The following information is provided by Stephens Inc. All inquiries on the following listings should be directed to Stephens. Hart Energy is not a brokerage firm and does not endorse or facilitate any transactions.

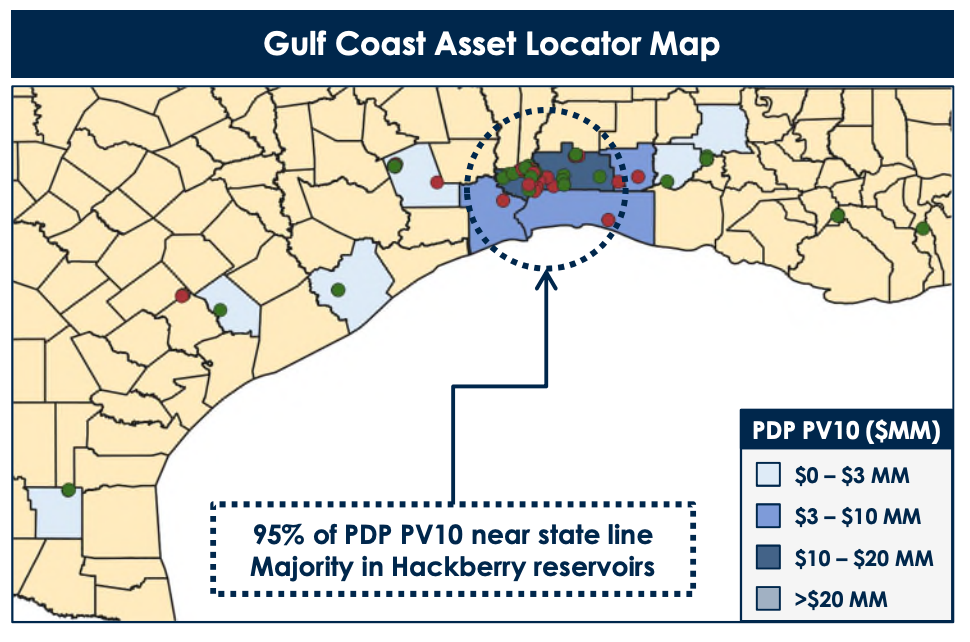

Ichor Energy LLC retained Stephens Inc. as its exclusive adviser to sell the company’s operated conventional oil assets in a single cash transaction. The primary acreage is located near the Texas-Louisiana border in the Hackberry reservoirs.

Highlights:

- Material Texas and Louisiana Hackberry Footprint with Operational Control

- Primary acreage located near the Texas-Louisiana border

- Vast majority operated on a PV-10 basis

- PV-10 Weighted Working Interest: ~93% | Net Revenue Interest: ~64% (~69% lease Net Revenue Interest)

- Note, Petrodome is the operator of record for operated well locations

- Reserves based upon an updated mid-year Netherland Sewell (NSAI) report; over 80% of PDP value from Hackberry producers

- Long-lived Production Provides Stable Cash Flow

- 2022E Net Production: ~1,350 boe/d

- Forecasts based on NSAI mid-year report, not including probable producing forecasts

- PDP PV-10: ~$80 million

- Next 12-month Average PDP Decline: ~10%

- Next 12-month PDP Cash Flow: ~$20 million

- PDP R/P: ~10 years

- 2022E Net Production: ~1,350 boe/d

- Significant Resources Potential From Asset Base

- Development potential includes return to production, artificial lift, behind pipe and new drill opportunities

- Future development is self-funding, with low drilling costs in conventional reservoirs accessible with vertical wells

- Nine PDNP opportunities quantified

- Nine PUD locations quantified

Bids are due Feb. 4. The transaction is structured as a sale of assets with an effective date of Jan. 1.

A virtual data room is available. For information visit stephens.com or contact Max Young, Stephens associate, at Max.Young@stephens.com.

Recommended Reading

EOG Testing 700-ft Spacing in Ohio’s Utica Oil Window, Sees Success

2024-08-05 - EOG Resources’ test at the northern end of its 140-mile-long north-south leasehold produced IPs similar to those from a nearby pad.

Devon Energy Expands Williston Footprint With $5B Grayson Mill Deal

2024-07-08 - Oklahoma City-based Devon Energy is growing its Williston Basin footprint with a $5 billion cash-and-stock acquisition from Grayson Mill Energy, an EnCap portfolio company.

Private Equity Looks for Minerals Exit

2024-07-26 - Private equity firms have become adroit at finding the best mineral and royalties acreage; the trick is to get public markets to pay more attention.

In Ohio’s Utica Shale, Oil Wildcatters Are at Home

2024-08-23 - The state was a fast-follower in launching the U.S. and world oil industry, and millions of barrels of economic oil are still being found there today.

Permian Resources Closes $820MM Bolt-on of Oxy’s Delaware Assets

2024-09-17 - The Permian Resources acquisition includes about 29,500 net acres, 9,900 net royalty acres and average production of 15,000 boe/d from Occidental Petroleum’s assets in Reeves County, Texas.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.