The following information is provided by EnergyNet. All inquiries on the following listings should be directed to EnergyNet. Hart Energy is not a brokerage firm and does not endorse or facilitate any transactions.

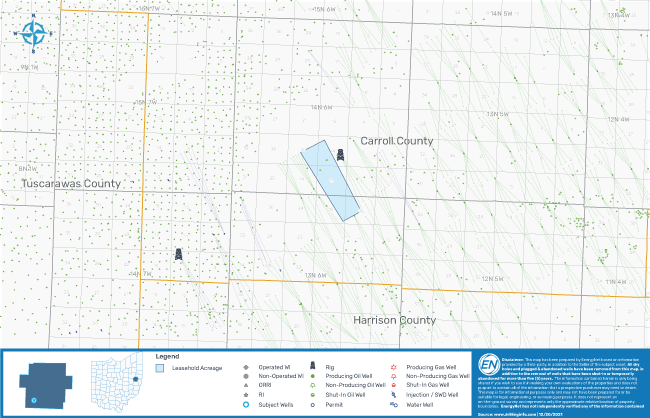

Garnet Energy Capital LLC retained EnergyNet for the sale of a Utica Shale opportunity through a sealed-bid offering closing Jan. 20. The offering includes nonoperated working interest in four permitted wells plus leasehold acreage in Carroll County, Ohio. Encino Energy is the operator.

Highlights:

- Nonoperated Working Interest in Four Permitted Wells:

- 7.87% Working Interest / 5.90% Net Revenue Interest

- ~14,000-ft Wells drilled into the unit at 800-ft Spacing

- First Well to be Spud Jan. 29

- First Production Estimated in June 2022

- Estimated Gross Capital of $8.8M/Well

- Attractive Returns at ~60% IRR/2.9x ROI

- 88.666567 Net Leasehold Acres

- Operator: Encino Energy

Bids are due at 2 p.m. CST on Jan. 20. For complete due diligence information on any of the packages visit energynet.com or email Cody Felton, vice president of business development, at Cody.Felton@energynet.com, or Denna Arias, vice president of corporate development, at Denna.Arias@energynet.com.

Recommended Reading

US Rig Count Makes Biggest Monthly Jump Since November 2022

2024-07-26 - The oil and gas rig count, an early indicator of future output, rose by three to 589 in the week to July 26.

US Drillers Cut Oil, Gas Rigs for Third Week in a Row, Baker Hughes Says

2024-08-30 - The rig count is 8% below this time last year, according to Baker Hughes.

US Drillers Cut Oil, Gas Rigs for First Time in Three weeks

2024-08-02 - The oil and gas rig count, an early indicator of future output, fell by three to 586 in the week to Aug. 2. Baker Hughes said that puts the total rig count down 73, or 11%, below this time last year.

US Drillers Add Oil, Gas Rigs for Second Time in Three Weeks

2024-07-19 - The oil and gas rig count, an early indicator of future output, rose by two to 586 in the week to July 19, its highest since late June.

US Drillers Cut Oil, Gas Rigs for Fourth Week in a Row

2024-09-06 - The oil and gas rig count fell by one to 582 in the week to Sept. 6, the lowest since June.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.