The following information is provided by PetroDivest Advisors. All inquiries on the following listings should be directed to PetroDivest. Hart Energy is not a brokerage firm and does not endorse or facilitate any transactions.

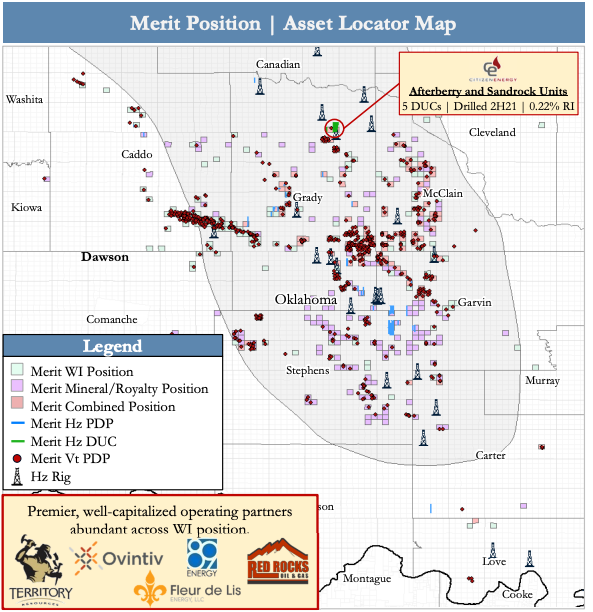

Merit Energy Co. retained PetroDivest Advisors to market for sale its oil and gas nonoperated working interest and mineral and royalty interest concentrated in the core of the Anadarko Basin.

The assets offer an attractive opportunity, according to PetroDivest, to acquire robust, low-decline production with growth potential including five recently drilled DUCs plus long-term cash flow bolstered by strong operating margins. The offering also includes a large, diversified nonoperated working interest and mineral/royalty interest position covering roughly 15,200 net acres that supports continued development and delineation of proven pay zones including the prolific Woodford, Springer and Sycamore formations, PetroDivest added.

Highlights:

- Robust Production (~2,100 Mcfe/d; 8% Next 12-month Decline)

- Low-decline, stable production provides reliable cash flow

- 40+ Horizontal PDP | 450+ Vertical PDP

- 3.4% average Working Interest and 3.4% average Royalty Interest

- 1P Reserves: ~12 Bcfe

- Oil: 26% | Gas: 65% | NGL: 9%

- Low-decline, stable production provides reliable cash flow

- Durable Cash Flow with Strong Cash Margins

- The efficiently operated asset generates meaningful cash flow

- $3.7 million Next 12-month PDP cash flow

- $16 million PDP PV-10%

- Resilient cash flow stream ensured by low operating expenses and healthy margins

- ~$5/Mcfe Next 12-month operating cash margin

- Cash flow from blended hydrocarbon production base bolstered by current commodity price rally

- The efficiently operated asset generates meaningful cash flow

- Prolific Acreage Position

- ~15,200 diversified net acre position

- Mineral: ~4,300 net acres

- Nonop: ~8,300 net acres

- Mineral and Nonop: ~2,700 net acres

- Leasehold acreage retains HBP status

- ~15,200 diversified net acre position

Process Summary:

- Evaluation materials available via the Virtual Data Room on Oct. 14

- Proposals due on Nov. 3

For information visit petrodivest.com or contact Jerry Edrington, director of PetroDivest, at jerry@petrodivest.com or 713-595-1017.

Recommended Reading

Diamondback to Sell $2.2B in Shares Held by Endeavor Stockholders

2024-09-20 - Diamondback Energy, which closed its $26 billion merger with Endeavor Energy Resources on Sept. 13, said the gross proceeds from the share’s sale will be approximately $2.2 billion.

Optimizing Direct Air Capture Similar to Recovering Spilled Wine

2024-09-20 - Direct air capture technologies are technically and financially challenging, but efforts are underway to change that.

Analyst: Is Jerry Jones Making a Run to Take Comstock Private?

2024-09-20 - After buying more than 13.4 million Comstock shares in August, analysts wonder if Dallas Cowboys owner Jerry Jones might split the tackles and run downhill toward a go-private buyout of the Haynesville Shale gas producer.

Matador Offers $750 Million in Senior Notes Following Ameredev Deal

2024-09-20 - Matador Resources will offer $750 million in senior notes following the close of its $1.83 billion Ameredev II acquisition.

Aethon, Murphy Refinance Debt as Fed Slashes Interest Rates

2024-09-20 - The E&Ps expect to issue new notes toward redeeming a combined $1.6 billion of existing debt, while the debt-pricing guide—the Fed funds rate—was cut on Sept. 18 from 5.5% to 5%.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.