, Cummings, Detrital, Dina, Lloyd and McLaren

- 2D and 3D seismic defined upside. Multiple stacked sands adjacent to proven development

- Reactivation opportunities. Identified horizontal locations. Waterflood optimization

- Up to 100% operated working interest. Minor royalty interests

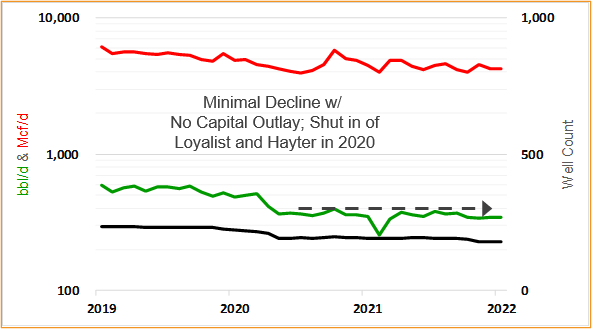

- Gross Production: ~450 bbl/d and 5.1 MMcf/d (Net Volumes: >1,070 boe/d. 40% Liquids). Low decline

- Net Operating Cash Flow: >$165,000/Mn

- PDP Reserves: ~1,855 Mboe. Scalable asset base. Established, low risk resources

- Highly economic light/heavy oil asset with proven technology

Quick Production and Cash Flow Summary:

- The active wells produced ~450 bbl/d of oil and 5.1 MMcf/d of gas (Net: ~350 bbl/d of oil and 4.3 MMcf/d of gas) in December 2021 bringing the revenues to >$1.4 million and an estimated operating net cash flow of ~$700,000 per month. With the recovering commodity prices, the margin has been improved. So has the net operating cash flow.

Bids are due on March 23. The transaction is expected to have an April 1 effective date with a purchase and sale agreement signed by April 12.

The virtual data room is available at EnergyAdvisors.com/deals. For more information email Steve Henrich, EAG director of business development and execution, at shenrich@energyadvisors.com, or Alan Yoelin, EAG director and petroleum engineer, at ayoelin@energyadvisors.com.

Recommended Reading

ConocoPhillips Hits Permian, Eagle Ford Records as Marathon Closing Nears

2024-11-01 - ConocoPhillips anticipates closing its $17.1 billion acquisition of Marathon Oil before year-end, adding assets in the Eagle Ford, the Bakken and the Permian Basin.

Investor Returns Keep Aethon IPO-ready

2024-10-08 - Haynesville producer Aethon Energy is focused on investor returns, additional bolt-on acquisitions and mainly staying “IPO ready,” the company’s Senior Vice President of Finance said Oct. 3 at Hart Energy’s Energy Capital Conference (ECC) in Dallas.

Twenty Years Ago, Range Jumpstarted the Marcellus Boom

2024-11-06 - Range Resources launched the Appalachia shale rush, and rising domestic power and LNG demand can trigger it to boom again.

BP Profit Falls On Weak Oil Prices, May Slow Share Buybacks

2024-10-30 - Despite a drop in profit due to weak oil prices, BP reported strong results from its U.S. shale segment and new momentum in the Gulf of Mexico.

Utica Oil E&P Infinity Natural Resources Latest to File for IPO

2024-10-05 - Utica Shale E&P Infinity Natural Resources has not yet set a price or disclosed the number of shares it intends to offer.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.