The following information is provided by Detring Energy Advisors. All inquiries on the following listings should be directed to Detring. Hart Energy is not a brokerage firm and does not endorse or facilitate any transactions.

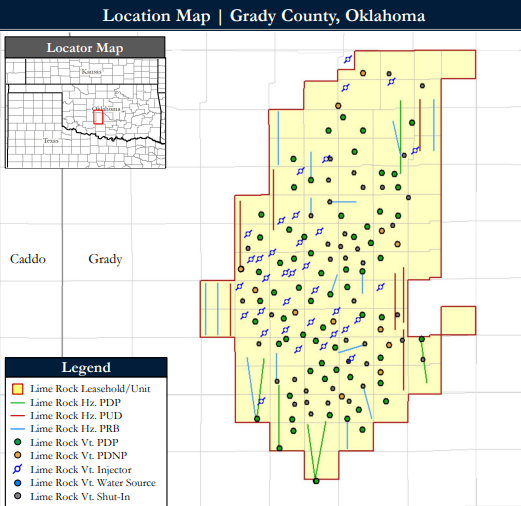

Lime Rock Resources has retained Detring Energy Advisors to market for sale its operated, contiguous, 100% HBP Norge Marchand Sand Unit located in western Grady County, Oklahoma. The assets offer an attractive opportunity to acquire substantial liquids-weighted production generating ~$12MM of NTM PDP cash flow, with multiple development and production optimization projects including highly-economic Marchand horizontal locations, vertical re-frac’s, returns to production and waterflood optimization.

Highlights:

- Substantial Liquids-Rich Production Base

- Current net production: 1 MBoed (50% oil / 75% liquids)

- PDP PV10: $45MM

- PDP Net Reserves: 3.3 MMBoe

- Well Count: 65 producers (59 verticals / 6 horizontals)

- Sizeable base of low-decline, predictable cash flow

- PDP NTM Cash Flow: $12MM

- 13% NTM Decline (11% 2024E)

- Low lifting costs of $12.40/Boe

- Current net production: 1 MBoed (50% oil / 75% liquids)

- Operated & HBP Waterflood

- Large, operated, and contiguous footprint of ~12,000 gross acres

- 100% HBP across multiple formations provides complete operational control with the opportunity for value-add projects

- Assets offer attractive optionality with exposure to the liquids-rich Marchand and gas-rich Medrano

- Efficient operations allowed by concise footprint (~8x4 miles)

- Attractive royalty burden at ~86% NRI 8/8th (average 78% WI / 67% NRI)

- Large, operated, and contiguous footprint of ~12,000 gross acres

- Large Inventory of Economic Development Opportunities

- Ten high-impact undeveloped locations identified for Marchand horizontal development boasting attractive IRRs

- Significant pipeline of 16 low-risk return-to-production & re-frac projects

- Substantial 3P PV10 ($69MM) and net reserves (7.1 MMBoe)

Proposals are due on Feb. 8. Upon execution of a confidentiality agreement, Detring will provide access to the Virtual Data Room, which opens Jan. 11.

For more information visit detring.com or contact Linda Fair, marketing coordinator, at linda@detring.com or 214-727-4996.

Recommended Reading

For Sale: Grandma’s Minerals

2024-08-16 - A younger generation more open to selling subsurface rights has increased supply for the minerals and royalties market, and Mesa Minerals III is buying up interests in the Permian and Haynesville.

Energy Producer Maverick's Owner Explores Sale Valuing It at $3B, Sources Say

2024-08-14 - Owned by energy-focused investment firm EIG, Maverick Natural Resources is working with investment bankers at Jefferies on the sale process.

Exxon Mobil Selling Malaysia Oil, Gas Assets to Petronas - Sources

2024-07-19 - Exxon Mobil, which last year marked its 130th year in Malaysia, has been trying to sell its upstream assets in the country since 2020.

Oxy Near $1B Deal to Sell Barilla Draw to Permian Resources— Sources

2024-07-25 - Occidental Petroleum and Permian Resources are in the process of finalizing the Permian Basin deal, which could be announced in the coming weeks if the talks don't fall apart, sources told Reuters.

Marathon Petroleum CEO Calls Rumors of Neste Purchase 'Not Factual'

2024-08-07 - The CEO of Marathon Petroleum Corp. downplayed rumors that the Ohio refiner was interested in acquiring Europe’s Neste Corp. during a second quarter 2024 webcast with analysts.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.